Lending is one of the fastest-growing verticals in the industry. Capitalising on the large credit gap among both business and consumer borrowers, Banks, non-banking financial companies, and other lenders view it as a high-potential revenue stream. However, the traditional banking ecosystem is not fully equipped to serve borrowers based on their diverse needs or execute […]

Achieving Confidence in Lending: How Bank Analyser Enables Accurate Loan Decisions

Advances in data analytics, big data, and artificial intelligence (AI) have opened up new avenues for banks and other financial institutions to improve their credit decision-making models. Additionally, the increasing appetite for digital transformation and sophisticated tech-driven services has translated into introducing innovative tools like bank analyser in the banking ecosystem. The Indian financial ecosystem […]

Early Warning Signals in Banks for Liquidity Profile of Businesses

Early warning signals (EWS) are indicators that help banks identify potential liquidity problems in businesses before they become critical. These signals help banks proactively manage their exposure and protect themselves from losses. The liquidity of a business is reflected in the abundance of its cash and readily convertible cash equivalents. Lenders prefer borrowers who have […]

Early Warning Signals for Bank Liquidity Assessment

Early warning signals in banks are indicators that help lenders and financial institutions identify potential liquidity problems in businesses before they become critical. These signals help banks proactively manage their exposure and protect themselves from losses. The liquidity of a business is reflected in the abundance of its cash and readily convertible cash equivalents. Strong […]

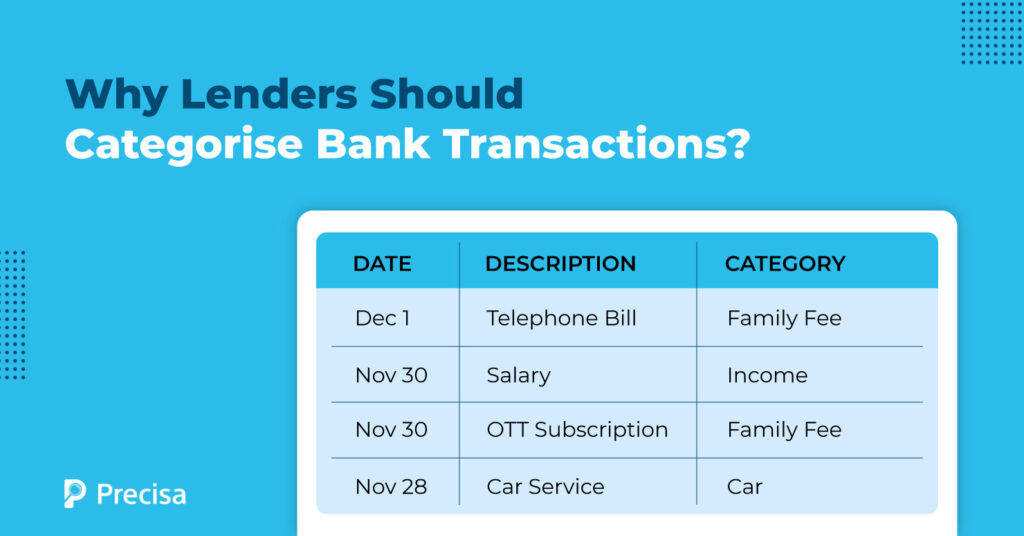

Why Lenders Should Categorise Bank Transactions (And How To Do It)

Did you know in the fiscal year 2023, India witnessed a staggering 103 billion digital transactions, amounting to over 166 trillion Indian rupees. Despite the substantial financial activity across the nation, effectively organising transactions in your bank statement remains a critical task for gaining insights into your spending patterns. Lenders always struggle to figure out […]

Fintech Startups: SWOT Analysis of RBI Regulations Regarding Consumer Borrowing

India, home to 9,000 fintechs, has the third-highest number of fintechs globally and holds a 14% share of Indian startup funding. Many fintech startups in India have forayed into digital lending. These fintech companies extend credit through the Non-Banking Finance Companies (NBFCs) they own or their partnerships with other NBFCs. As per industry estimates, the […]

How to Leverage Balance Sheet Analysis to Make Informed Credit Decisions?

The balance sheet is a financial statement that provides information about a company’s assets and its sources of capital (equity and liabilities/debt). In this context, balance sheet analysis examines a company’s balance sheet to assess its financial position, liquidity, solvency, and overall financial stability. It has emerged to be a valuable tool that helps lenders, […]

How Account Aggregators are Using ‘Informed Consent’ and Revolutionising Digital Lending

When financial data is involved, consenting without the full knowledge of the terms and conditions can have trust-reducing consequences for consumers. This can make financial consumers more reluctant to consume important services like loans. On the other hand, consumers may also need to share the same data several times when applying to multiple service providers […]

Managing Risks of AI in Finance: Governance and Control

The use of Artificial Intelligence (AI) comes with several opportunities to help businesses scale and excel in meeting their goals. AI is now being used in almost every field to build innovative products and services. AI-based predictive analysis is key in helping companies forecast the future. For instance, lenders can predict the potential creditworthiness of […]

AI in Banking: Why Financial Institutions are Betting Big on Artificial Intelligence?

AI in banking is redefining the financial sector and changing how banks function and interact with customers. Financial institutions are assessing options and adopting groundbreaking technology to meet the ever-evolving expectations of tech-savvy customers and meet emerging challenges like security, compliance and changing marking dynamics. The convergence of banking, telecom, retail and information technology has […]