What is Big Data and How Can Modern Banks Leverage It?

Big data is transforming the world, and its immense advantages have left no industry untouched. For example, big data analytics has been at the core of online banking’s revolution, becoming an integral part of the biggest banks worldwide.

The digital world is generating massive volumes of data. According to a study by IBM, more than 2.5 quintillion bytes of data were created daily in 2020. As a result, the global revenue for big data and business analytics solutions is predicted to reach $260 billion by 2022 (Business Wire).

Banking is one of the business domains that invests the most in big data and business analytics technology.

What is Big Data?

Big data is defined as a vast, diverse, and complicated collection of structured and unstructured data that may be used to solve business challenges for financial services and banking firms worldwide.

Through hundreds of thousands or even millions of individual transactions every day, banking customers generate a staggering amount of data. This huge, diversified set of information that is growing at ever-increasing rates encompasses big data.

For banks seeking to understand better their customer base, market trends, and product performance, this data holds untapped potential.

Leveraging Big Data in the Banking Sector

Big data is a complicated subject, yet it streamlines everything from filtering information based on the customer’s name to responding to customer questions more rapidly. For example, in better understanding banking, big data makes financial operations run more smoothly.

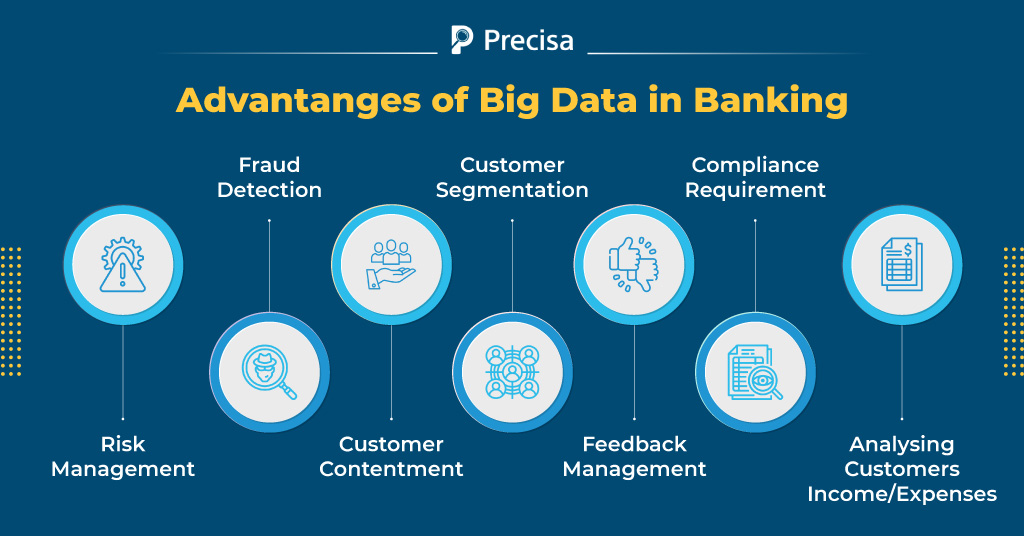

Here are a few instances of how banks are utilising big data and the benefits it provides.

-

Risk Management

Banks must continually create new products to stay competitive and improve profitability.

In addition, establishing a solid risk management system is critical for banking firms, or they will face significant income losses. Banks can detect risk in real-time with extensive data analysis, thereby saving the customer from possible fraud.

The United Overseas Bank (UOB) Limited, Southeast Asia’s third-largest bank, has used big data to guide risk management. However, estimating the risk value is time-consuming and might take up to 20 hours or even days.

UOB has partnered with SAS and was able to overcome this problem with a high-performance analytics solution that complete the identical task in just a few minutes

-

Fraud Detection

One of the most important big data applications in banking is fraud detection, which may distinguish between genuine and fraudulent business transactions.

By analysing customers’ transaction history, spending patterns, savings, and income sources, any unusual activity can be detected, indicating fraud. Following that, quick actions such as blocking irregular transactions may be taken to prevent fraud from occurring.

Danske Bank is Denmark’s largest bank, having a customer base of almost 5 million. However, the bank was having trouble with its fraud detection techniques, which had a poor detection rate of only 40% and generated up to 1200 false positives each day.

They then teamed up with Teradata, a significant database and analytics service provider, to use advanced big data analytics to improve their fraud detection capabilities, and they quickly saw substantial benefits.

-

Customer Contentment

Given the significant level of risk involved when dealing with financial institutions, ensuring customer satisfaction is one of the most challenging challenges banks face. Customer retention is a lifelong process for banks, from maintaining the security of customers’ transactions to offering them the most relevant and beneficial offers.

Hence, it is now more vital than ever for banks to acquire data from their customers. Analysing their clients’ data based on different parameters allows banks to target their customers better.

JPMorgan Chase and Co. is the largest bank in the United States. With over 3 billion customers, the amount of data it generates is unfathomable, including a massive amount of credit card information and other transactional data.

To manage this data, they have turned to big data technologies, primarily Hadoop. They can now generate insights into customer trends using big data analytics, and the same reports are provided to their customers. They can examine each customer separately and create reports in a matter of seconds.

-

Customer Segmentation

Banks have been under pressure to shift from a product-centric to a customer-centric mindset for a long time. One approach to achieve this is to segment their customers to gain a better understanding of them.

It’s easy to separate their customers into distinct segments using big data, which can be based on daily transactions, demographics, interactions with telephonic and online customer care, and external data like property value.

For instance, Axis Bank has a dedicated analytics team that specialises in customer segmentation, need-based analysis, and hyper-personalisation of products.

-

Feedback Management

People nowadays provide comments on a financial institution’s work by phone or on the website, and they share their thoughts on social media. With the help of big data, experts examine these publicly available mentions.

Hence, the bank will reply to comments quickly and effectively, thereby increasing customer loyalty to the brand.

-

Compliance Requirement

Data, finance, and other aspects of banking and financial services require continuous compliance and auditing.

They are governed by a regulatory authority that mandates data privacy, security, and other requirements. Big data analysis can assist in analysing data and identifying situations that could lead to a financial crisis or a security risk. This will assist banks and the financial sector in avoiding regulatory and compliance concerns.

-

Analysing Customers Income/Expenses

Banks can utilise big data to analyse if customers’ income has increased or decreased, details about their expenditure, other sources of income, among others.

Banks, by comparing data, can make informed decisions regarding the potential of credit extensions, analyse risks, consider if the customer is interested in loans or investments, and identify potential risks like bad investments or payers.

Many businesses use Precisa, an automated financial analysis tool, to make smarter financial decisions. Precisa’s service allows for a simple process in which all information is available at the click.

Precisa’s financial statement analysis helps to extract perspectives from numerous statements and strategically deconstruct them. Then, in a matter of seconds, it gives you a real-time view of the borrower’s financial status.

Final Thoughts

Every day, banks are discovering new ways to harness the power of big data analytics in banking – a journey of discovery fuelled by technological advancement. Banks may now use big data analytics to detect fraud, assess risks, personalise financial services, and develop AI-driven client resources.

As more individuals create and consume data, the volume of data will only continue to grow over time. Likewise, as more sectors use big data analytic tools, the amount of data will expand, but so will its profitability.

To learn more about how you may use bank statements to make smarter decisions, contact Precisa now! Precisa can be easily integrated into your existing system via APIs. Find out more. Take advantage of our 14-day free trial.