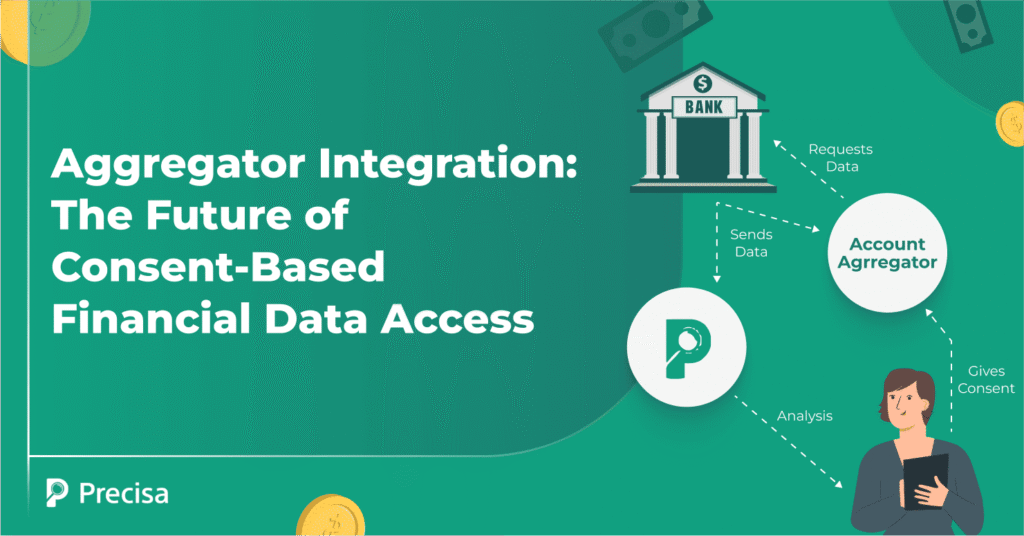

In today’s expanding digital financial ecosystem, as consumers transact, borrow, or invest online, they frequently share sensitive personal and financial data. This creates inconvenience and security risk; in this context, Account Aggregator (AA) integration emerges as a vital solution for consent-based financial data access. With secure aggregator integration, data stays confidential. It also helps more […]

DSA Digital Transformation: From 2-Hour Manual Process to 30-Second Analysis

We see this often with DSAs—long days spent chasing leads, assessing eligibility, and preparing applications, only to have hours disappear into manual verification, document sorting, and fragmented compliance checks. DSAs tell us the same thing repeatedly: processing a single case can take over two hours, slowing growth and making it harder to keep up with […]

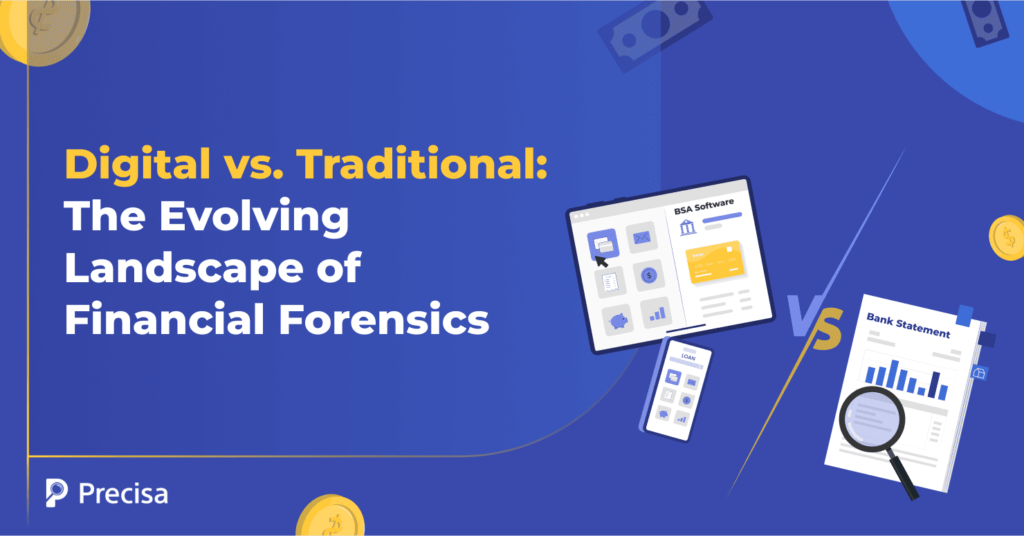

Digital vs. Traditional: The Evolving Landscape of Financial Forensics

In the last few years, financial forensic investigations have changed a lot. You might be surprised to learn that forensic auditors used to spend 30 to 45 days going through bank statements by hand and following money trails across several accounts. And today’s digital platforms? They can complete those same investigations in 25 to 30 […]

Understanding RBI’s Decision to Exclude Fintech-Sourced Loans from Default Coverage

In a decision that could drastically change how fintech companies associate with non-banking financial companies (NBFCs), the RBI, on June 6, 2024, ruled that Default Loss Guarantees (DLGs) by fintech on their loans can no longer be valid while determining provisions or credit loss buffers. This actually means NBFCs cannot depend on fintech-provided guarantees to […]

Major Document Lending Challenges Facing Fintech Companies

Despite showing promising signs of revitalising Indian lending, the challenges faced by fintech companies are by no means insignificant. These generally include a combination of a complex regulatory framework, evolving operational guidelines by the Reserve Bank of India (RBI), and most importantly, document-heavy processes. From Know Your Customer (KYC) documents and income proofs to property […]

Commercial Credit Bureau Reports: Complete Analysis Guide

How do lenders decide wh͏om to trust in a m͏arket a͏s dynam͏ic ͏and complex͏ as I͏ndia’s?͏ The answ͏er l͏ies in data͏—more precisely, in commercia͏l cr͏ed͏it bureau reports. These reports, prov͏ided by reputable͏ agen͏cies like CIBIL, CRIF͏ High ͏Mark, Experian, and Equifax,͏ offer a co͏mprehensive vie͏w o͏f a company’s͏ ͏creditwo͏rt͏hine͏s͏s. As businesses seek loans, working capital, […]

8 Essential Pillars of Effective Forensic Audit in Finance

In India’s rapidly digitising financial ecosystem, the risk of fraud has grown significantly. A PWC report pointed out that nearly 59% of Indian organisations had been defrauded over the previous 24 months. For financial institutions, early fraud identification is not merely a regulatory requirement but a business imperative. This is where forensic audits become critical. […]

5 Ways Lenders Can Prevent Economic Offences and Financial Crimes

The Indian police registered approximately 193,000 economic offences in 2022, an 11% growth from the previous year. These crimes accounted for 5.4% of all the crimes reported that year. Furthermore, the National Crime Records Bureau (NCRB) has broadly divided economic offences into three main categories: criminal breach of trust, counterfeiting and forgery, and cheating and […]

Why Modern Lenders Must Offer Salary Loan Products Today

In June 2024, the Punjab & Bank signed an MOU with the Indian Army to facilitate salary accounts. HDFC Bank is also set to take over 60,000 salary accounts of employees and pensioners of the Southern Railway. The salary account facility banks offer helps businesses simplify employee payroll. Simultaneously, the salary accounts vertical enables businesses […]

4 Reasons Why Lenders Rely on Fintech Solutions for Bank Statement Analysis

India’s digital lending market has grown from strength to strength. In the financial year 2023-24, the sector experienced a remarkable 49% increase in disbursements, totalling ₹1.46 trillion across over 10 crore loans issued. A significant growth in the number of outstanding credit card dues and gold loans are two major factors driving the demand for […]