5 Top Reasons Why Bank Statement Analysis Is Crucial for Loan Assessment

After the second wave of coronavirus, economic growth has stalled all over the nation. As the markets are opening up once more, there are hopes for a fresh start, but everyone is even more cautious this time, especially in the lending sector.

In such a case, how can formal credit markets extend credit to borrowers without exposing themselves to the risk of loan default?

Here’s where Bank Statement Analysis comes to the rescue.

A Bank Statement Analysis gives an overview of the financial health of the applicant. It informs the lender about the financial soundness of the borrower to repay the extended credit. In addition, it gives out periodical records of the account holder’s transactions — deposits, transfers, withdrawals, credit payments, interest earned, etc. to the lenders to exercise their analytical muscle to check the creditworthiness.

Lending is a risky proposition to delve into. The lending institutions such as banks and NBFCs need protection from bad credit. Bank statement analysis helps ease that process and mitigate risks at the same time.

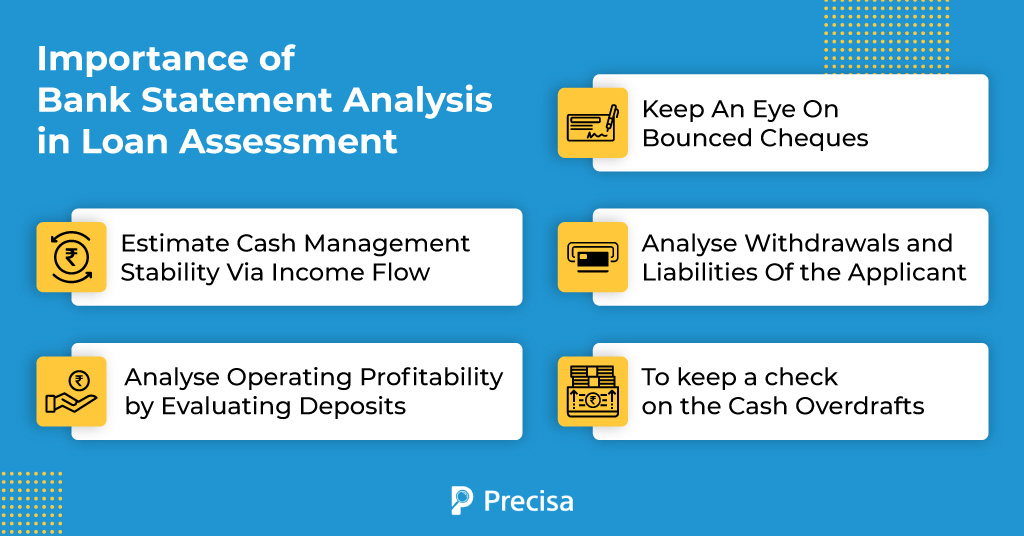

Importance of Bank Statement Analysis in Loan Assessment

A prospective lender always asks for a copy of the bank statement from the past 3-6 months. The borrower can simply download it from the bank’s internet banking portal and share it as a PDF/Excel sheet.

For a borrower, it is common to feel perplexed about why after complying with all the required documentation, such as the credit reports, financial statements, tax statements, and personal identification documents, the bank still requires this document for assessment.

Here’s why banks conduct a Bank Statement Analysis during Loan Assessments:

1. Estimate Cash Stability Via Income Flow

While analysing the bank statements, the lending institutions scrutinise the income flowing into the business by studying the cash balance and checking for any red flags such as windfall type incomes. Therefore, the lenders must check if the applicant keeps a healthy cash position.

As a rule of thumb, cash flow-based lenders put a great emphasis on this as they don’t take any collateral as security. Here, a negative cash balance in the bank statement would only tell a tale of a potential delinquent borrower to the lenders.

2. To Keep An Eye On Bounced Cheques

One of the elements on every bank’s financial hygiene checklist is — No Bounced Cheques.

Before proceeding with credit sanctioning, lenders check the Bank Statement for any bounced cheques in the past and their frequency.

A bounced cheque can cause some problems as it has the potential to bring down the borrower’s overall credit score. A lower credit score indicates the inability of the borrower to repay the debt and acts as an indicator of poor account balance maintenance.

The lending institutions always check if a bounced cheque is followed by paying off the dues right after. The loan is only sanctioned by the bank as long as the bank statement does not reflect a habit of bounced cheques and is clear of the dues.

3. Analyse Operating Profitability by Evaluating Deposits

While analysing the bank statements, lenders study the nature, frequency, and source of the deposits. A massive chunk of cash deposit is always a major red flag for lenders.

The formal credit markets check the consistency of deposits through revenues, interests earned, etc., as they reflect a brisk business and financial standing.

4. Analyse Withdrawals and Liabilities Of the Applicant

Withdrawals and liabilities are as important to examine as income and deposits. A sturdy BSA will frequently reflect withdrawals replenished by deposits, no cancelled cheques in the last 6 months, and no huge withdrawals.

A steady withdrawal in regular intervals points in the direction of a good repayment history of the applicant. Despite that, there are other factors such as the remaining balance that the banks tend to analyse while studying the bank statement. Lenders analyse the bank statement to get a realistic view by deducting the liabilities from the average monthly profit.

Regular liabilities such as business expenses are seen as healthy as they indicate steady operational flow, while some can be red flags as well.

The applicant is in a positive light as long as the regular withdrawals and the liability payment figures are well below the deposits figures. A positive balance reflects that the applicant is capable of returning.

5. To keep a check on the Cash Overdrafts

A negative balance or an overdraft fee situation is not a very likely situation while trying to apply for a loan. If the bank statement indicates the overdraft fees charged, a detailed explanation needs to be sought by the lenders as to why the statement went into excess and calls for supporting documentation as well. Cash overdrafts are not considered a part of a clean statement.

To make an informed decision, lenders evaluate the loan proposal based on a variety of factors that constitute the overall credit rating of the applicant. A bank statement needs a detailed evaluation. If this goes wrong, it can adversely affect the institution’s revenues as well as reputation. Therefore, a robust 360-degree software engine must be deployed to conduct predictive and statistical analysis of the bank statements thoroughly.

Precisa — A Modern Day Smart Solution for Bank Statement Analysis

All lending institutions today need cutting-edge analytical software for easing the process of bank statement analysis. Precisa is miles ahead of today’s solutions to do a critical analysis of the creditworthiness of the applicants.

It is an online financial data analytics tool that lets you derive insights from multiple statements, dissect them strategically in the areas of cash flow-based lending, wealth management, and insurance. It gives you a real-time picture of the borrower’s financial standing within no time.

It helps in identifying discrepancies such as fraudulent statements, circular transactions, irregular patterns, and other red flags in the applicant’s Bank Statement Analysis and safeguards lending institutions of NPAs.

Adopt Precisa today. Try our free trial period.