The Fintech industry uses innovative digital solutions to optimise financial services and banking. A growing number of NBFCs are offering financial services, including bank accounts, wallets, electronic payments, insurance, and personal loans by offering Banking as a Service. Businesses of all types plan to launch embedded financial services to serve business and consumer segments better, […]

Digital Lending Point of Sale: Can It Drive Sales of Your Business?

Almost every aspect of our economy has changed in some way due to the COVID-19 pandemic, and commerce is no exception. Today’s merchants aim to develop frictionless digital lending experiences that make it simple and quick for customers to buy products from their online store. Point of sale financing is one such technology that retailers […]

How NBFC Software Can Make Your Lending Business Easy

In the world of business, non-banking financial companies (NBFCs) play a vital role by providing loans and advances to businesses and individuals. These financial institutions cater to the needs of those who do not have access to banking services. In India, the NBFC sector is growing at a rapid pace, and it has filled the […]

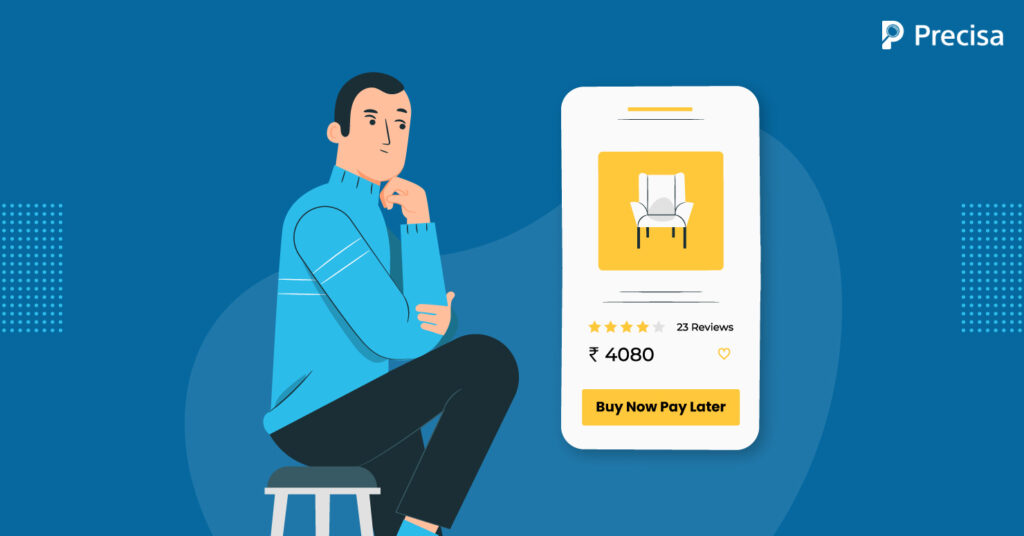

Is India Really Ready for a Buy Now Pay Later Plan?

India’s payments market size is expected to grow to $ 10 Trillion in 2026, according to a report by Boston Consulting Group. With payments, Buy Now Pay Later, or BNPL, a newer trend is also projected to grow to a BNPL Gross Merchandise Value of $93.509 B by 2028. Buy Now Pay Later or BNPL […]

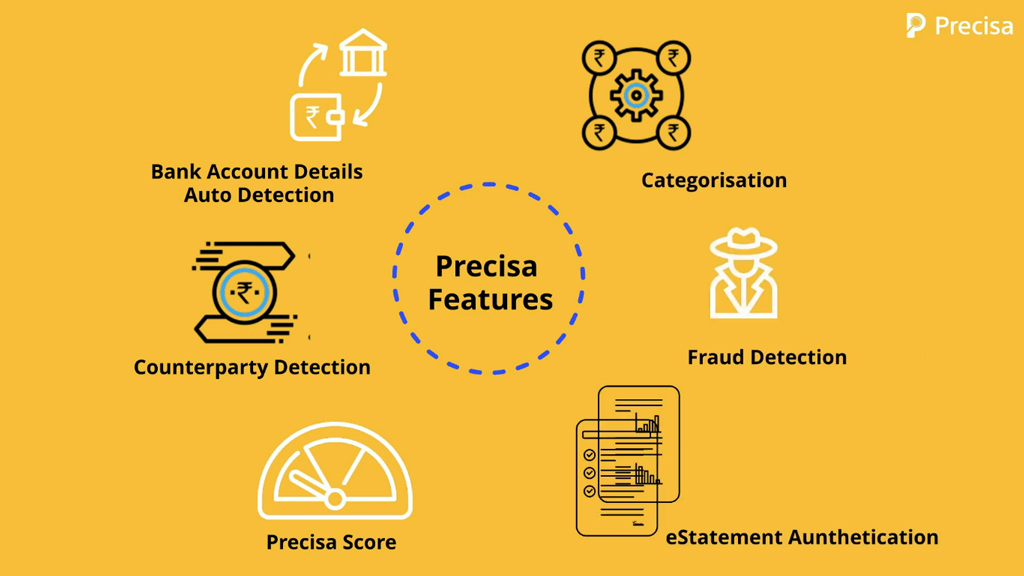

Maximize your financial decisions with Precisa’s updated statement analysis software

