Early Warning Signals for Bank Liquidity Assessment

Early warning signals in banks are indicators that help lenders and financial institutions identify potential liquidity problems in businesses before they become critical. These signals help banks proactively manage their exposure and protect themselves from losses.

The liquidity of a business is reflected in the abundance of its cash and readily convertible cash equivalents. Strong liquidity management is one of the key factors contributing to healthier asset quality across the banking sector.

According to the Reserve Bank of India’s Financial Stability Report (December 2024), the Gross Non-Performing Assets (GNPA) ratio for scheduled commercial banks declined to a 12-year low of 2.6% as of September 2024, indicating improved asset quality and effective risk management practices.

Lenders prefer borrowers who have higher liquidity, as it indicates they will have enough to repay the loan even if the operations are inefficient or the business is slowly turning unprofitable.

This blog post focuses on early warning signals in banks and their role in understanding the liquidity profile of a business.

What are Early Warning Signals In Banks for Liquidity?

Early warning signals in banks are a mixed group of indicators that can help identify risks that come with biased or subjective decision-making.

Traditionally, lenders have relied on manual options, like reviewing credit histories, verifying incomes, evaluating collateral, and conducting personal interviews to identify potential defaults.

Now, emerging technologies like AI and rule-based EWS systems can provide financial and non-financial indicators at the customer and industry levels for early detection of possible default. These indicators have the potential to predict customer accounts that are likely to default.

In this article, let’s explore the early warning signs and their main categories lenders must know.

What Are the Early Warning Signals in Banks?

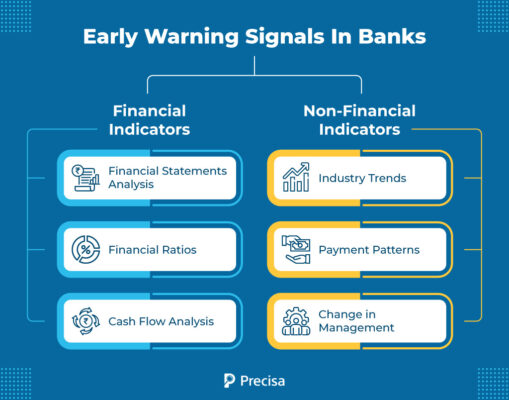

Early warning signals in banks fall into two broad categories: Financial and Non-Financial Indicators.

1. Financial Indicators

Recognising liquidity issues in a business early is crucial for banks to manage their risk exposure and protect their financial stability. Below are a few ways banks can achieve this:

Financial Statements Analysis

Analysing financial statements provides crucial insights into a business’s financial health and can help identify early signs of liquidity issues. These statements highlight trends, reveal anomalies, and offer a clear view of available cash and bank balances—key indicators of a company’s ability to meet its obligations.

Core financial documents used in liquidity assessment include:

- Income Statement: Shows profitability over a period, helping evaluate whether revenues are sufficient to support operational costs and liabilities.

- Balance Sheet: Offers a snapshot of assets, liabilities, and equity—critical for understanding current liquidity positions.

Cash Flow Statement: Details actual cash inflows and outflows, highlighting potential gaps in working capital. - Statement of Changes in Equity & Notes to Accounts: Provide context on ownership structure, reserves, and hidden financial risks.

Additionally, AI-powered financial statement analysis tools can automate the detection of liquidity red flags, enabling faster, data-driven credit decisions and helping lenders proactively manage risk.

Financial Ratios

Financial ratios are a valuable tool for banks to assess a firm’s ability to meet both short-term and long-term obligations, offering a quick snapshot of its overall financial health.

For short-term liquidity assessment, lenders often look at:

- Current ratio: Compares a company’s current assets to its current liabilities. A higher ratio indicates that the business has sufficient assets to meet its short-term obligations.

- Quick ratio: Offers a stricter view of liquidity by excluding inventory, which may not be easily converted to cash. A quick ratio above 1 suggests the business can comfortably meet its short-term liabilities without relying on inventory sales.

For long-term liquidity and solvency, two key ratios include:

- Debt-to-equity ratio: Measures the proportion of capital financed by debt. A lower ratio implies greater financial flexibility and reduced dependency on external borrowing.

- Interest coverage ratio: Compares earnings before interest and taxes (EBIT) to interest expenses. A higher ratio reflects a stronger ability to service debt and withstand financial stress.

Cash Flow Analysis

Cash flow analysis examines a company’s cash inflows and outflows over a specific accounting period. The three integral aspects of cash flow statements that help make a comprehensive analysis comprise cash from operations, financing, and investing.

A favourable cash flow signifies positive fiscal health and improves the company’s creditworthiness. Understanding the timing and predictability of a business’s cash inflows and outflows helps identify potential cash flow shortages and liquidity risks.

As per a 2023 study by PwC India, lenders using automated cash flow and statement analysis tools reported a 25% reduction in delinquency rates among SME borrowers.

AI-powered bank statement analysis tools help extract account receivable and payable reconciliation and also simplify the job of collecting and evaluating bank statements for better cash flow analysis.

2. Non-Financial Indicators

While financial indicators are integral for assessing the liquidity of a business, non-financial indicators also act as early warning signals in banks.

Industry Trends

A business does not operate in a vacuum, and monitoring industry trends is essential to assess the liquidity profile of a business. Assessing these trends can identify potential challenges specific to the industry and how they may impact business performance.

Payment Patterns

Observing the customer payment pattern also offers useful insights into the liquidity of a business and acts as an early warning signal in banks. An increase in late payments or defaults indicates impending financial difficulties for the business.

For example, Days Past Due acts as an early warning system in banks and lenders. Calculating DPD can help banks spot the onset of delinquency well before it escalates into a more severe issue.

Change in Management

A business’s success is closely linked to its management; hence, leadership changes are among the crucial early warning signals in banks. Frequent changes in top management or the exit of some key personnel are indicators of instability and can influence the business’s liquidity and financial health.

To Sum It Up

Early warning signals in banks can promote timely intervention and help avoid significant financial loss. For banks and lenders, it is no longer enough to rely on traditional financial ratios or surface-level cash flow reviews.

Precisa’s Bank Statement Analyser is purpose-built to strengthen early warning frameworks with deep, actionable insights. Key features that directly support liquidity risk detection include:

- Real-time Transaction Categorisation: Automatically classifies cash inflows, outflows, loan repayments, and non-standard transactions, providing instant visibility into cash flow patterns.

- Receivables and Payables Trend Analysis: Highlights irregularities in collections and payments, flagging businesses with deteriorating liquidity positions early.

- DPD (Days Past Due) Tracking: Extracts repayment behaviour data from account statements to identify early signs of repayment delays or delinquency.

- Anomaly Detection Engine: Detects sudden account balance fluctuations, unexpected fund transfers, or cash flow gaps that are often early symptoms of liquidity strain.

By consolidating these insights into structured, lender-ready reports, Precisa enables credit teams to act faster, prioritise interventions, and reduce portfolio risk significantly.

Book a free trial today and experience how Precisa transforms bank statement data into a powerful early warning system for liquidity risk management.