Precisa’s e-Statement and Bank Account Authenticator Can Spot Fraudsters

Versatile software and tools that enable editing and modification of official documents make it easy for anyone to counterfeit them. This makes it easy for fraudsters to manipulate sensitive documents like bank e-statements to obtain loans or other financial benefits.

In the financial year 2021, the Reserve Bank of India (RBI) reported bank frauds amounting to 1.38 trillion Indian rupees. This is an alarming stat. Banks, NBFCs, and other fintechs have reported multiple instances of unauthorised/illicit digital activities and tweaking of the banking data.

This is why banks and every other financial entity requires a robust security mechanism they can trust on. Precisa’s e-statement Authentication can simply see through these ill intents. It can detect a diversity of frauds related to bank statements or altered bank statements at advanced assessment levels.

For instance, Precisa’s tool is powerful enough to spot meticulous manipulations done using Adobe Acrobat Pro and other similar software!

How does Precisa’s eStatement Authentication Feature Work?

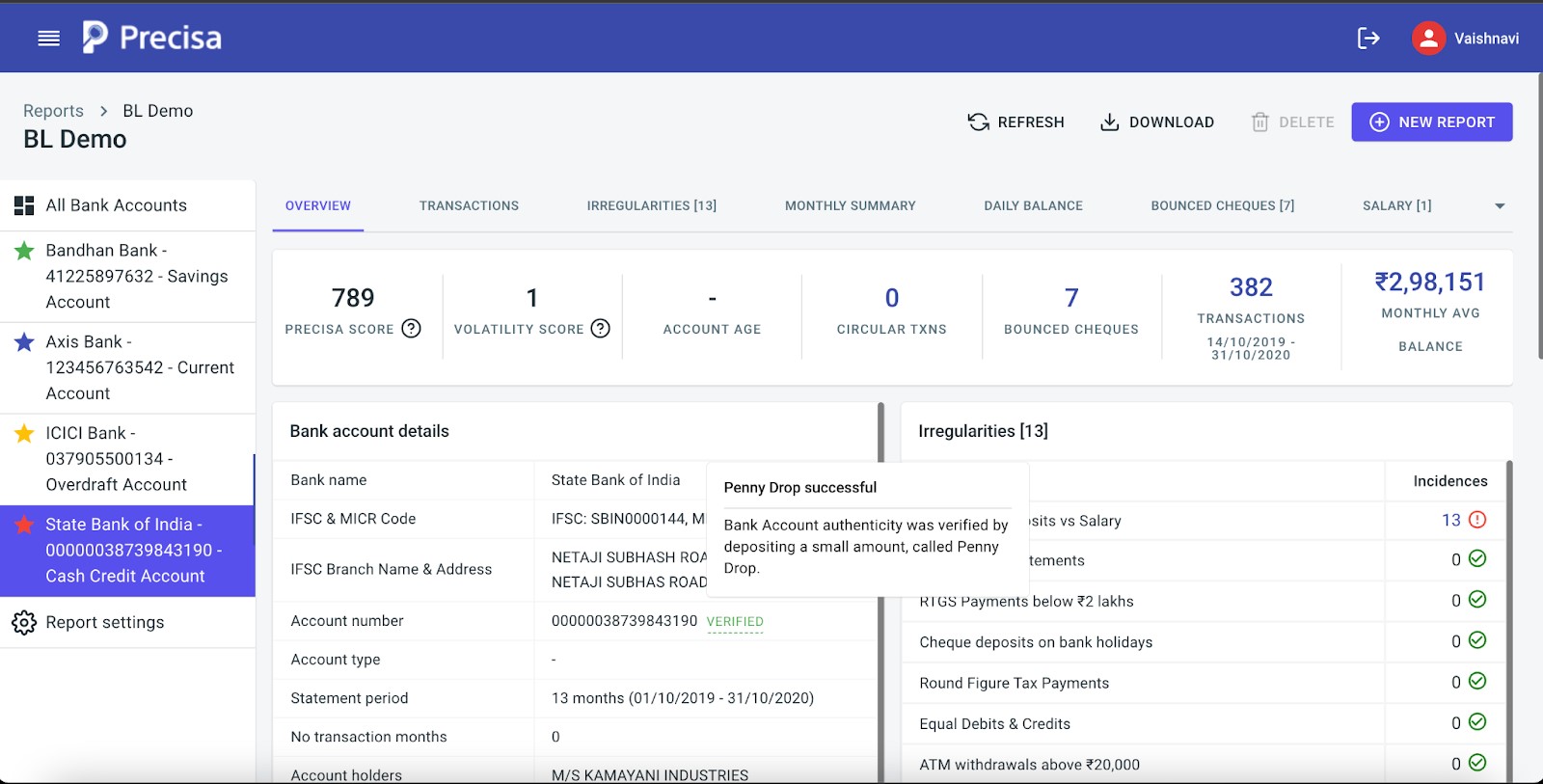

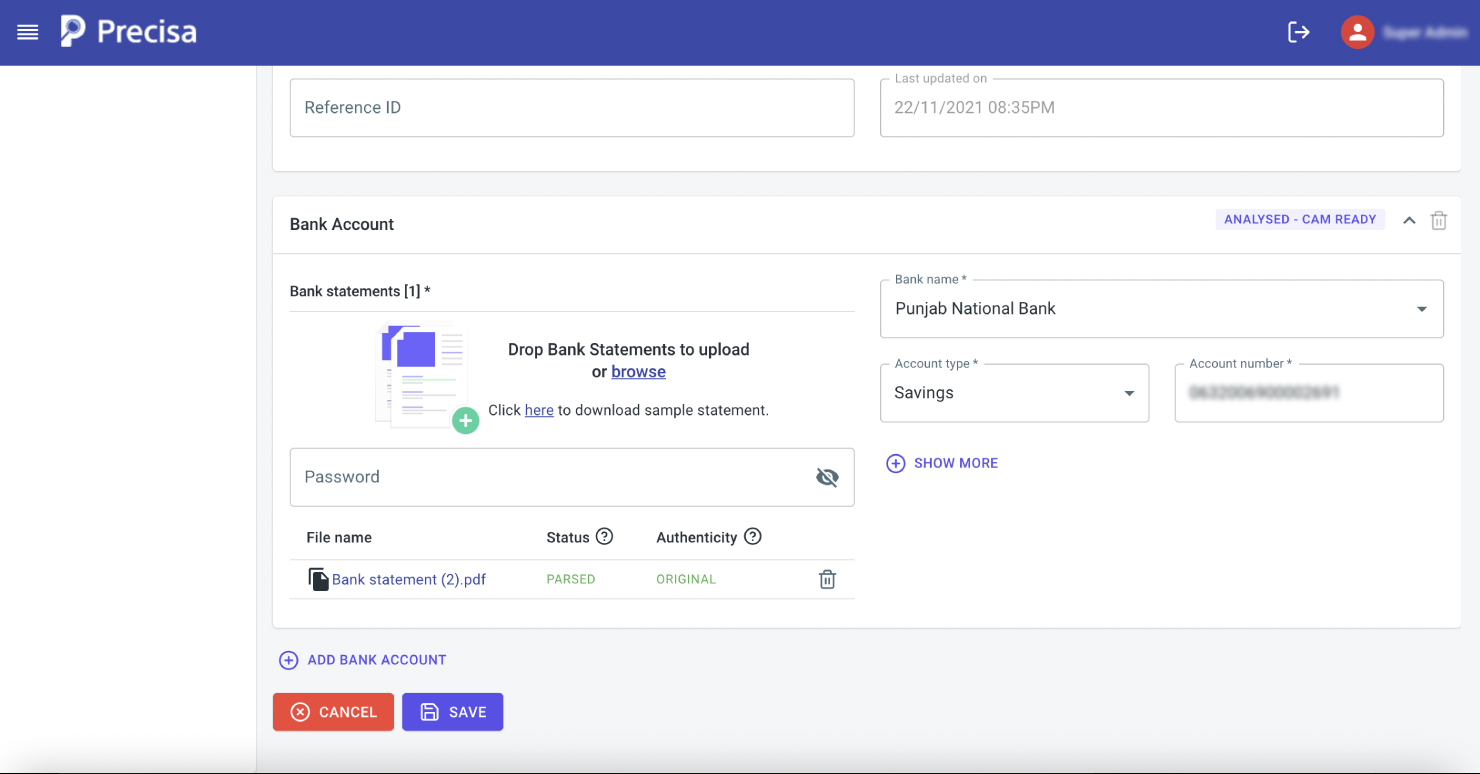

Precisa uses a series of formats and data checks on PDF bank statements to detect manipulation of the e-statements and identify any potential fraudulent activity.

The checks help to validate the uploaded bank statement by identifying any unexpected behaviour, discrepancy and computes an authenticity rating as FRAUD, ORIGINAL, REVIEW or UNKNOWN.

Precisa also uses a Penny Drop (depositing INR 1 or any small amount into a user’s bank account) to verify the authenticity of the bank account mentioned in the e-statement of the beneficiary.

How does it benefit our customers?

The e-Statement authentication feature on Precisa helps our customers identify if a statement has been tampered with or altered.

Primarily, the bank statement is verified by the lender or lending institutions for its authenticity. But it is not enough.

Organisations must also verify the bank account details in multiple layers to check if they are valid.

Precia’s eStatement authentication improves the reputation of lending institutes and banks by helping them make accurate and informative lending decisions.

In a nutshell, the e-authentication feature of Precisa:

- Identify whether the statement was tampered with or not.

- Identify the authenticity of the bank account by checking whether the account is valid or not.

- Helps them to make informed lending decisions.

- Makes lending processes faster and more efficient.

Try these and other advanced features of Precisa. Sign in or take a free trial.