Business owners often have to make smart, strategic decisions under pressure. Having access to critical financial information is necessary to help expedite this process. However, combing through bank statements can be a cumbersome, time-consuming process. Precisa’s financial statement analysis software is designed to scan through bank statements and gives you access to the exact information […]

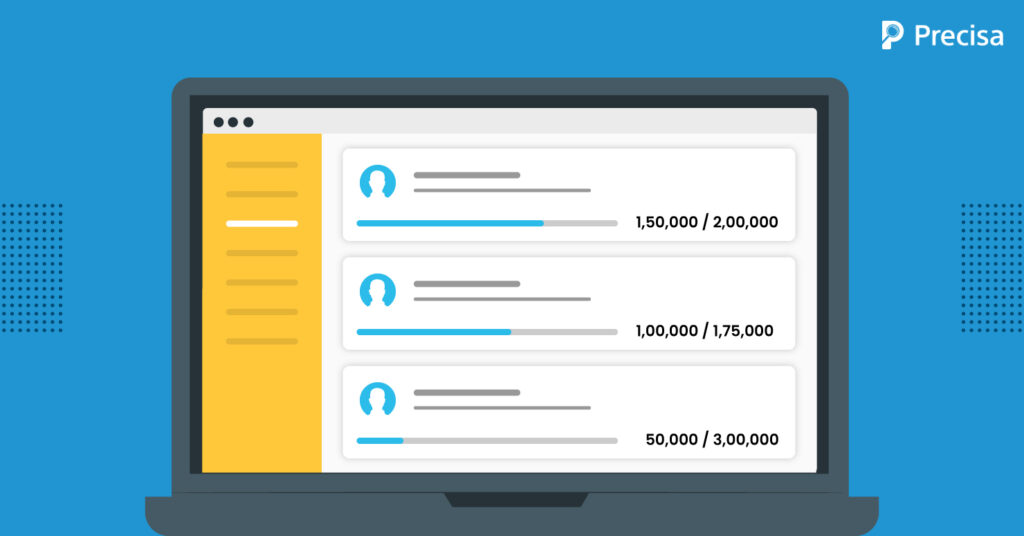

How Can Bank Statement Analyser Tool Help You in Sanctioning Business Loan?

Artificial intelligence is redefining how industries operate at the surface level. The wave of digitisation has pushed businesses to provide their tech-savvy customers with cutting-edge services. The banking sector is adapting to the changing dynamics. The global AI in the banking industry was recorded at $3.88 billion in 2020 and is expected to reach $64.03 […]

Financial Statement Analysis Software Helps Lenders Decide

Every business has a unique story. While digital marketing and ad campaigns push a company’s brand narrative, a business’s bank statements tell the real story. Reading a bank statement, however, can be a labour-intensive, and overwhelming experience. Also, it can be easy to miss out on important details. This is where financial statement analysis software […]

Accelerate the Lending Process With Precisa’s Bank Statement Analyser

With our easy-to-use web application, we at Precisa aim to simplify the bank statement analysis (BSA) process by allowing you to upload bank statements and present actionable insights in a visually appealing, intelligent dashboard. Precisa’s BSA is an all-in-one AI-powered analytics platform designed to catch any irregularities in bank statements in real-time. It evaluates the […]

How Co-lending Is Changing the Overall Credit Game in India

India’s retail credit market has always represented a vastly underserved and exciting opportunity in financial services. Entrepreneurship, risk capital, and supportive infrastructure have contributed to the current uptick in innovation in this field. Technology has been instrumental in closing some credit gaps by reducing distribution costs, enhancing risk management, and enabling more customer-friendly products. However, […]

5 Things Lenders Should Look For in Bank Statements for Loan Approval

Lending is a tricky affair. It is always essential for lenders to be very careful about whom they are lending the money. There are a lot of risks associated with lending, and one of the most significant risks is that the borrower may not be able to repay the loan. That’s where bank statements come […]