Understanding DPD in Finance: Unveiling Early Risk Signals for Proactive Mitigation

In today’s dynamic financial world, risk management is critical to ensuring the stability and sustainability of financial institutions. One critical part of risk management is the early detection of prospective credit defaults, which can have far-reaching consequences for an institution’s financial health. To accomplish this, financial experts use a variety of instruments and indicators, one of which is the Days Past Due (DPD) statistic. In this article, we will look at the concept of DPD in finance, including its importance, methodology, and role as an early warning signal for proactive risk management.

Understanding Days Past Due (DPD) in Finance

Comprehending Days Past Due (DPD) in finance is critical for analysing and managing credit risk.

- It suggests the number of days a borrower has gone past the due date for payment. It is a crucial signal of possible defaults and financial instability.

- By analysing DPD trends, financial institutions can obtain insights into borrowers’ payback behaviour, uncover early warning indications, and adopt proactive risk-mitigation steps.

- Understanding DPD also enables lenders to make informed judgements about credit restructuring, repayment conditions, and risk management.

- It also aids in assessing borrowers’ overall financial health, establishing their creditworthiness, and properly managing loan portfolios.

As a result, financial stability and resilience can be improved by regularly monitoring DPD, ensuring a stable and safe financial system.

Application of DPD in Finance: Some Examples

Consider the following two scenarios to better understand the actual application of DPD analysis in risk mitigation:

Personal Borrower

A lender reviews the DPD of an individual borrower who has made regular payments in the past.

However, during the last six months, the DPD has constantly grown. Recognising this early warning sign, the lender contacts the borrower to learn more about the underlying causes of the delinquency. It was found that the borrower experienced an unexpected job loss, which impacted their cash flow.

As a result, the lender provides a temporary payment plan, allowing the borrower to manage their finances and avoid a potential default.

Business Loan Portfolio

A financial institution examines DPD patterns in its company loan portfolio. It discovers that a single industry cohort, which comprises numerous stores, consistently demonstrates higher DPD than other cohorts. When the institution digs deeper, it discovers that these retailers are suffering significant competition from online marketplaces, resulting in declining revenues.

Based on this information, the institution takes proactive measures such as providing financial assistance, advocating business diversification, or tightening credit terms to lessen the risk associated with that industry cohort.

The Role of DPD in Finance as an Early Warning Signal

DPD analysis is used by financial organisations to manage risk and make educated lending decisions. Here are some of the reasons why DPD in finance is crucial:

1. Timely Identification of Delinquencies

DPD is an important predictor of delinquency and eventual default risks. Financial organisations can spot borrowers who display a regular trend of late payments or a rising number of past-due days by closely tracking DPD.

Because of this early detection, banks can engage quickly and begin necessary procedures to limit the risks associated with delinquent borrowers.

2. Predictive Insights into Credit Quality

Analysing DPD patterns provides prognostic information about debtors’ credit status. Financial institutions can assess the possibility of future payment issues by studying previous DPD data and spotting trends.

A borrower with a growing DPD trend, for example, may signal poor financial health or an inability to satisfy payment obligations. These insights enable banks to change credit limits, restructure loans, or engage in communication with borrowers to avoid prospective defaults.

3. Portfolio Risk Assessment

DPD analysis makes portfolio risk assessment and management easier. Institutions acquire a thorough knowledge of their entire credit risk exposure by collecting and analysing DPD data across their loan portfolio. Higher DPD levels, or a considerable number of borrowers with increasing DPD, suggest a higher risk of default and likely portfolio deterioration.

This assessment enables institutions to effectively allocate resources, focus on high-risk sectors, and execute risk mitigation techniques tailored to specific borrower profiles.

4. Enhanced Credit Risk Management

DPD analysis is critical in credit risk management. Institutions can increase the accuracy of credit risk evaluations by incorporating DPD information into risk assessment models and credit scoring systems.

Therefore, DPD serves as a supplement to standard credit ratings, offering additional information about borrowers’ payment behaviour and creditworthiness.

