If you’ve ever been part of a financial forensic audits, you know how long and tiring it can be. These audits are essential for spotting fraud, checking creditworthiness, and ensuring compliance. But traditional audits move at a snail’s pace. According to the International Journal of Innovative Science and Research Technology, AI can now perform real-time […]

Why DSA Ratings Drop: How Manual Due Diligence Costs You 10x More Cases?

Direct Selling Agents (DSAs) connect potential borrowers with the most suitable financial institutions and vice versa. As the number of borrowers grows, financial institutions are relying more on DSAs for loan distribution. However, as DSAs, you face stiff competition and numerous challenges; manual due diligence is one of them, which ultimately impacts DSA ratings. DSAs […]

RTGS Fraud Detection: Exposing Money Laundering Patterns Under ₹2 Lakh

Designed for high-value, real-time transfers, RTGS transactions are irreversible. Once money leaves an account, recovery is difficult. This means RTGS transactions are a prime target for fraudsters. For instance, in October 2025, a major scam happened in Mumbai. A victim was duped of Rs 58 crore via RTGS into various accounts under the pretext of […]

How API Integration Simplifies Bank Statement Analysis for Lenders

APIs (Application Programming Interfaces) now drive innovation and operational efficiency across fast-evolving technology domains. API integration enables lenders to automate bank statement analysis, replacing manual reviews with data-driven insights. This approach accelerates and standardises the process for extracting and analysing customer financial data. All lenders, including fintechs, banks, and NBFCs (Non-Banking Finance Companies), process thousands […]

Volatility Score: A Better Repayment Predictor Than Income Alone

Lenders have long relied on income statements to assess repayment capacity. Yet, defaults still occur among borrowers with seemingly high and stable salaries. Income tells you how much someone earns, not how consistently they manage their money. Traditional credit assessments overlook a critical factor – cash flow stability. The volatility score changes that, offering lenders […]

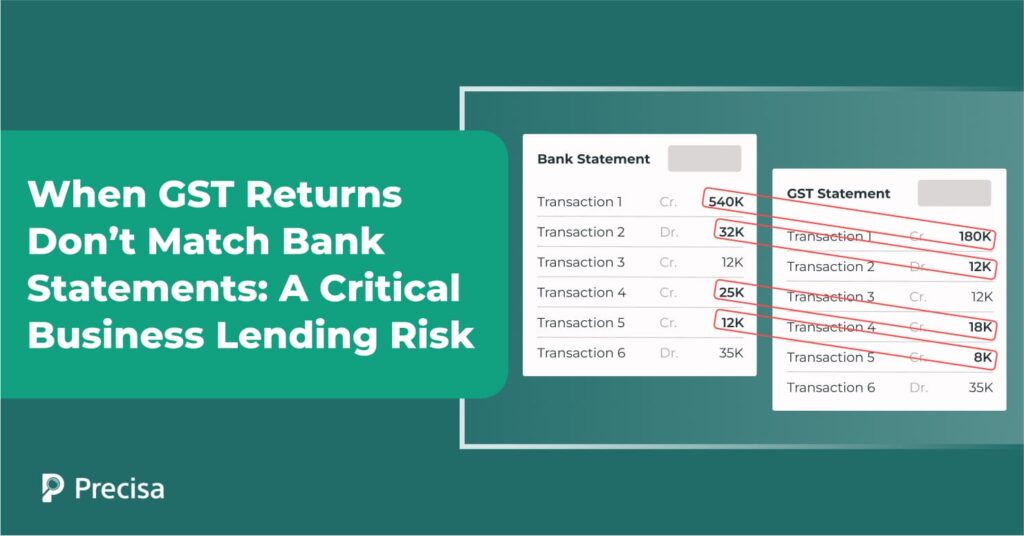

When GST Returns Don’t Match Bank Statements: A Critical Business Lending Risk

GST returns are now one of the most dependable indicators of a business’s financial footprint. They reflect declared revenues, tax compliance, and transaction consistency. However, when GST filings don’t align with actual bank inflows, it raises serious questions about the data credibility and borrower transparency. According to the CAG report of 2024, the authorities identified […]

Cash Deposits on Bank Holidays: An Often Missed Red Flag in Financial Fraud Detection

Financial fraud detection is a complex and challenging task, whether you are a lender, forensic auditor, or compliance officer. Despite staying vigilant, fraudsters often find ways to circumvent systems and defraud the financial system. The Reserve Bank of India (RBI) reports a decrease in fraud cases, dropping to 23,953 in 2024-25 from 36,060 the previous […]

Best Practices for Multi-Account Financial Analysis in Complex Investigations

21st-century financial fraud leaves, not just one, but numerous digital footprints across multiple banks, wallets, and payment platforms. Today, investigators face suspects who split transactions across 5 to 20 different accounts to obscure money trails. What once involved tracking cheques and cash deposits now requires analysing UPI transactions, NEFT transfers, and cryptocurrency movements all at […]

Why Choose Precisa: Analysis of 1000+ Bank Formats Across 21 Countries

Even with digital adoption, loan approvals in India still take considerable time. A major part of this delay comes from manual bank statement verification and financial assessment. Analysing one application traditionally takes 30 to 45 days. For a lending institution processing 100 applications monthly, that’s 3,000 to 4,500 days of cumulative work. As a result, […]

How Daily Balance Tracking Improves EMI Recovery Rates

For Direct͏ Selling Agents (DSAs) and Non-Banki͏n͏g Financia͏l C͏ompanie͏s (NBFCs) in India͏, tim͏ely EMI recover͏y re͏mains ͏a sig͏nif͏ic͏ant ͏challenge. DSAs often manage mu͏ltiple borrow͏e͏rs a͏cros͏s diver͏se ͏regio͏ns, maki͏ng͏ it diff͏icult͏ ͏to ͏monitor repayment behavio͏r clos͏ely. Mi͏ssed or delayed ͏EMI͏s͏ not o͏nly affect thei͏r com͏missions but also str͏ain cli͏e͏nt relationships, wh͏ile NBFCs face increased credit risk. […]