Use Precisa Bank Statement Analysis to

Reduce Processing time by 5X

Improve Productivity by 8X

- Support for more than 500 Banks and 1000 formats

- Processed over 55 Million transactions

- Analysed more than 13 Million pages

- Analysed more than 6.5 Lakh Bank Statements

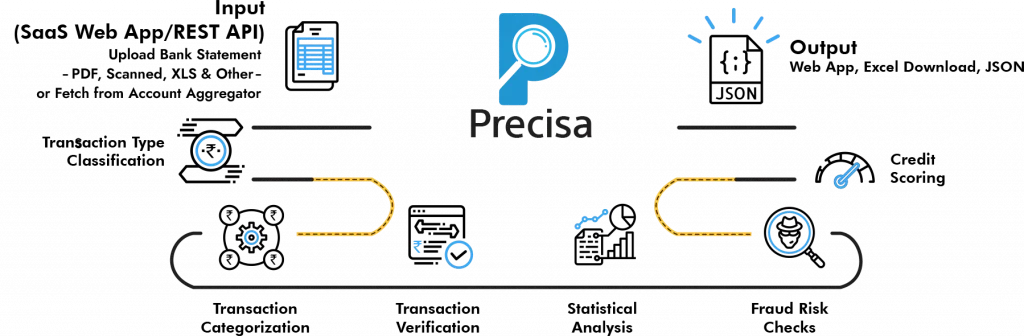

How Precisa Bank Statement Analyser works??

The Bank Statement Analyser extracts data from the bank statement, classifies & categorizes transactions, analyses the data, detects fraudulent transactions and other anomalies, and assigns an overall creditworthiness score called Precisa score.

Precisa Bank Statement Analyser Features

Precisa Score

Volatility Score

Irregularities

Transactional Patterns

Circular Transactions

Cheque Returns(In/Out)

Aggregation Across Multiple Bank Accounts

Account Aggregator Integration

Export Analysis to Excel

APIs for Integration

Integrate Precisa’s Analytics capability with your existing systems with a few simple steps, and give your team a smooth, fast and secure user experience.