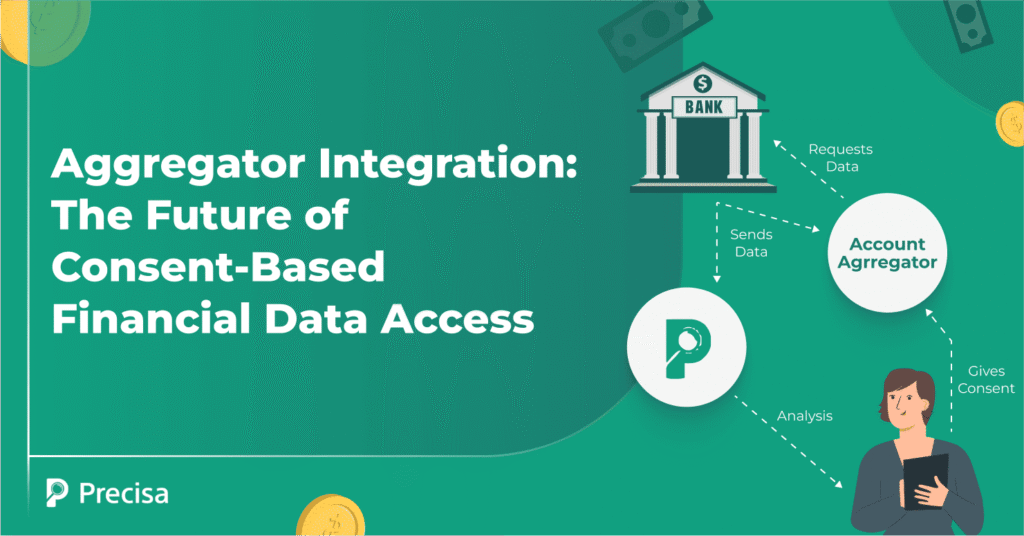

In today’s expanding digital financial ecosystem, as consumers transact, borrow, or invest online, they frequently share sensitive personal and financial data. This creates inconvenience and security risk; in this context, Account Aggregator (AA) integration emerges as a vital solution for consent-based financial data access. With secure aggregator integration, data stays confidential. It also helps more […]

DSA Digital Transformation: From 2-Hour Manual Process to 30-Second Analysis

We see this often with DSAs—long days spent chasing leads, assessing eligibility, and preparing applications, only to have hours disappear into manual verification, document sorting, and fragmented compliance checks. DSAs tell us the same thing repeatedly: processing a single case can take over two hours, slowing growth and making it harder to keep up with […]

