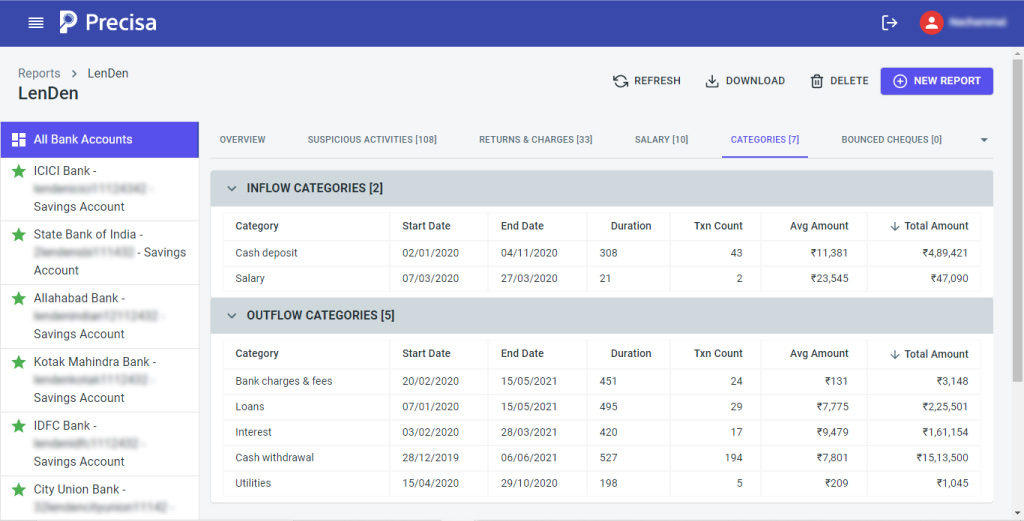

New Category Tab: Simplifying Cash Flow Analysis for Banks

Bank transactions can reveal a customer’s preferences, spending patterns, and risk factors if you can create structured features from their unstructured text. Precisa automatically detects the context or purpose of transactions in the bank statement based on its description. For example, if the transaction is ECS/BAJAJ FINANCE LI/7UPBFR809765435 Precisa will automatically detect that this payment belongs under the category “Loans”.

Precisa classifies transactions into inflow & outflow categories:

- Outflow Categories – Utilities (electricity, telephone, water, gas), Insurance, Interest, Bank charges & fees (Charges, Minimum balance charge, Foreign exchange), Investments (Fixed Deposit, EMI – SIP), Loans (Close loan, EMI – loan repayment, Debt servicing), Cash withdrawal, Other

- Inflow Categories – Salary, Non-business inflow, Promoter funds, Loans (New loan), Cash deposit, Other

Precisa’s ready-to-use and easy-to-understand categories data is available at the individual Bank Account levels and also across all the Bank Accounts belonging to a customer. This data can be used following purposes:

- Lending – for verification of real income & active loans, gaining insight into active liabilities, identifying unusual behaviour like high-value cash deposits or withdrawals or non-business inflow.

- Personal Finance Management – for tracking expenses and budget planning.