All You Need to Know About the Four Levels of Digital Lending

Digital lending is a tool to enhance financial inclusion. It facilitates provisions to financial service providers (FSPs) to deliver better solutions quicker, cost-efficient, and engaging.

Whether financial institutes develop their digital lending capabilities, partner with other organisations, or both, they can adopt this framework to understand digital lending better.

But before you delve into the four levels of digital lending, here’s a quick glimpse into what it is.

What is Digital Lending?

Digital lending involves applying for, distributed through, and managed digitally, utilising data analytics to provide better credit decisions and innovative customer engagement.

What are the Components of Digital Lending?

Digital lending isn’t about improving the existing system but innovating something new. In other words, it refers to the process of applying for, disbursing, and managing digitally-driven financial products. Digital lending comprises three components:

1. Digital channels

Digital lenders leverage various digital channels to reach new and existing customers. It can be a smartphone app or a USSD (Unstructured Supplementary Service Data) menu. It enables a borrower to apply for credit, receive loan disbursements, obtain information on their accounts from the comfort of their home, work, or on the go.

Customers can engage with a product or service from anywhere and anytime. Such channels also allow lenders to gather digital customer data.

2. Customer experience and engagement

Customers’ experiences with digital products are central to the concept of digital lending. A digital lender’s core focus relies on engagement, such as quicker approvals, convenient access, personalised communications, and affordable products.

3. Digitised data

Rather than face-to-face, time-consuming evaluations, digital lenders rely on digitised data to evaluate borrowers. Various data sources like bank statements, payment history, e-commerce transactions, and credit bureau information are fed into algorithms to analyse repayment capacity and willingness.

On the other side, data helps marketers develop engagement tactics and improve customer service. It can be personalised communications or targeted promotions based on customer buying patterns.

Eventually, credit decisions could be made with digital processes in place within a day.

With such competing components, what is the process involved in digital lending? All you need to know about the four levels of digital lending is right below.

