Fixed Obligation to Income Ratio (FOIR) shows how much of your monthly income is already locked into fixed payments. This includes EMI payments, rent, and insurance premiums. When you apply for a loan, lenders assess your FOIR ratio to see if you can handle more debt. Most lenders in India favour your FOIR to stay […]

Detecting Missing Transaction Months: A Critical Fraud Prevention Technique

Detecting missing transaction months might sound like a boring bookkeeping job. But fraudsters love to exploit gaps in your paperwork. Modern tools like Precisa make it possible to spot these gaps automatically, so risky omissions don’t slip past busy reviewers. When you, as a lender, accountant, or compliance officer, review bank statements, you depend on […]

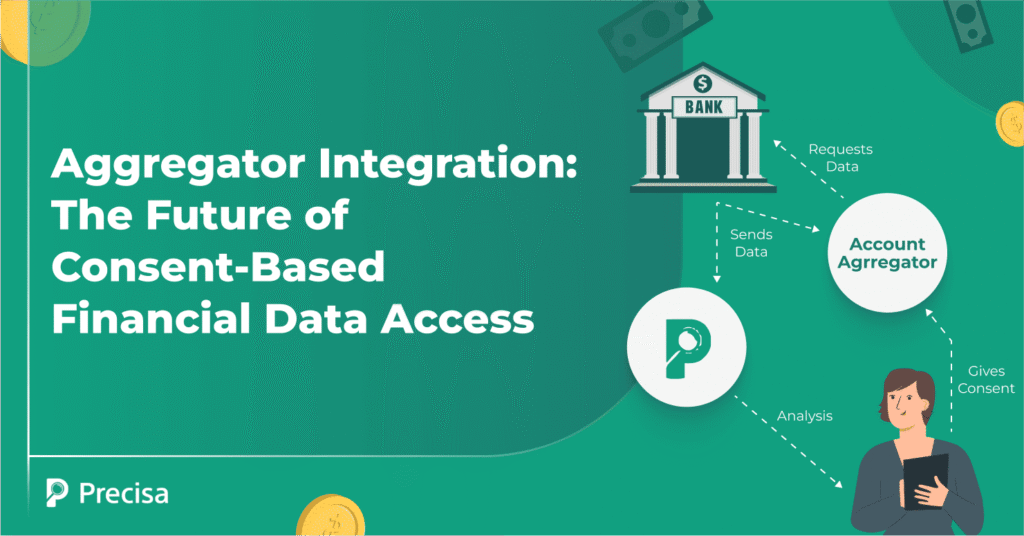

Account Aggregator Integration: The Future of Consent-Based Financial Data Access

In today’s expanding digital financial ecosystem, as consumers transact, borrow, or invest online, they frequently share sensitive personal and financial data. This creates inconvenience and security risk; in this context, Account Aggregator (AA) integration emerges as a vital solution for consent-based financial data access. With secure aggregator integration, data stays confidential. It also helps more […]

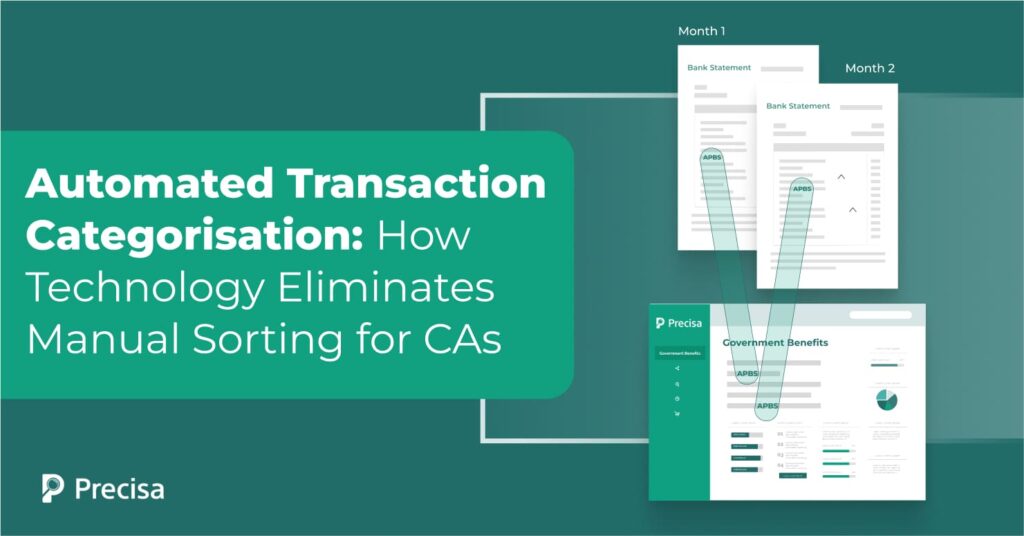

Automated Transaction Categorisation: How Technology Eliminates Manual Sorting for CAs

