Financial statements offer insights into the health of an individual or a business. Lenders can extract valuable information from bank financial statement PDFs to aid them in their lending decisions. Automation has replaced manual analysis of financial statements for many lending businesses, helping reduce the time and effort required to extract, organise, and interpret data […]

Fraud or Not? RBI Urges Banks to Listen Before Labeling

Loan fraud is one of the top financial risks faced by lenders today. As of May 2024, it was revealed that the number of bank frauds has increased four times over the last five years. These cases predominantly comprise digital fraud. Such incidents have caused major concerns across the industry. Some lenders have been triggered […]

Bank Statement Analysis Strategies for Today’s Challenges

As the lending industry continues to grow, risk assessment and management will emerge as one of the top functions, enabling lenders to build sustainable, profitable businesses. Managing risk effectively can help companies prevent the growth of non-performing assets (NPAs), loan fraud, lending scams, and other negative consequences. Financial technology will play a key role in […]

8 Ways Bank Statement Analysis by Precisa Can Accelerate Productivity

Productivity levels are an important measure of success for ambitious lenders looking to build a long-lasting, profitable business. A recent survey indicated that seven out of every 10 employers prioritise the quality of work, while performance indicators such as targets and project completion on time are considered to be primary indicators of productivity. As more lenders […]

Bank Reconciliation Statement Analysis of Data: Optimise Lending Decisions

Data is increasingly vital in enabling businesses to streamline their workflows, drive revenues, and become profitable in the Internet economy. According to a McKinsey survey titled ‘The data-driven enterprise of 2025,’ adopting artificial intelligence (AI)- powered data practices is helping businesses grow revenues by at least 20% before interest and taxes. Access to high-quality data […]

Streamline Bank Statement Analysis with Python and AI: Faster, Smarter Decisions

Scaling a lending business presents a significant dilemma: higher loan volume increases potential profits but also the risk of default and fraud. Thorough risk assessment is essential, yet the sheer number of loans can make this process overwhelming. Lenders that embrace the benefits of technologies such as automation, Artificial Intelligence (AI), and Python can strengthen […]

Bank Statement Analysis: Uncovering Patterns with AI driven Insights

Emerging forces, like geopolitical tussles, socioeconomic factors and climate change, have increased the demand for improved risk management in the financial services sector. Breakthrough technology like AI and ML, profuse amounts of data, and new business models are redefining how banks interact with consumers, third parties, and internal processes. A recent report by Business Insider […]

Contextual Analysis in Bank Statement Analysis

Bank statement analysis is crucial for investors, analysts, and stakeholders interested in learning more about a banking institution’s financial health and performance. Historically, this review has focused mostly on the numerical data reported in financial accounts. However, contextual analysis is an often overlooked part that goes beyond the numbers and provides a better knowledge of […]

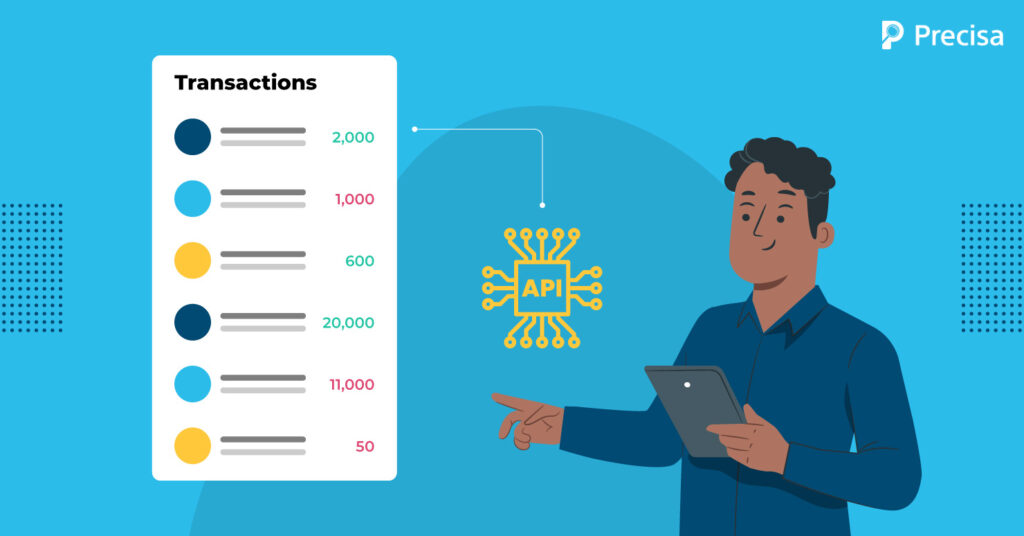

Overcoming 10 Challenges in Integrating API to Get Bank Transactions

Application Programming Interfaces (APIs) integration has become crucial for frictionless communication and data sharing between various systems in today’s quickly expanding digital ecosystem. Implementing API connectivity for bank transactions within the banking industry is a game-changing move towards boosting productivity, increasing consumer experiences, and opening up fresh doors for innovation. However, this procedure is not […]

Improving Loan Processing Times and Accuracy with Automated Bank Statement Analysis

As the lending market grew from $7887.89 billion in 2022 to $8682.26 billion in 2023, speed and accuracy have become critical factors determining the success of lending operations like loan processing. Financial institutions must continually evaluate and analyse various financial documents, including bank statements, to determine a borrower’s creditworthiness. However, manual analysis of bank statements […]