Bank Statement Analysis API Solutions for Tamper-Proof PDF Validation

Loan applicants often submit numerous PDF bank statements. Lenders use web-based financial analysis software to quickly extract and analyse data from these documents, assessing cash flow and creditworthiness. PDFs may include identity documents, statements, invoices, and Goods & Service Tax Returns (GSTR).

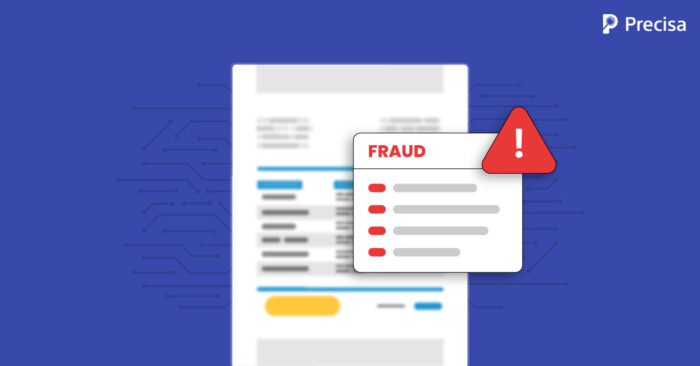

However, a growing challenge for lenders is verifying whether the PDFs are authentic. Fraudulent borrowers are leveraging PDF editing software and image manipulation tools to falsify financial documents. They may commit identity fraud, submit fake documents, or inflate a business’s revenues.

Failure to detect tampered PDFs can cost lenders substantial resources, not to mention a loss of reputation and revenues. Therefore, lenders must implement robust verification and authentication measures.

However, the use of superior bank statement analysis API solutions is enabling lenders to validate the authenticity of PDFs effectively and efficiently.

Let’s understand why this is emerging as a best practice and how the process works.

What is a Bank Statement Analysis API?

A bank statement analysis API is an automated solution that empowers lenders to evaluate the authenticity of all borrower PDFs, extract data, and analyse the data in depth. Based on the results, lenders can make data-driven underwriting decisions.

Lenders embroiled in loan fraud cases are at risk of financial losses and investigation by regulatory bodies. Loss of reputation and potential shutdown are also long-term consequences.

The ability to successfully validate all PDFs and confirm their authenticity is an important asset of a superior solution. This is because even if one or two documents have been tampered with, this scenario can result in loan fraud.

The use of evolved technologies such as Artificial Intelligence (AI), Machine Learning (ML), Optical Character Recognition (OCR), and robotic automation enable tamper-proof PDF validation at scale and high speed.

How Bank Statement PDF Validation Works

Bank statement analysis API solutions automate the entire lending cycle from the time borrowers submit their loan applications. Superior document validation capabilities are one important function of this solution.

Here’s a step-by-step guide to how the technology works to ensure that only authentic documents are processed.

1. Upload PDF files

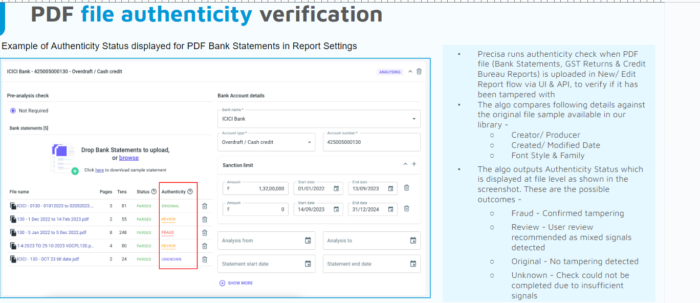

The bank statement analysis software runs an authenticity check every time any new PDF document is uploaded into the lender’s digital ecosystem. The types of PDF documents can include bank statements, credit bureau reports, and GST returns. The documents then become part of a digital library, stored securely on the cloud.

2. Key Details

The software’s algorithm compares various details of the document against the originals present in the digital library. They can include:

- Creator/ producer

- Created/ date modified

- Font style and family

3. Authenticity Outcomes

Once the comparison of PDF documents is complete, the software delivers authentic results. The dashboard displays four potential authenticity outcomes for each document as follows:

- “Original” means there is no tampering

- “Fraud” confirms tampering

- “Review” means a user review is recommended as there are mixed signals

“Unknown” means that the check cannot be completed due to insufficient signals

Lenders can request further documentation from borrowers based on the results. Alternatively, they can proceed to reject the loan application if the need arises.

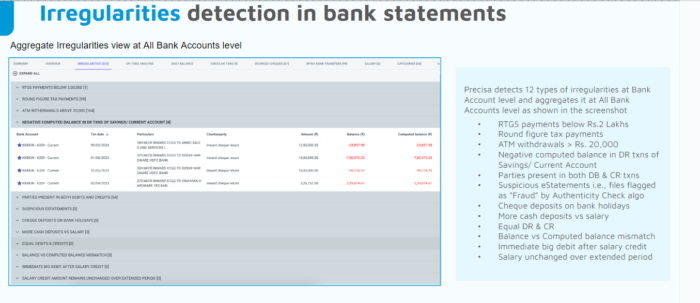

4. Detection of Irregularities in Bank Statements

While PDFs can be tampered with, it is also possible for borrowers to commit loan fraud in other, more sophisticated ways too. AI-powered bank statement analysis API can detect irregular transaction patterns and alert lenders early on.

Here’s a round-up of 12 types of transactional irregularities that the software can detect:

- Real-Time Gross Settlement (RTGS) payments of a value below INR 2 lakhs

- Round figure tax payments

- ATM withdrawals of above INR 20,000

- Negative computed balance due to debit transactions of savings or current accounts

- The same parties present in both debit and credit transactions

- Suspicious eStatements that were marked as “fraud” in the authenticity checks

- Checks deposited on bank holidays

- More cash deposits versus salary deposits

- Immediate large debts after a salary credit

- Salary remains unchanged for an extended period

- Equal amounts of debits and credit transactions

- A mismatch between the balance and the computed balance

Benefits of Ensuring Bank Statement Integrity

Lenders can benefit in multiple ways by automating the document validation process and catching transactional irregularities early on.

Prevention of Loan Fraud & NPAs

Lenders can prevent the occurrence of loan fraud, which can be facilitated through identity fraud, fraudulent documents, and fraudulent transactions. Lenders can also reduce the growth of non-performing assets (NPAs), which significantly eat into business revenues.

Compliance With Regulatory Guidelines

Lenders can comply with all regulatory guidelines, avoid being under the authorities’ radar, and avoid paying hefty fees and penalties, which cuts operational costs.

Avoid Negative Publicity

Loan fraud, scams, and growing NPAs can damage a lender’s reputation due to negative press coverage. The stock price of publicly listed companies can also suddenly plummet, significantly impacting the company’s valuation.

Lenders must also hire expensive public relations agencies to control damage and manage their public image.

Drive Revenues & Profitability

Lenders making bank statement validation a best practice can gain customers with a clean record. In doing so, they can stay focused on offering customers superior, customised, and swift service. In turn, their efforts will drive revenues and optimise profitability.

Key Takeaway

Lenders investing in the right technology can take measures to weed out tampered documents right from the start of the lending life cycle. A superior bank statement analysis API software automates the entire process, thus eliminating any scope for human error and omission.

Lenders can focus on the more strategic aspects of the businesses, from driving revenues to offering customised, relevant services to diverse borrowers.

Presica’s comprehensive and seamless bank statement analysis solution simplifies and automates the process. The software provides actionable insights on a customisable dashboard, thus helping companies make informed business decisions and minimise room for errors.

Request a free demo today!