Role of User Experience Design in Fintech

The speed of digitisation in financial services had been picking up for a while, but the pandemic has accelerated it big time. Fintech-as-a-Service (FaaS) platform, growth in digital-only banks, increased usage of biometric security systems, and the rise of autonomous finance have all lately emerged.

When it comes to digital transformation, Fintech, of course, is at the forefront. We must keep in mind that traditional banks are lagging behind with a $30 billion yearly investment in this area, compared to $111 billion for Fintech.

What Does a UX/UI Designer in Fintech Do?

In 1994, Microsoft founder Bill Gates stated, “Banking is needed; banks are not“. Nowhere is this more visible than in the Fintech sector wherein the emergence of intuitive, user-friendly, and accessible financial services technologies has driven legacy banks to enhance their game.

According to a Business Insider Intelligence study, about 89% of all consumers now use mobile banking, with 91% preferring mobile banking over visiting a branch. According to Capgemini’s research, the three primary reasons customers switch from traditional banks to Fintech services, are cheaper costs, ease of use, and faster service.

Throughout the Fintech revolution, UX/UI designers have played a critical role in enhancing accessibility and using design to both address the pain points that customers encounter while using banking services and to create and maintain confidence.

Understanding the value of design in attracting and retaining customers, both Fintech startups and large banks are hiring UX/UI designers to help them differentiate their products and services. This increase in demand has resulted in more Fintech job postings, higher incomes, and exciting opportunities to influence how people think about and manage their money.

How Is UX/UI Design Used in Fintech?

UX/UI design in Fintech is similar to UX/UI design in other industries in that the ultimate goal is to create a pleasant user experience that leads to increased user engagement, retention, and conversion, based on the product/service. However, the exact uses of UX/UI design can vary widely, and the stakes in Fintech, where customers’ finances are involved, can be high.

1. Building an engaging product identity

Banking apps have always been associated with muted colours and technical jargon. Fintech has offered a wholly distinct, thrilling brand experience that is far from the traditional banking product. And in today’s industry, when new user acquisition can be difficult, product identification is extremely important. According to studies, a strong brand identity not only encourages customers to try new products but also encourages them to engage with a company for a longer period of time.

2. Building Trust

Users, particularly those who are not digital natives, will be far more hesitant to entrust their finances to an app. Even people who are accustomed to financing apps will need to know that they can trust a service before handing over personal data. A UX designer’s understanding of user behaviour and user-centred design can be transformative in this situation.

Users will require “near continual reassurance and validation” that their information is protected and that the transactions they have made have actually gone through, whether the Fintech product or service is for banking, budgeting, investing or advising—all of which may be achieved through excellent design.

3. Onboarding

No matter how well-designed or simple-to-use a Fintech product or service is, it will inevitably require an onboarding process that includes the collection of financial data, identity verification, and anti-money laundering checks, which may necessitate potential customers to wait a few days before they can use their account.

Because the onboarding process can be time-consuming and overwhelming, UX designers play a critical role in making the process easier to manage. Some of the design ideas employed include breaking up the “registration stages into small sections.” Doing so will make the entire process much more palatable and provide the mental space you need to concentrate on the answers.

4. Simplifying and delighting

Fintech is more than just digitising a bank.

“It’s all about giving people a better experience.”

This implies a big part of the Fintech UX/UI designer’s job is addressing existing banking pain points like making financial jargon less intimidating, visualising financial information, trying to make frequently performed actions simpler and more intuitive, and, depending on the app, incorporating graphics, conversational language, and sound effects to delight customers.

5. Introducing features one by one

When it comes to developing a new Fintech or banking product one of the worst things you can do is overload your users with options. Limit the number of options your customers are presented with at each stage of the process by keeping your main product suite to a bare minimum.

If you want to upsell a new product or introduce a new feature to your existing customers, make sure you do so after they’ve had enough time to engage with your original offer.

6. Paying attention to device adaptation

Graphs and statistics are a particular feature of Fintech that must be ascertained when considering how the product presents on mobile or tablet devices, and also on a desktop or laptop screen. As a result, ensure your graphics are scalable and readable at all times. Make sure there isn’t too much information in them to display well in a smaller size.

You must research the devices that your target audience uses the most since this will help you establish the screen size for which you want to optimise your product.

Final Thoughts

Financial product designs don’t have to be dull as long as your designers can produce an engaging fintech UI/UX design that speaks to your clients in the language they choose. The ultimate strategy to make customers fall in love with your product is to develop a pleasant and user-friendly financial app. Fintech UX design is more science-based, concentrating on data, user behaviour, design patterns, and developing products that address customers’ problems.

Disrupting long-held paradigms and fusing them with cutting-edge technology is a difficult endeavour. Product owners, on the other hand, have no choice but to concentrate on the user experience to improve engagement and interaction.

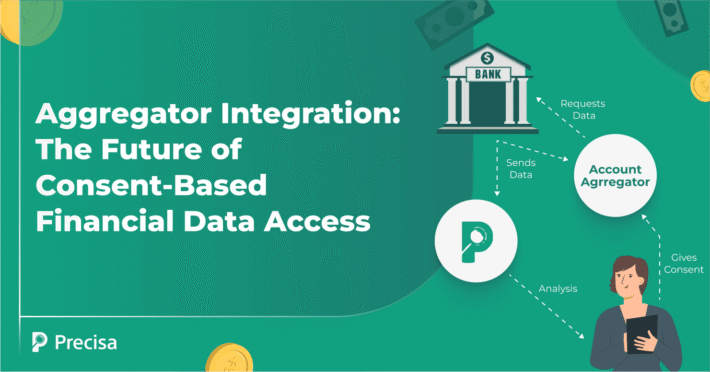

Precisa’s bank statement analysis software allows you to totally reconstruct your bank statement analysis process, thanks to its seamless integration with your existing lending management system.

Precisa allows for a full review of the applicant’s financial analysis by providing a complete real-time view of the bank data. This allows for a more detailed assessment of the applicant’s creditworthiness as well as quicker turnaround and decision-making on the lender’s end.

Customer satisfaction rises as a result of the BSA’s quick judgments and agility, and the result is improved customer relations, increased business, and increased customer retention.