How Can Open Banking Overcome the Challenges in Underwriting?

In a digitally-accelerated financial services sector, traditional lending services relying on manual workflow often face several roadblocks. One of the biggest challenges is assessing a borrower’s creditworthiness in terms of accuracy and speed.

A thorough process to determine creditworthiness takes time and requires access to relevant data. Loan origination processes are equally time-consuming, and these factors severely limit the scalability of businesses.

This is where the concept of open banking offers the potential to tackle underwriting challenges quickly and accurately. As a result, lenders can expedite the loan origination process by leveraging a mix of state-of-the-art digital tools, ensuring a quicker turnaround for customers.

This blog evaluates the nature of underwriting challenges and open banking-enabled solutions.

What is Open Banking?

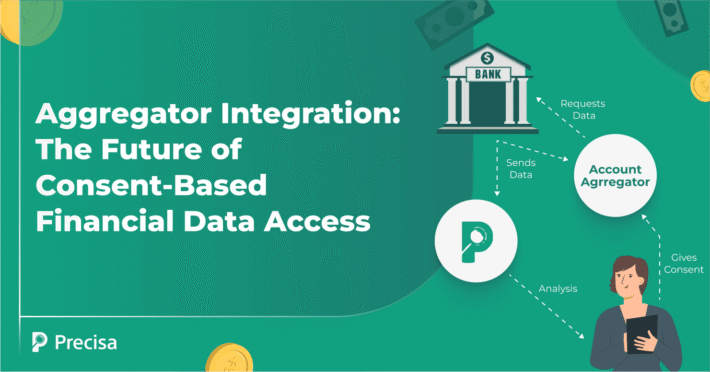

Open banking is a growing practice that enables secure and seamless interoperability of customers’ sensitive financial data for executing financial services.

Essentially, third-party financial services providers and fintech tools can directly access customer-permitted financial data, such as banking transactions, from banks and financial institutions. This process paves the way for accelerated and secure transactions anytime, anywhere.

Today, open banking is seen as an answer to expedite the underwriting process for insurance and loan applications.

But first, let’s understand exactly what underwriting is.

What is Underwriting: A Short Explainer

When a lending platform, bank, Non-Banking financial company (NBFC), or any other lending entity funds a loan to a business or individual applicant, they essentially agree to take on a certain amount of risk.

Underwriting is the process of evaluating the risk factor involved in the proposed agreement in case the applicant cannot repay the loan.

Therefore, the lender must determine how much risk it can take before the loan becomes profitable. It is a vital process that ensures financial institutions do not bleed dry due to bad loans.

However, the traditional underwriting process comes with some particular challenges.

3 Major Challenges with Underwriting

In a crowded and competitive lending services market, traditional lending businesses and their borrower pipeline often face the following challenges:

1. Manual processes

To demonstrate their creditworthiness, loan applicants need to submit a ton of paperwork, including salary slips, identity proof, income tax records, and bank statements.

This is a cumbersome process for lenders and applicants who must put in manual effort to collect and evaluate the paperwork.

2. Slow turnaround time

A significant amount of manual paperwork slows down the entire loan origination process, and the turnaround time can run into days or weeks, thus resulting in loan applicant drop-offs.

Such lending outcomes do not bode well for a healthy, business-positive economy.

3. Uninclusive processes

Submitting salary slips is much easier for employees who have full-time jobs over some time.

However, for borrowers with multiple and informal income sources, submitting salary slips may not adequately represent their creditworthiness. Lenders need to go much deeper to get a complete picture of their financial status.

Hence, more robust, all-encompassing processes are needed to accommodate a broader customer base.

Impact of Open Banking on Lending Services

Due to these obstacles in the traditional underwriting process, the current system struggles with the timely and accurate assessment of a potential customer’s creditworthiness.

Consequently, a customer’s loan application may be unfairly rejected, thus excluding a customer from the ecosystem. Also, the inconclusive financial information a prospective loan applicant shares may render it challenging for businesses to detect risk attributes.

These challenges in the underwriting process make it difficult for lending businesses to be inclusive, scale their operations, and successfully predict risk.

This is where the intervention of open banking can address many of the current underwriting challenges.

Key Benefits of Open Banking

Here are some advantages Open Banking could offer to modernise the underwriting process.

1. Improve financial inclusion

One of the pivotal outcomes of open banking is the potential to accelerate financial inclusion, especially in a segment like lending.

For instance, a growing number of borrowers in India require a fast underwriting process. Open banking is instrumental in offering accurate financial data so lenders can make informed decisions.

2. Eliminating financial data silos

Open banking can bridge the data-sharing and interoperability gaps, as it is built on a foundation of networks and shared data.

Several banks can now share customers’ data with third-party developers to finetune their services.

3. A frictionless experience

Another key benefit of leveraging open banking systems is that businesses and customers can access a frictionless digitised experience.

A third-party API smoothly integrates a connection between a consumer’s data and the lending entity’s app for quick transfer and analysis of the financial data. Since this is a completely automated process, every step of the customer experience is seamless without manual interventions.

Lending platforms can automate an accurate, accelerated underwriting process, a smooth onboarding process, fast-track the risk evaluation process, and speed up the verification and delivery of the loan.

4. Scaling operations

With the current underwriting process, lending companies find it hard to scale operations and simultaneously serve diverse customers.

Open banking can handle large volumes of financial data, access the data in real time, and execute data analytics-led processes. These capabilities enable data-driven underwriting, fast processing of loan applicants and the ability to scale quickly and accurately.

5. Safeguarding customer data

The Reserve Bank of India has provided a new digital lending guideline underpinning the importance of customers’ data security and safeguarding customer interests.

There are fintech tools that ensure the optimum and ethical utilisation of the customer’s data and align the business interests with the regulatory frameworks.

Key Takeaway

Open banking offers a dynamic, innovative, and secure solution to tackle current challenges in underwriting.

While many APIs are available in the market, businesses need to integrate those with a promise of security, an identity management framework, compliance with all regulations, and stellar API management.

Effortlessly Analyse Bank Statements with Precisa

Precisa, a cloud-based, intuitive analytics solution with intelligent automation, offers effective tools to decision-makers in lending, insurance, wealth management, and personal finance.

Presica’s comprehensive and seamless financial data analysis solution simplifies and speeds up the process through automation. The software provides actionable insights on a customisable dashboard, thus helping companies make informed business decisions.

Request a free demo today!