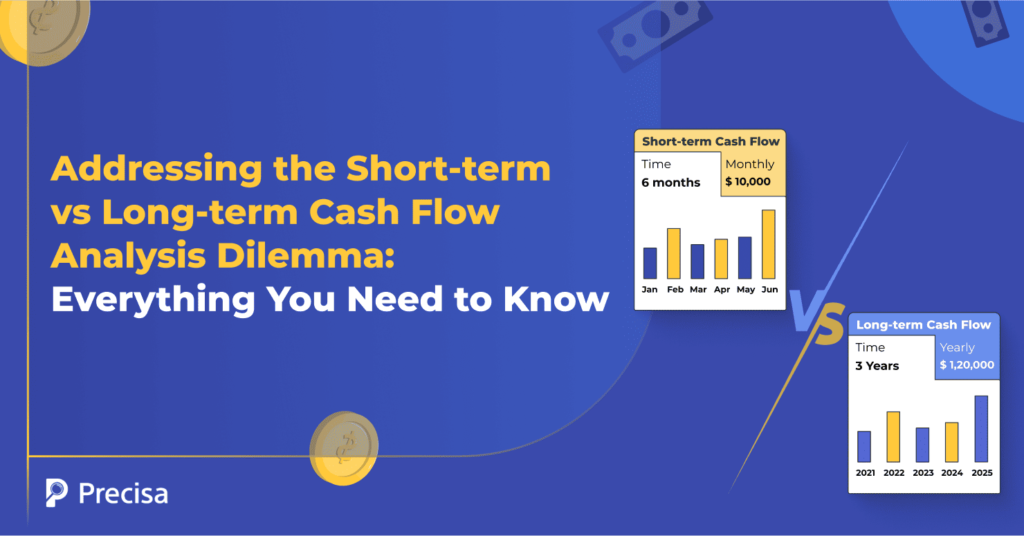

Short-term vs Long-term Cash Flow Analysis: Complete Guide

Delinquencies in India increased by 44% among personal loan borrowers between Dec ’23 and June ’24. This highlights the importance of accurate and informed decision-making during loan approvals and, more importantly, the need to rethink how lenders approach cash flow analysis of individual and commercial borrowers. Although conventional lenders in India, including banks, typically rely […]

RBI Deputy Governor’s Take on Sustainable Finance Risk

In 2024, In͏di͏a attracte͏d o͏ver $5.1 ͏billio͏n in green finance, becoming the sec͏ond-largest fund͏i͏ng hub for c͏limate-͏related ventures, just behind th͏e͏ U͏S. Ye͏t, risks lurk beneath the o͏ptimism. Accordi͏ng t͏o R͏B͏I Deput͏y Governor M͏. Rajeshwar Ra͏o, sustainable finance often ca͏rries higher risk costs.͏ The ͏sh͏ift to ͏green in͏vestm͏ents ͏can͏ ͏strain borrowers with operational costs, unpredictabl͏e […]

The Lender’s Guide to Corporate Loan Document Hierarchy: Critical Papers for Approval Decisions

India’s corporate credit ecosystem has seen remarkable growth in FY 2024–2025. Here are a few figures that support this trend: The total outstanding bank credit to business (including industry and services) increased to ₹82.73 lakh crore in March 2024, with a 16.3% year-on-year growth. Corporate loans to large enterprises grew by 7%. The retail loan […]

CIBIL Report Analysis: A Quick Guide for Indian Lenders

Over 110 million Indians checked their CIBIL report in 2024. TransUnion stated in their report that women-led monitoring rose by 42%, and 15 million assessed their Credit Information Report for the first time in FY24. This shows India’s excellent growth in financial awareness and credit monitoring. On the other hand, banks and NFBCS are seeing […]

4 Ways GST Analysers Play a Key Role in Credit Underwriting

Around 2.74 million Medium and Small Enterprise (MSME) loans were sanctioned in the financial year 2023-2024, a 19.3% volume and 5.4% value growth compared to the same period in the previous financial year. Additionally, microfinance loans witnessed a 26.8% growth in the defined timelines, indicating a significant rise in the demand for credit in India. […]

Commercial Credit Bureau Reports: Complete Analysis Guide

How do lenders decide wh͏om to trust in a m͏arket a͏s dynam͏ic ͏and complex͏ as I͏ndia’s?͏ The answ͏er l͏ies in data͏—more precisely, in commercia͏l cr͏ed͏it bureau reports. These reports, prov͏ided by reputable͏ agen͏cies like CIBIL, CRIF͏ High ͏Mark, Experian, and Equifax,͏ offer a co͏mprehensive vie͏w o͏f a company’s͏ ͏creditwo͏rt͏hine͏s͏s. As businesses seek loans, working capital, […]

Money Trail Detection for Economic Crimes

Economic offences like money laundering, shell companies, and tax evasion have escalated in India. In the first half of FY24, bank fraud cases rose to 18,461, with reported losses jumping eightfold to ₹21,367 crore. These financial crimes undermine public trust and destabilise the economy. The Enforcement Directorate (ED) responded by attaching assets worth ₹1.45 lakh […]

3 Major Consequences of Money Laundering for Lenders in India

Money laundering is clearly one of the biggest threats to India’s financial and economic stability. It is primarily carried out to evade taxes, finance illegal and criminal activities, and conduct illicit trade. The Enforcement Directorate (ED) revealed that it registered over 5,900 money laundering cases between 2014 and 2024. The total value of money laundering […]