Underwriting SaaS Companies for Cash-Flow Based Lending Using Precisa

Over the ages, traditional banks have struggled to play a bigger role in the expansion of SaaS companies. On the surface, a SaaS company lacks many of the traditional creditworthiness indicators, such as inventory and receivables.

With intangible assets and technologies that some banks still consider experimental despite decades of proof points, SaaS companies struggle to offer the deep book of typical net 30 or net 60 receivables, or even much security at all. This can make obtaining a traditional line of credit of any size problematic.

That’s why institutions successfully lending to SaaS companies have embraced a new set of metrics to objectively analyse an opportunity. SaaS companies are often measured by cash flow rather than traditional receivables. Banks may make smart decisions that aren’t tied to 20th-century loan criteria when they integrate client renewal rates and the robustness of the company’s revenue growth.

The choice to lend is based on the predicted lifetime value of current customers and the ability to acquire equally loyal new customers in the future. This cash-based financing shows a shifting perception of SaaS’s potential.

Cash-Flow Based Lending: The Next Big Thing in Lending

Cash flow-based loans take into account the borrower’s overall financial health and give loans based on projected cash flows, or the profits and revenue margins of the business. The lender will determine the borrower’s payment capacity based on a review of previous cash flows and a prediction of future cash flows. It implies that the borrower expects future revenues which would be used to repay the loan.

Cash-flow based lending allows lenders to reinvent the end-to-end loan process by leveraging real-time cash flow data. This comprises credit product configuration, underwriting, and payback. It eliminates the need to evaluate users using collateral. The introduction of new loan products with a short duration, small ticket size, faster approval turnaround time (TAT), and variable repayment terms is made possible by real-time visibility of cash flow.

Cash-Based Financing Business Models:

1. Revenue-Based-Financing Model (RBF)

Revenue-based finance (RBF) is a new alternative to debt financing and more traditional equity-based investments (such as venture capital or angel investing). RBF allows entrepreneurs to raise capital without diluting their equity or requiring security, and repayments are made as a percentage of monthly revenue. This ensures that your company always has enough cash on hand to cover inventory and marketing expenses.

Revenue-based financing (RBF) is gaining traction in a market where venture capital reigns supreme and start-ups rely on their networks for investor introductions, ultimately diluting ownership in exchange for funding. It promotes businesses to raise financing by pledging a percentage of their sales, with no collateral, personal guarantees, or stock dilution required.

Revenue-based lending combines the best aspects of debt and equity. In exchange for a percentage of future revenues, financing is offered. There is no loss of corporate ownership, and the risk to the business is reduced because repayment is not fixed.

2. Subscription-Based Financing (SBF)

Subscription-based finance (SBF), an intriguing idea, has evolved as an appealing alternative source of funding over time. SBF allows recurring revenue businesses to raise funding without diluting their stock by quickly exchanging subscription revenue for cash.

The predictable cash flows and recurring revenue maturities make it similar to a fixed income-yielding asset profile for an investor. It’s great for SaaS and other subscription-based businesses in need of capital to expand and acquire new customers.

Outside traditional equity and venture loans, additional funding solutions for SaaS startups have evolved in recent years. With more than 95% of SaaS companies never raising venture capital or being deemed unsuitable for venture capital, these new SBF has created flexibility for SaaS founders looking to limit dilution, extend the runway to reach a value target/milestone, or simply run a profitable SaaS business bootstrapped.

What is Monthly Recurring Revenue (MRR)?

MRR is a figure that represents a company’s recurring monthly revenue on an average basis. Software-as-a-Service (SaaS) enterprises that rely on a subscription-based revenue model frequently employ it.

Although MRR is not recognised by accounting rules such as GAAP or IFRS, investors continue to track it. Investors can rapidly assess a company’s growth by examining its MRR trend from month to month.

Hence, the predicted total revenue generated by a company from all active subscriptions in a given month is known as Monthly Recurring Revenue (MRR). One-time payments are excluded, however recurring charges from discounts, coupons, and recurring add-ons are included. You can use MRR to evaluate your company’s current financial health and forecast future earnings based on active subscribers.

Underwriting Requirements: How Does an MRR Line of Credit Work?

Unlike traditional financing, an MRR line of credit allows a company to get funding based on revenue rather than assets or profits. The credit line is revolving, which means the company can use the funds again and over while paying off their debt. However, depending on the company’s earnings, the maximum borrowing amount of the credit line will change month to month.

Because the amount due each month is determined by the amount of money generated by the borrower, MRR does not normally have a target repayment date. If the company’s profits slow down, the instalments will be reduced. Conversely, if revenues are higher, the loan is repaid faster.

Lenders usually look at the typical expenses involved with the activity the business is trying to fund before accepting a loan. They also consider how much revenue the company is anticipated to generate, to agree on a fair repayment percentage.

The maximum loan amount will be determined by a multiple of trailing MRR, adjusted for customer retention (or renewal) rate. For instance, if the credit is predicated on a 3x multiple, your trailing three-month MRR is INR 6,00,000, and your retention rate is 95%. Your maximum loan amount in this situation would be INR 17.10 lakhs (3 * 6,00,000 * 0.95). The retention rate could also be expressed as (1-0.05), where 0.05 is the churn rate, which is a measure of customer attrition or loss.

How to Identify Monthly Recurring Revenue (MRR) with Precisa?

Bank statements are useful for determining a company’s or individual’s revenue, costs, and, most crucially, spending patterns. Hence, most financial institutions assess a customer’s creditworthiness by carefully scrutinizing bank statements.

With a simple web application that allows you to upload bank statements and delivers actionable insights in real-time, intuitive dashboards, Precisa strives to simplify the bank statement analysis process.

The bank statement analyser extracts data from bank statements and categorizes transactions, analyses the data, finds fraudulent transactions and other irregularities, and assigns a Precisa score to overall creditworthiness.

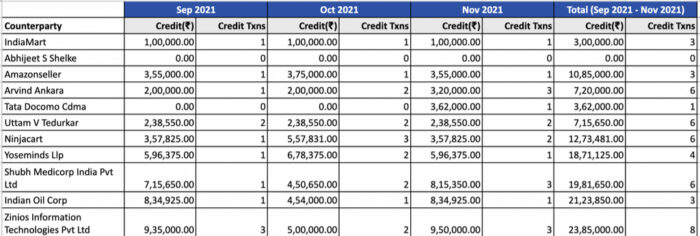

On a monthly basis, Precisa’s Monthly Counterparty Tab lists all the counterparties linked with inflows (revenues: credit transactions) and outflows (expenses: debit transactions). This aids in the identification of recurring revenue contracts because the monthly view allows you to see from which counterparty you’re receiving monthly/repeat inflows (revenue) and how much income is coming in. This tab displays information about the user’s business’s benefactors and receivers.

Takeaways

Precisa is a powerful bank statement analyser that may help you save time by reducing processing time, generating risk and volatility scores, detecting abnormalities, and tracking transactional trends and account aggregations.

This user-friendly tool delivers valuable insights into the financial health of potential borrowers, detecting abnormalities that could otherwise go unnoticed.

Book a demo today to get a hands-on experience.