How to Create a Fool-Proof Credit Appraisal Process

Whenever there’s a discussion about personal loans or any other loans in general, the term ‘credit appraisal’ is commonly used. The credit appraisal process refers to evaluating a borrower’s loan application to determine the financial health and its ability to generate sufficient cash flows to service the debt.

In other words, a lender conducts a credit appraisal on the potential borrower to determine their creditworthiness and the level of credit risks associated with extending credit to them.

Why is Credit Appraisal Required?

A lender conducts credit appraisal mainly to ensure they get back the money they lend to the customers. Whether the borrower applies for the loan individually or as a corporate entity, the lender will always conduct a detailed and systematic credit appraisal process.

Before giving a loan to the entities, a comprehensive process is followed, which appraises or evaluates management, market, financial, and technical elements. No lender will approve and sanction anybody’s loan application instantly without an evaluation.

The lender needs to ensure that the borrower has the capacity to repay the entire loan amount on time without missing any payment deadlines. Both the banks and NBFCs will utilise the credit appraisal process.

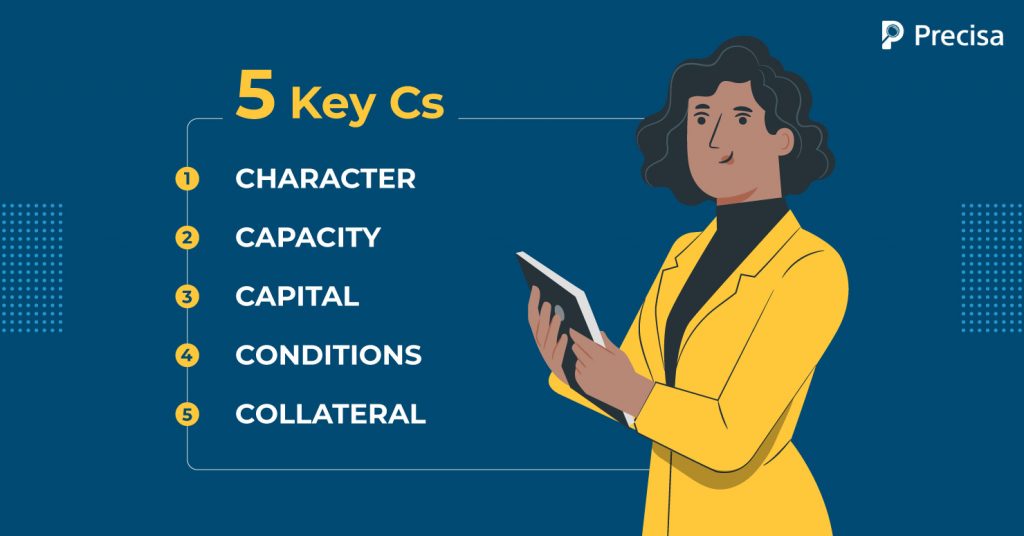

5 Key Cs that Shape Up the Credit Appraisal Process

Wondering what makes up the credit appraisal process?

The credit appraisal process mainly depends on several core factors that deserve to be carefully enumerated. It primarily depends on the five Cs of credit – character, capacity, capital, conditions, and collateral. These are the vital criteria that give lenders the right perspective on evaluating borrowers who have just applied for the loan.

1. Character

This is one of the basic Cs of the credit appraisal process. It is the first aspect looked into by the lenders to seek the reliability and trustworthiness of borrowers.

This is the parameter wherein the lenders delve into the borrower’s credit history to assess the type of borrower and see whether they pay the loans on time without defaults. The borrowers with higher credit scores always have a natural advantage in any credit appraisal since banks feel that they will not create any problems in the repayments.

However, lenders will be reluctant to fund borrowers with poor credit scores or those who do not have a good reputation in the market.

2. Capacity

This is also extremely important as it equates to the borrower’s cash flow. It indicates how financially strong the borrower is when it comes to repaying the loan.

