When it comes to fighting financial crimes like money laundering and financing of terrorism, deciding when should a bank apply Customer Due Diligence (CDD) has become critical. Knowing your customer remains one of the primary bulwarks and one of the four fundamental components of an Anti-Money Laundering (AML) compliance programme. This entails confirming customers and […]

Reforming the Lending Landscape: RBI’s Directive to Review Overcharging on Loan Rates

Recently, the RBI has pointed out cases where bank loan rates have been excessively charged, emphasising the need for reform. Addressing this pressing issue, the central bank has taken a stand against unfair lending practices through a recent directive to restore transparency and fairness to the lending process. The lending practices in India have evolved […]

Bank Statement Analysis API Solutions for Tamper-Proof PDF Validation

Loan applicants often submit numerous PDF bank statements. Lenders use web-based financial analysis software to quickly extract and analyse data from these documents, assessing cash flow and creditworthiness. PDFs may include identity documents, statements, invoices, and Goods & Service Tax Returns (GSTR). However, a growing challenge for lenders is verifying whether the PDFs are authentic. […]

Bank Statement Analysis APIs for a Competitive Edge

Due to several factors, lenders are now more likely than ever to make poor risk assessment decisions. These include the speed at which lenders aim to approve loan applications, the growing potential for loan fraud, and increasing delinquent debt. Also, unexpected market downturns and opportunity costs contribute to the risk factors. Moreover, as lenders scale, […]

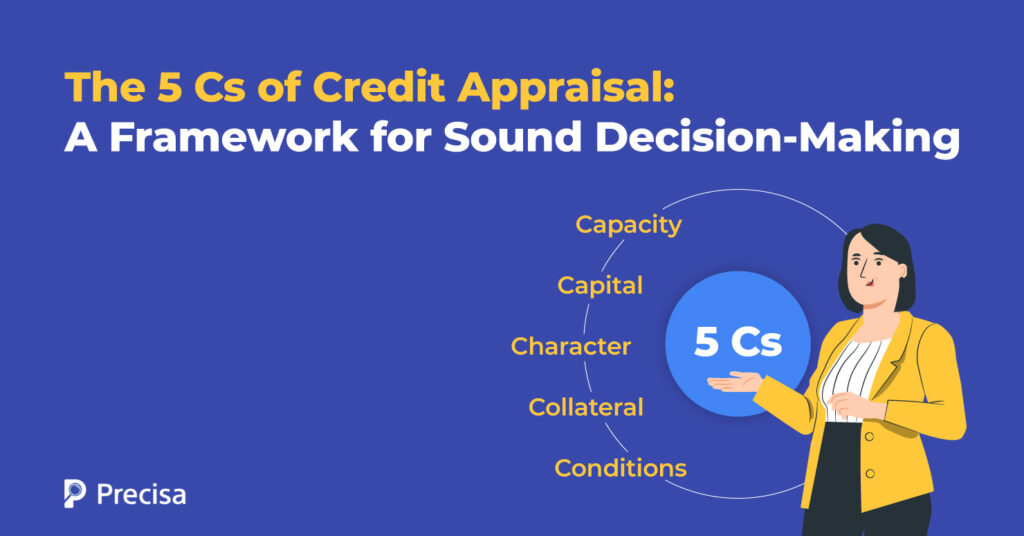

Understanding the 5 Cs of Credit Appraisal

In a dynamic environment, several external factors — from market downturns to operational disruptions — can impact a borrower’s repayment ability. Thus, lenders must build credit appraisal systems that account for multiple risks and are robust enough to handle worst-case scenarios. Leveraging superior bank statement analysis and financial data analytics software empowers lenders to strengthen […]

Fintech Generational Shift: How Younger Consumers are Disrupting Traditional Finance

Do you know we have used online banking for almost 20 years? Time has flown very quickly, but the financial sector has changed significantly throughout the years. The demographic shift among young people is influencing the developments in the fintech industry. Younger consumers’ preference for individualised and digitised financial services is transforming the banking landscape. […]

Data Quality & Integrity in Financial Analysis Tools

In financial analysis, every decision–from investments and risk assessments to strategic planning–relies on the accuracy and reliability of your data. Data quality and intеgrity arе cruciаl bеcausе dеcisions arе mаdе basеd on thе insights dеrivеd frоm thе data. If the data is inaccuratе, incomplеtе, and inconsistent, it can lead to faulty analysis and potentially erroneous […]

How Lenders Can Stay Ahead with AI in Banking

Artificial intelligence (AI) has immense potential to transform operations across all industries, including banking and lending. Employing AI in their day-to-day functioning helps banks reduce costs, increase productivity, improve decision-making, spot fraud, and be more customer-centric. A Business Insider report suggests that nearly 80% of banks are aware of AI’s conceivable benefits in banking. Another […]

India’s Lending Fintech Landscape: Road Ahead and Potential Challenges

With over 9,000 registered lending fintechs, India has the third-largest fintech ecosystem worldwide. The notable rise in fintech companies can be attributed to several factors including high internet penetration, incompetent banks and financial institutions, evolving consumer behaviour, and favourable regulatory policies. Additionally, India’s large unbanked or underserved population coupled with a thriving startup ecosystem has […]

Bank Statement Analysis Strategies for Today’s Challenges

As the lending industry continues to grow, risk assessment and management will emerge as one of the top functions, enabling lenders to build sustainable, profitable businesses. Managing risk effectively can help companies prevent the growth of non-performing assets (NPAs), loan fraud, lending scams, and other negative consequences. Financial technology will play a key role in […]