Why Fintechs Must Educate Customers to Boost Cashless Economy

The Indian government has been pushing the idea of a cashless economy for a decade. A cashless economy, its proponents insist, would herald India’s arrival on the global stage as a technologically savvy and advanced economy.

While India has made strides towards cashless, the benefits have only reached a minor privileged section of the nation’s 1.39 billion population.

The Government has undertaken several initiatives to further its cashless economy agenda, such as making digital welfare payments and helping build the UPI system.

However, a lot of work remains to be done before calling the nation a digital economy. This article will discuss why Indian Fintech companies and start-ups must educate their customers to help India become a cashless economy.

Why Should Fintechs Inform and Educate their Customers?

There are three primary reasons why fintech start-ups need to educate their customers:

1. Start-ups cannot reach customers who are not digital-ready

Fintech companies, as the name suggests, primarily operate digitally and reach their customers through information technology. This means that a cashless economy is in the best interest of Fintech start-ups.

One of the main challenges faced by fintechs is that customers are still used to doing things the old way – which is using cash to make transactions. As a result, the bulk of the transactions in India uses cash.

For a fintech start-up to grow, it needs technologically savvy customers and access to enablers such as the internet and smartphones. However, as long as customers do not adopt the cashless economy, the scope of growth for fintechs is still limited to a privileged few.

2. Fintechs can become thought leaders

Fintechs indirectly establish themselves as thought leaders by educating and informing potential customers. This thought leadership has an educational benefit for the masses, but it may also have a financial advantage for the fintech.

Ask how? Though leadership can open the doors to better brand visibility, lead generation, sales enablement, increased opportunities and above all, give back to the public in the form of value. All these parameters may directly influence finances and businesses.

By regularly using social media, publications, blogs, etc., to promote educational content, fintechs can not only gather an audience that wants to learn, but they can also establish a brand for themselves.

The goal of a fintech should be to become a thought leader in its space. Since we live in an information economy, fintechs can leverage their position as thought leaders to build an engaged and loyal audience.

3. Fintechs can promote their services

Content marketing is not a new idea, but since fintech is still in its nascency in India, content marketing makes sense. By regularly publishing educational content, fintechs can inform their customers and promote their services simultaneously.

For example, start-ups like Groww regularly publish content that informs readers about developments in the personal finance space. Over time, this has led to Groww being perceived as the go-to brand for investing needs.

Educating customers serves a dual purpose in this model:

- First, it informs customers about why they need the services offered by the fintech company.

- Second, it informs customers about how to take advantage of such services.

This method of promoting services can quickly turn top-of-the-funnel prospects into bottom-of-the-funnel customers.

How Can Fintech Start-ups Help?

Fintech companies have a massive role in making India a digital economy. These start-ups will be the future backbone of the cashless Indian economy.

For example, PayTM is one of the leading services helping consumers conduct cashless transactions. For instance, the company provides a way for people to hold money in digital wallets and pay for their purchases directly through that wallet.

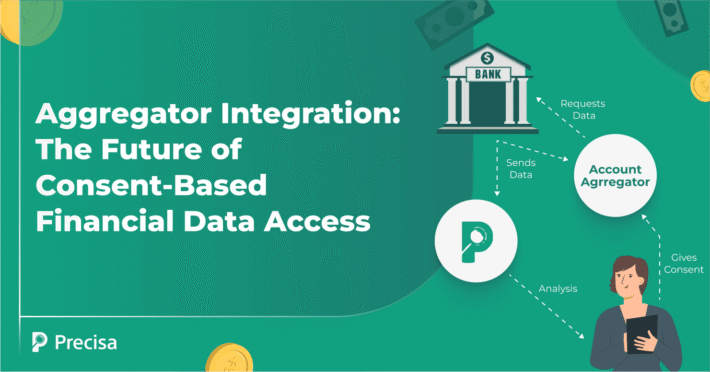

There are several aspects to a digital economy that can only come to fruition with the help of Fintech assets. For example, we need digital insurance services, banking services, digital brokerages, etc., all working in seamless tandem to make the cashless dream a reality.

Several companies in India are already working to make this possible. However, a large section of Indians lacks the education and awareness of such facilities and how they can benefit them.

Therefore, the first step to realising the fintech dream is to educate the masses. Fintechs need to create accessible content that their target consumers can read. Furthermore, this content needs to be written in languages that India’s diverse people can understand.

Wrap Up

Over the next few decades, we should witness a surge in cashless financial activity as the economy matures and moves away from cash.

If you’re interested to learn more about how a cashless economy can be realised, check out our article on the digital rupee.

Do you own a fintech company and are looking forward to streamlining lending? Our bank statement analysis software tool at Precisa can help quickly, efficiently, and securely process transactions. Know more about it here.