Methodologies for Analysing DPD in Finance

Methodologies for analysing Days Past Due (DPD) in finance involve various approaches that provide insights into delinquency patterns and potential credit defaults. Here are some commonly used methodologies for analysing DPD:

1. Trend Analysis

Trend analysis entails reviewing past DPD data to identify patterns and trends across time. Financial professionals can examine a borrower’s payment behaviour and detect potential problems by observing changes in DPD, such as rises or decreases. It aids in identifying the direction and amount of DPD changes, providing insights regarding the borrower’s financial health.

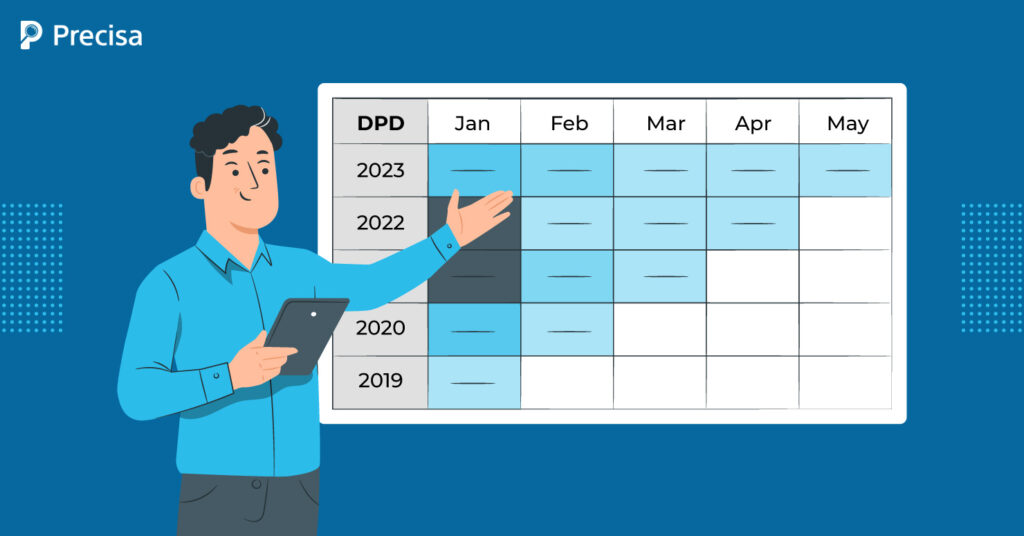

2. Cohort Analysis

Cohort analysis categorises borrowers into specific cohorts based on important factors such as credit score, loan type, industry, or geographic region. Financial organisations can identify high-risk populations by analysing DPD patterns across cohorts. Cohort analysis aids in measuring the risk associated with various borrower segments and customising risk mitigation methods accordingly.

3. Exception Reporting

Exception reporting entails creating automatic reports that highlight borrowers who have large deviations in DPD from their regular payment patterns. These reports identify borrowers who require closer monitoring or prompt help. Exception reporting enables quick action to be done for borrowers exhibiting indicators of financial trouble.

4. Data Integration

Data integration entails combining and analysing numerous DPD-related data sources, including loan payment records, credit reports, and financial accounts. Financial experts can acquire a full perspective of the borrower’s financial condition and identify any hazards linked with DPD by integrating data from multiple sources.

Together, these approaches provide a comprehensive analysis of DPD and aid in proactive risk management and decision-making in the finance sector.

Summing Up!

The DPD metric is vital in risk management within the finance sector. Financial institutions rely on it to identify early warning signs of possible defaults, enabling proactive risk mitigation. By analysing DPD trends, lenders gain valuable insights into the financial health of borrowers, guiding decisions related to credit restructuring, repayment terms, and overall risk management.

The effective utilisation of DPD as an early warning signal enhances financial stability and resilience within a complex financial ecosystem. One essential tool for DPD analysis and early warning signals in finance is the Precisa Automated Bank Statement Analyzer. This advanced software employs cutting-edge algorithms to swiftly and efficiently process substantial financial data, including credit histories, market patterns, and GSTR analysis.

By generating timely risk assessments, Precisa identifies potential default risks, empowering institutions with the information they need to manage their portfolios and make informed lending decisions effectively. As a result, risks are minimised, contributing to a stable and secure financial system.

Book a free trial to learn more about Precisa.