Lenders Face RBI Scrutiny: Will Credit Growth Take a Backseat?

Regulations have always played an important role in the growth trajectory of lenders across the world. In India, the Reserve Bank of India (RBI) sets guidelines to ensure the smooth and ethical functioning of lending players and fair practices for borrowers.

Recent news reports indicate that the RBI is taking strict action against lenders who violate regulatory guidelines governing the sector. This has resulted in business shutdowns and restrictions on certain financial products offered by lending companies.

As a direct consequence of RBI’s intervention, credit rating agency S&P Global Ratings expects loan growth to decline to 14% in Financial Year 2025 from 16% in FY24.

In this blog, we decode the reasons for RBI’s clampdown on lenders, what this means for lenders, and how lenders can be prepared for stricter governance.

What Is Driving RBI’s Actions?

The lending industry is often prone to incidents of loan fraud, the rise of non-performing assets, poor risk assessment capabilities, fraudulent lending practices, and poor consumer protection.

A report published by Google on loan apps in 2023, for instance, revealed that the company had prevented over 1.43 million apps that had violated its policy from being available on the Play Store.

By doing so, Google prevented $2.3 billion worth of global fraud transactions.

Preventing such bad actors and restricting exposure to risks are important goals of regulatory bodies like the RBI. By strengthening governance, the regulatory authority also seeks to achieve the following:

- Reduce non-compliance across lending platforms, financial apps, banks, and Non-banking Financial Companies (NBFCs)

- Ensure consumer data privacy and prevent leakages and sale of sensitive financial data

- Build a transparent lending ecosystem by strengthening overall governance

- Ensure that all borrowers are know-your-customer (KYC) compliant.

- Prevent the growth of anti-money laundering activities

- Ensure that lenders have enough liquidity in case of non-repayment of loans, loan fraud, and other financial incidents

Lending is growing, and stronger compliance can help lenders scale up securely at a sustainable pace.

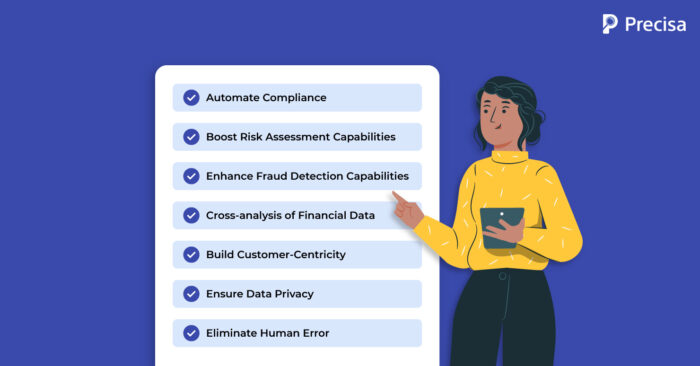

Stay Compliant and Avoid Risks: 7 Pointers for Lenders

Financial technology, or fintech, is likely to play a major role in empowering lenders to stay compliant and build accountable, transparent cultures. Let’s review how tech-driven solutions, such as AI-enabled bank statement analysis tools, can help lenders be compliant and manage risk optimally:

1. Automate Compliance

Lenders can find it challenging to keep up with constantly evolving regulations, especially as they begin to scale quickly. Manual compliance interventions can result in errors and omissions during the lending workflow.

One approach to address this issue is to automate the compliance process, end-to-end, with the adoption of financial analysis software.

Lending teams can customise dashboards to meet the latest compliance requirements. The software can identify areas of non-compliance, such as non-adherence to Know Your Customer (KYC) requirements, within minutes and recommend solutions to address the issues.

2. Boost Risk Assessment Capabilities

A superior financial analysis tool has the capabilities to:

- Analyse massive volumes of borrower data

- Segregate every bank transaction into categories

- Reconcile the data

- Paint a comprehensive picture of a borrower’s finances.

This capability enables lenders to predict the potential of a borrower to repay a loan realistically based on historical and real-time data.

The software generates its creditworthiness score that enables lenders to make data-driven decisions.

3. Enhance Fraud Detection Capabilities

The growth of loan fraud is a major setback for lenders, which may consecutively come under the radar of the RBI and face investigations. Lending firms will need to invest resources in building a defence strategy and managing their reputation.

The use of AI-powered financial analysis tools enables lenders to flag inconsistencies in identity, documents, and bank statements. For instance, the software can flag unusual transaction patterns in banking transactions early on.

4. Cross-analysis of Financial Data

Financial analysis tools can analyse a wide spectrum of alternative borrower data. For instance, Goods And Services Tax Returns (GSTR) can be cross-referenced against revenue-related bank transactions in statements. This GSTR cross-analysis can authenticate revenue-related data.

This capability plays an important role in helping lenders understand borrowers’ cash flows. In turn, they can predict their ability to repay a loan on time and in full.

5. Build Customer-Centricity

Businesses must ensure that their products deliver value to their borrowers and refrain from predatory lending practices.

For instance, a growing trend of charging high interest rates to small businesses, resulting in an inability to repay a loan, can result in scrutiny by the RBI.

Hence, lending must try to tailor its products to serve the real needs of businesses. To address this issue, businesses can leverage financial analysis tools, which offer customised solutions for borrowers based on real-time data.

Hence, these solutions are more likely to be affordable to customers and, in turn, repaid on time.

6. Ensure Data Privacy

Lending ecosystems generate massive amounts of sensitive borrower data every day. This includes bank statements, income statements, invoices, underwriting reports, and personal information, which must remain confidential.

The adoption of a superior financial analysis system enables lenders to prioritise borrowers’ privacy. Any compromise of borrower data privacy can invite investigations and penalties from regulators. Such events can also prove to be reputational hazards for businesses.

7. Eliminate Human Error

Manual processes in the lending workflow can result in errors, omissions, duplication and leakage of data.

Leveraging solutions that combine the power of technologies like automation, python, Artificial Intelligence (AI), Machine Learning (ML) and Optical Character Recognition (OCR) helps automate the entire lending workflow.

Businesses can reduce dependence on human capital for repetitive tasks and reallocate human resources for strategic tasks. This shift enables lenders to make accurate decisions based on well-processed data.

The Takeaway

By making early investments in state-of-the-art technology, lenders can protect themselves from outcomes such as loan fraud, the rise of NPAs, and non-compliance with regulatory guidelines. They can also sustain their lending practices and improve the prospects of credit growth.

Access to automated AI-powered financial statement analysis software, for instance, empowers lenders to do their due diligence proactively and function within the ambit of RBI guidelines. They can continue to build resilient, sustainable, profitable businesses that optimise operations to grow faster.

Presica’s user-friendly Bank Statement Analysis aims to simplify the evaluation process through automation, which enables the results to be delivered in minutes. The software provides actionable insights on an easy-to-use dashboard, helping businesses make informed lending decisions.

Request a free demo today!