The role of chartered accountants has changed significantly over the past ten years. They are now expected to provide more insightful analysis, manage compliance, and offer strategic counsel in addition to keeping the books organised. However, one task still requires a significant amount of time: manually sorting through financial transactions. S͏t͏ud͏i͏͏e͏s show͏ ͏͏that ͏fi͏na͏n͏ce pr͏of͏e͏ssi͏ona͏͏ls […]

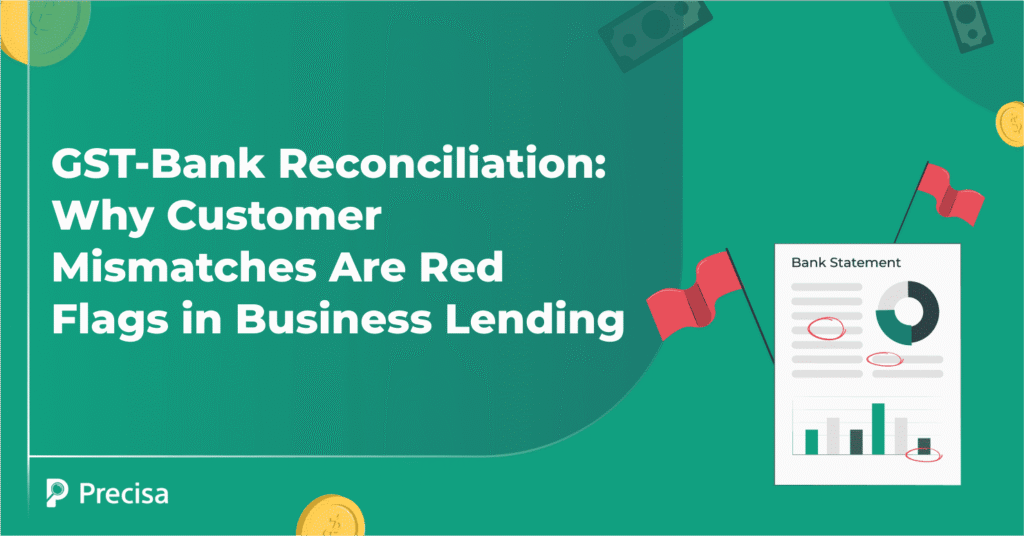

GST-Bank Reconciliation: Why Customer Mismatches Are Red Flags in Business Lending

Lending decisions are only as strong as the financial data behind them. Yet, lenders know that not all numbers on tax returns or balance sheets can be taken at face value. GST-Bank Reconciliation provides one of the most effective ways to ensure this transparency. This process involves aligning a company’s Goods and Services Tax (GST) […]

Understanding FIFO Patterns: How First-In-First-Out Analysis Detects Money Laundering

You have a competent forensic team that excels in financial investigations. However, when money laundering transactions involve multiple bank accounts and thousands of transactions, does FIFO analysis still take weeks? These delays could leave your institution vulnerable and also pose a threat to a country’s financial system, its integrity, and sovereignty. So what is the […]

The Hidden Cost of Manual Bank Statement Analysis: Why 2-Hour Processing Leads to Higher NPAs

When lenders think of adopting technology, they mainly focus on customer-facing platforms, speed of disbursal, or digital onboarding. But there’s a less visible process that actually carries massive consequences for portfolio health: bank statement analysis. The way NBFCs and DSAs handle this step can make or break the way they detect risky borrowers early. According […]

DSA Digital Transformation: From 2-Hour Manual Process to 30-Second Analysis

We see this often with DSAs—long days spent chasing leads, assessing eligibility, and preparing applications, only to have hours disappear into manual verification, document sorting, and fragmented compliance checks. DSAs tell us the same thing repeatedly: processing a single case can take over two hours, slowing growth and making it harder to keep up with […]

New in Precisa: PPU Flow Enhancements and Advanced Government Benefits Detection

We’re excited to announce the release of the most significant update of Precisa, delivering enhanced Pay-Per-Use capabilities and automatic government benefits detection in transactions. This release addresses the top user requests for flexible credit purchasing whilst advancing financial inclusion through intelligent transaction categorisation. Available now for all Precisa users, this update fundamentally changes how lenders […]

How Precisa’s Multi-User Financial Analysis Platform Serves Different Teams

Lending has never been a one-person job. Credit risk managers, compliance officers, and other financial teams must review the same applicant bank statements before making a decision. However, doing this manually without the right financial analysis platform can lead to costly errors. Consider this: data shows that 43% of occupational frauds were caught through tips, […]