Data is increasingly vital in enabling businesses to streamline their workflows, drive revenues, and become profitable in the Internet economy. According to a McKinsey survey titled ‘The data-driven enterprise of 2025,’ adopting artificial intelligence (AI)- powered data practices is helping businesses grow revenues by at least 20% before interest and taxes. Access to high-quality data […]

Explore the Importance of Digital Data for Instant Credit Appraisal Process

Digital innovation and fintech have made life easier than ever. There is hardly any waiting in the line. You can simply book tickets, order groceries, or even secure a loan in minutes – all from the comfort of your home. The instant loan market in India is making financial help more accessible than ever with […]

Streamline Bank Statement Analysis with Python and AI: Faster, Smarter Decisions

Scaling a lending business presents a significant dilemma: higher loan volume increases potential profits but also the risk of default and fraud. Thorough risk assessment is essential, yet the sheer number of loans can make this process overwhelming. Lenders that embrace the benefits of technologies such as automation, Artificial Intelligence (AI), and Python can strengthen […]

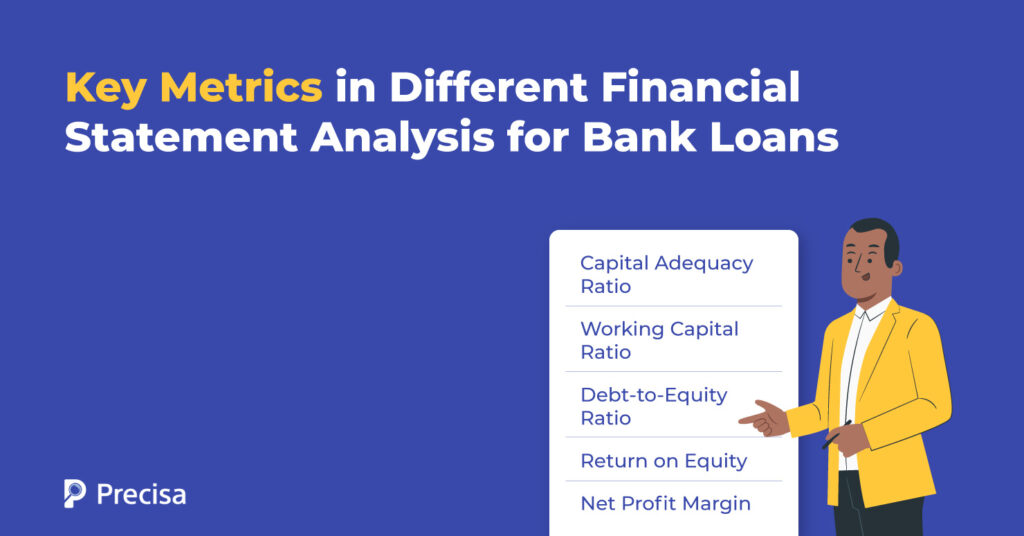

Key Metrics in Different Financial Statement Analysis for a Bank Loan

Lenders generally need to cross-examine the applicant’s financial strengths and weaknesses before approving a loan application. Financial statement analysis helps them make these decisions; it involves evaluating an applicant’s financial statements to assess their financial health and determine their creditworthiness. This includes information about the borrower’s assets, liabilities, income, and expenses. Financial statement analysis for a […]

Bank Statement Analysis Time Reduced: Power of Precisa’s API

Extending credit inherently often carries risk for lenders, such as: Borrower’s inability to repay due to job loss, unexpected expenses, or poor financial management. Economic downturns can lead to increased defaults across an entire portfolio. Lenders may fall victim to identity theft or false information provided by the applicant. Many lenders rely on gaining deeper, […]

Decoding Income Verification’s Role in Credit Appraisal System

Imagine applying for a loan to start your dream business. The lender is excited about your idea, but they need one crucial thing: proof that you can afford to repay the loan. That’s where income verification comes in – a crucial step in the credit appraisal system which determines your ability to handle the financial responsibility. […]

Lender Awareness: Understanding the Most Common Business Loan Frauds and Scams

Many lenders often decide to entice borrowers with the promise of instant loans. However, lenders’ urgency to disburse more loans and borrowers’ eagerness to receive them can have adverse consequences, especially if the former does not perform due diligence. For example, lenders face the risk of engaging in loan fraud when dealing with dubious borrowers. […]

Everything You Need to Know About Bank Statement Extraction As a Lender

Digital transformation in India has paved the way for accelerated growth in the lending domain. According to reports, the lending market size was valued at $ 270 billion in 2022. This figure is projected to grow at a compound annual growth rate of 22% to over $ 720 billion in 2030. A mix of banks, […]

Precisa Credit Appraisal System: A Complete Guide

Lenders face several challenges concerning the credit risk management process. Some of these include inadequate data quality, lack of skilled underwriting personnel, lack of data security, lack of inclusive risk assessment strategies, and poor compliance monitoring frameworks. These multiple challenges converge into one major challenge – the inability to appraise potential borrowers’ creditworthiness accurately. In […]

Red Flags in GSTR Analysis: What Lenders Should Look For When Reviewing Returns

As the world becomes increasingly interconnected and digitised, each transaction and interaction generates valuable data, which, if harnessed well, can offer invaluable insights and aid decision-making. One such revolutionary use of data is the leveraging of Goods and Service Tax (GST) data by lenders to make more objective lending decisions. GSTR analysis helps lenders employ […]