If a lender finds out that the borrower doesn’t have enough income to repay the loan, then it won’t be sanctioned for the same. Here the main thing is the debt to income ratio, which is measured along with the income proof and bank statement. The lower this ratio, the higher the borrower’s eligibility for the loan in terms of the amount.

The bank statements, ranging from three months to even years, will indicate the available capital at the borrower’s hand, and lenders will also ascertain their employment history through this.

3. Capital

It is one of the main criteria to judge the loan amount that the borrower deserves. A strong capital power shows the borrower’s capability to withstand market ups and downs.

This helps lenders analyse the money that borrowers have already invested in their business if they are self-employed borrowers, for instance. This may include the money pumped in for establishing the business, how long you have been doing business, do they have ample assets as collateral for other debts, etc.

The capital and assets that the borrowers have will naturally be ascertained along with the investments in the right channel.

4. Conditions

For loan applicants, the bank will look to see what they will be using the money for. This is a vital aspect of credit appraisal processes. Banks will offer loans considering the prevailing market conditions, industry status, company, interest rate movements, inflation, etc.

Thus, strong and positive industry growth and economic conditions are indicators of the applicant’s ability to generate revenue and repay the debt.

5. Collateral

The fifth and the final C of the credit appraisal process pertains to collateral. This is the quantum of assets or securities that the borrower can pledge against the loan. Normally, this could be anything from shares, real estate, life insurance policies, equipment, accounts receivable, etc.

While some loans like home loans and car loans have the home or car as the collateral, other loans may necessitate collateral as the backup option for lenders. Lenders wish to see that they will at least recover some of the money if the borrower is unable to repay the loan via this collateral.

Documents Needed From the Borrower for Credit Appraisal

1. KYC Documents

Lenders must first identify the customer, for which KYC is a must. Complete the KYC norms before going further into the loan proposal. Certain things required for establishing KYC are:

– Proof of Identify

– Proof of address

– Proof of business address

– PAN

Photocopies of all these need to be verified with originals and need to be signed by the borrower and kept on record.

2. Bank Statements

Among all the documents collected during the loan application stage, the customer’s bank statement is one of the most important documents.

Bank statement analysis can reveal key details like daily/monthly closing balances, OD/OC utilisation, recurring payments, suspicious transactions, etc.

In today’s era, legacy systems of analysing bank statements are not used. Instead, automated bank statement analysis tools like Precisa are preferred by lenders and banks across the nation for fast, efficient, and more insightful analysis of bank statements.

3. CIBIL Score

This is the most important and widely used CIR in India. There are mainly two types of CIBIL reports- personal and commercial. The commercial is for business entities, whereas personal is for individuals. This report contains the credit history of the borrower.

Through this, lenders can know the current loans, credit card dues, etc., that the borrower is availing, which will help analyse his repayment capacity.

4. Registration Certificates

Obtain the copies of necessary registrations as per the nature of the business. Some of the registrations are TAN, GSTIN, IEC, registration under Shop & Establishment Act, etc.

5. Financial Statements

Financials for the previous three years need to be obtained. If some part of the financial year is over, obtain a provisional balance sheet up to some latest dates.

Get to know it thoroughly, such as the trend in sales, profitability, sources and uses of cash flows, use of capital, the trend in unsecured and secured loans. Compare the loans appearing on the balance sheet with those in CIBIL.

6. Income Tax Returns

Obtain the borrower’s income tax returns, partners, directors, and guarantors for the previous three years. Also, verify the authenticity of ITRs independently.

Precisa, being an online financial data analytics solution, helps lenders, wealth managers, and underwriters assess the creditworthiness of borrowers with our software-as-a-service product.

Precisa is miles ahead of today’s legacy systems regarding fraud detection and identifying red flags to help you make informed decisions for cash flow-based lending, insurance underwriting and financial planning.

Contact us to know more about our features and services. Try out the FREE 14-day trial today!