Precisa’s Custom Bank Account Analyzer for Gromor’s Credit Assessment

Gromor Finance is a lending company that provides secured and unsecured financing to unassisted enterprising entrepreneurs of India, who are otherwise excluded from the lending landscape. Through simple lending processes, Gromor aims to give them the right impetus to move forward.

Now, being in the lending business, Gromor’s operations rely on analysis of bank statements and CIBIL scores of clients for accurate credit evaluation. Over the years, Gromor has advanced itself in terms of technology to upgrade its processes. However, the company never shied away from feedback and improvisations.

This is Gromor’s story, and this is how it emerged as a full-fledged financing institution, harnessing Precisa’s state-of-the-art custom Bank Statement Analyser (BSA) since July 2018.

The Problem

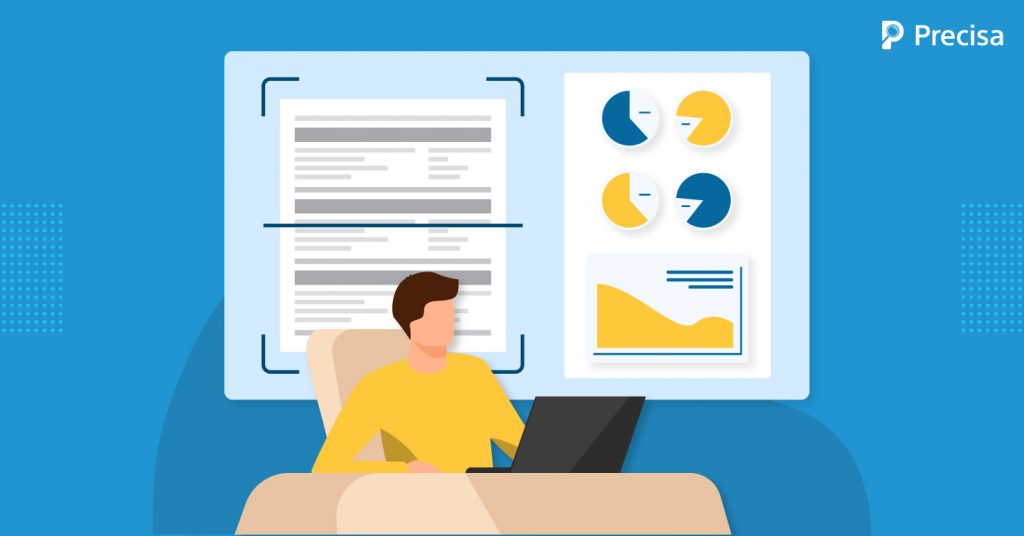

Undertaking bank statement analysis has been a principal task for Gromor’s credit team. For bank statement analysis, the earlier trend was to manually extract the numbers (data) from the bank statements and then file them into Excel sheets.

Also read: Decoding the Emerging Trends in Loan Products

But as evident, the method was painstaking and time-consuming. For example, one would have to spend 2-3 hours getting a statement ready for analysis and barely get through 5-7 cases a day, with the possibility of manual errors or due to parsing many bank statements at a time. This outdated process will affect any team’s productivity and make it difficult for them to meet their targets.

The Solution

From the outset, Gromor felt that using manual methods to extract numbers from bank statements and generate reports would not suffice in the long run. So, they wanted a solution that could automate this process and reduce the time and labour required to extract the numbers so that the credit team could analyse the data faster. Because the faster the credit-checking process, the better they could serve the customers.

How Did Precisa’s Custom BSA Help?

The BSA tool helped Gromor smoothen and simplify the data analysis process, which earlier was arduous. With Precisa’s BSA, data from the bank statements were parsed and formulated into reports quickly.

Moreover, the BSA was easily integrated into Gromor’s systems; and the time it took to prepare all the details for analysis was reduced to 5 minutes from 2 hours.

Also read: What are APIs in Bank Transactions, and How Are They Effective?

“It takes very little time and has eased out my life. It has allowed me to give me more time to analyse the cases in a detailed manner which I couldn’t do earlier. The whole process has been really amazing,” Priyanka Gaikwad, Credit Manager, Gromor, said in a statement.

Why Did it Work?

So how did Precisa’s advanced bank statement analyser make such profound changes for Gromor Finance’s operations? Here are three major reasons:

1. Simplicity

Precisa’s BSA is incredibly easy to use and does not require too many additional skills to make it work. The team just needed to:

- Upload the scanned copies of the bank statements under each client’s profile.

- The integrated tool would efficiently analyse the bank statement and make the analysis reports ready to view in minutes.

2. Unique Automated Features

The BSA has multiple unique automated features that benefits Gromor:

- For example, counterparty Calculation calculates the amount received from a single party and its percentage to the numbers.

- Balance Distribution Graph and Recurring Payment help to draw a good analysis of the statements.

- Monthly balance, average daily balance, transaction fields and other account details are extracted by the BSA software. This reduces human error and saves time significantly.

3. Instant Report Generation

As already mentioned, Precisa’s BSA simply fast-tracked the bank statement analysis process several times. This saves a lot of time and has made processes easier for Gromor’s credit team.

Also, Precisa generates its unique volatility score that helped Gromor’s team make more accurate decisions.

This gives more time for the credit team to study and analyse the reports and allows them to make detailed inspections of the statements, thereby increasing accuracy and productivity. The team now feels more at ease.

The Outcome

When compared to other NBFCs, Gromor’s processes stand out as they use BSA for credit evaluation. NBFCs usually have a “month-end” concept in place where targets are assigned and cases start piling up by the end of the month, placing a huge strain on credit teams.

But with an advanced BSA like Precisa’s, to-do lists don’t pile up for Gromor’s credit teams as the BSA takes a big load off their shoulders. Now the team can perform detailed analysis over a short period and have no problems with achieving targets.

“The Auto CAM generation feature has greatly reduced evaluation and decision time. The credit team is taking qualitative, data-backed decisions.” -Bhupesh Morye, CoFounder, Gromor Finance

Precisa’s advanced Bank Statement Analysis tool is used by many lending institutions like Gromor to process and analyse the bank statements of loan applicants. Precisa:

- Supports more than 350 banks and 650+ formats

- Processed over 3.5 Crore transactions

- Analysed more than 25 Lakh pages

- Analysed more than 1.25 Lakh Bank Statements

It has built-in security checks and other unique features including Precisa Score to make credit evaluation processes simpler and instant for lending institutions, banks, NBFCs, and firms. Take our 14-day free trial or contact us for more information.