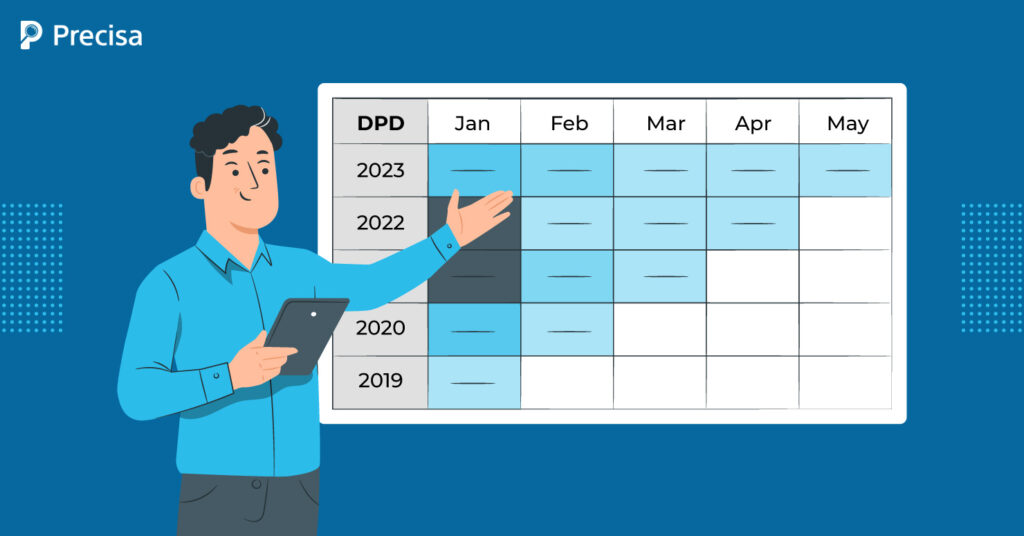

In today’s dynamic financial world, risk management is critical to ensuring the stability and sustainability of financial institutions. One critical part of risk management is the early detection of prospective credit defaults, which can have far-reaching consequences for an institution’s financial health. To accomplish this, financial experts use a variety of instruments and indicators, one […]

Enhancing Efficiency in Bank Financial Statement Analysis: Troubleshooting Tips and Solutions

Bank financial statement analysis is critical for assessing the financial health of banks. However, manual analysis of complex financial statements requires significant time and effort to extract, organise, and interpret data accurately. On top of that, intricate financial instruments and diverse accounting standards further complicate the process. To enhance efficiency, banks are adopting technology-driven solutions. […]

Enhancing Customer Experience with Personalised Bank Transaction Analysis

Offering outstanding customer service is crucial for financial institutions to stay ahead in today’s competitive banking environment. A Business Wire study notes that 72% of customers seek personalised services. Therefore, banks have to seek creative approaches to satisfy their demands constantly. One such strategy is using innovative technologies like bank transaction analysis to improve customer […]

The Role of AI in Automating Balance Sheet Analysis for Credit Appraisal

Over the last decade, artificial intelligence (AI) has made a noteworthy impression across different industries, and finance is no exception. Banks and other financial institutions are increasingly favouring the inclusion of AI across various functions, including balance sheet analysis for credit appraisal and bank statement analysis. This trend will gain further momentum as banks continue […]

Using Bank Statement Analysis to Navigate Cryptocurrency Transactions

Today, a growing number of businesses, including a mix of e-commerce platforms, retail companies, and electronic businesses, accept payments in Bitcoin cash and other cryptocurrencies. This trend mirrors the growing number of interested consumers who are investing and transacting in cryptocurrency. According to a 2022 survey, over 75% of retailers have plans to accept either […]

Future Outlook: The Evolving Relationship Between Fintech and Banks

Fintech combines finance and technology; it is transforming the financial landscape and reshaping the future of finance, leading to a collaboration between fintech and banks. Generally, it refers to businesses that leverage technology to improve and automate their financial services and processes. Fintech encompasses a rapidly growing trend, making financial services inclusive and efficient and […]

Bank Statement Analysis: Uncovering Patterns with AI driven Insights

Emerging forces, like geopolitical tussles, socioeconomic factors and climate change, have increased the demand for improved risk management in the financial services sector. Breakthrough technology like AI and ML, profuse amounts of data, and new business models are redefining how banks interact with consumers, third parties, and internal processes. A recent report by Business Insider […]

Financial Statement Analysis Tools: Innovations, Opportunities, and Challenges in the Era of AI

The adoption of Artificial intelligence (AI) across various industries and domains is increasing rapidly, as is evident from its application and utility. The finance sector, in particular, has embraced AI enthusiastically to modernise the entire industry and streamline the traditional manual banking processes. A Forbes report reveals the global AI fintech market is expected to […]

The Role of Bank Financial Statement Analysis in Strengthening Regulatory Compliance

Banking institutions are critical to the global economy’s stability and operation. According to McKinsey, the year 2022 brought substantial challenges and increasing uncertainty for banks. However, there are laws and regulations to preserve financial stability and protect depositors’ interests. The banking industry must comply with these rules; effective financial statement analysis can help. Regulators can […]

Enhancing Credit Appraisal through Collaborative Data Sharing and Open Banking

A recent Mckinsey report indicates that collaborative data sharing in finance has the potential to boost the GDP of economies by 1 to 5 per cent by the end of 2030. In light of this, many nations in the G20 have identified micro, small, and medium enterprises (MSMEs) as a major driver of economic growth, […]