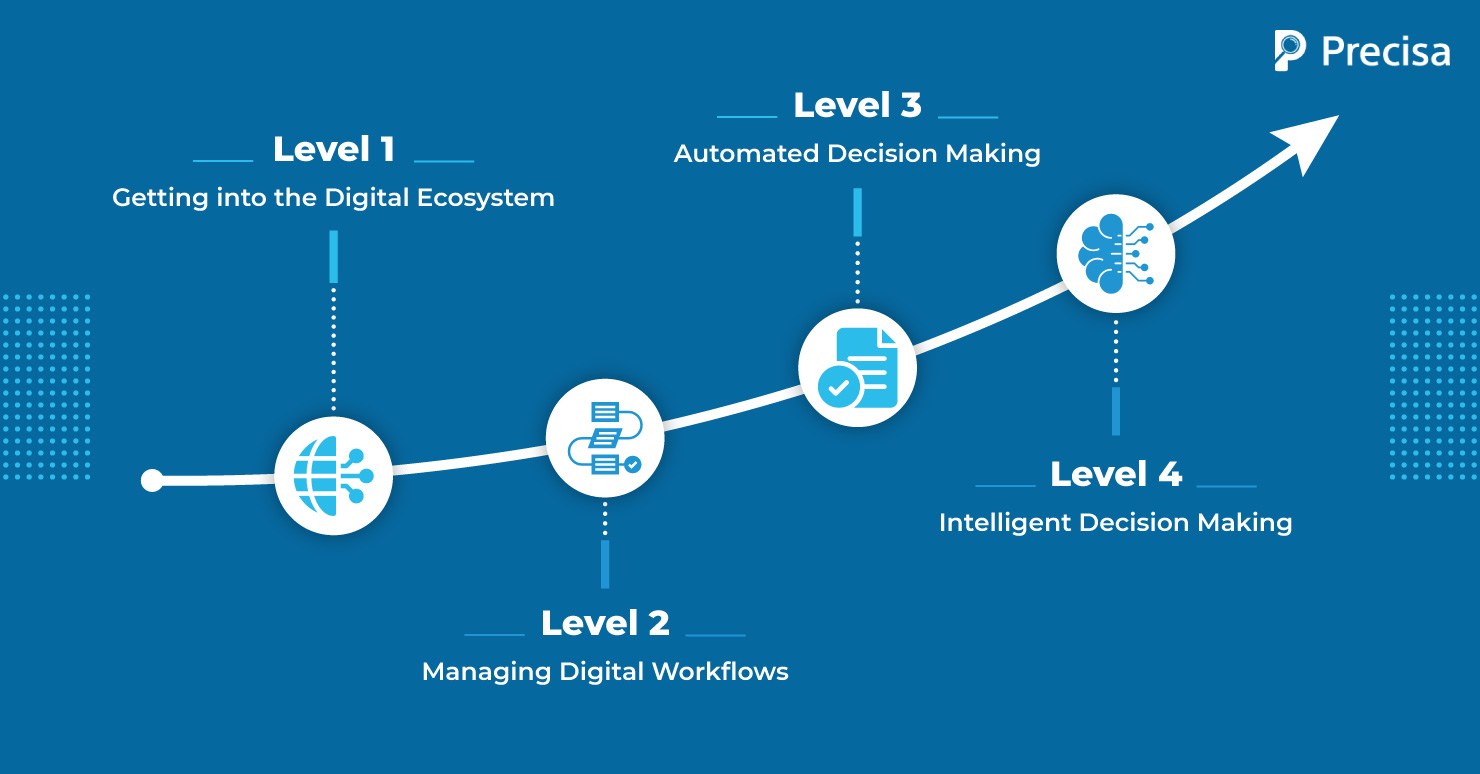

What are the Four Levels of Digital Lending?

Some financial institutions take a systematic series of steps towards digital lending, while others leapfrog to the highest levels of digitalisation.

In the first approach, it takes various levels to complete the process. As a result, system and internal resource investments vary with each level.

Different stages will have a different impact on lenders’ performance and customer experience. So let’s see what those levels are and how the process goes:

Level I – Getting into the digital ecosystem.

Moving any process online begins with building a digital user experience. However, early digitisation is not seamless. Every online application would need personal communication to bridge the starting struggles in most cases. Nevertheless, it is a basic level of digitisation that many lenders have already achieved. That would be a significant first step, but today’s consumers expect an entirely digital, integrated experience.

An online process that leads to a branch visit or a phone call can be frustrating. It is no wonder users walk away from such a process. Why should an applicant wait to know if they qualify for credit?

Instead, they would prefer an immediate offer with better flexibility and a simple user interface. Although consumers can tolerate some friction in more complex businesses such as lending, it will wane over time if they find alternatives. So, what next?

Level II – Managing Digital Workflows

As lenders move to the second level, they switch from online applications triggering offline processes to a fully-digital process. Yet, these processes are copy-paste versions of the old, offline ones more often than not.

For example, an executive needs to manually review underwriting documents, proof IDs and payslips in person. Thus, nearly replicating the in-person branch experience.

As a result, loan origination can be slower with manual back-end processes. Also, as a result, many users may give up. You can call this digitisation of legacy processes.

While getting to this phase had a lot of hard work and significant technology investment, it is not the journey’s end. What makes it better then? The next step.

Level III – Automated Decision Making

The third stage involves migrating your existing front-end processes to digital interfaces. Leverage unique digital capabilities for your customers and your employees to transform the approval and closing process.

First, a fully automated process. A soft pull – like an automated underwriting process for all applicants documents. It works on unlimited permutations and combinations of data processing. The result is better credit results, faster decisions, and happier customers.

Second, simplifying the approval and closing process even further with a digital environment. A bank statement analysis tool at the rescue. It helps to make informed decisions precisely. These processes can significantly improve close rates and potentially reduce loss rates.

So are we done? Automated decision making – That’s it? There’s something beyond.

Level IV – Intelligent Decision Making

Now lenders need to enhance their ability to make better decisions using advanced technologies, such as machine learning. For instance, powerful tools to detect fraud applications result in a higher share of decisions, faster close times, happier customers, and increased revenue.

Additionally, advanced analytics enable lenders to automate and improve their processes even better. Updating your systems with emerging technologies unlocks the potential to expand their loan portfolio and grow their customer base without risking their portfolios.

To conclude, these are the steps involved in a journey towards digital lending. But level four is set to upgrade anytime soon with innovative and cutting-edge technologies.

Lenders are striving to maximise the digital experience. In today’s world, financial providers value the importance of digital interaction with their customers.

It is a constant process to automate and often rebuild the underlying processes to leverage those capabilities. Need help digitising your financial operations? Precisa could be your best bet. You’re one click away from unlocking opportunities.