The Indian government has been pushing the idea of a cashless economy for a decade. A cashless economy, its proponents insist, would herald India’s arrival on the global stage as a technologically savvy and advanced economy. While India has made strides towards cashless, the benefits have only reached a minor privileged section of the nation’s […]

What Taxing Digital Assets and Launching Digital Peso Means for Digital India

In the Union Budget for 2022-23, Finance Minister Ms Nirmala Sitharaman talked about the virtual currency space. She also mentioned the creation of a Central Bank Digital Currency (CBDC), or the digital rupee, in the financial year 2022-23, in addition to announcing a flat 30% tax on profits from virtual currencies. Income from the transfer […]

Irregularities Detection with Precisa’s Bank Statement Analyser

Precisa’s BSA is designed to catch any type of irregularities in bank statements. Precisa detects and flags the following activities as potentially fraudulent or indicative of poor creditworthiness: ATM withdrawals above ₹20,000 – This section includes the following details about each transaction: Txn date, Particulars, Counterparty, Amount, Balance Suspicious eStatements – if any PDF eStatement […]

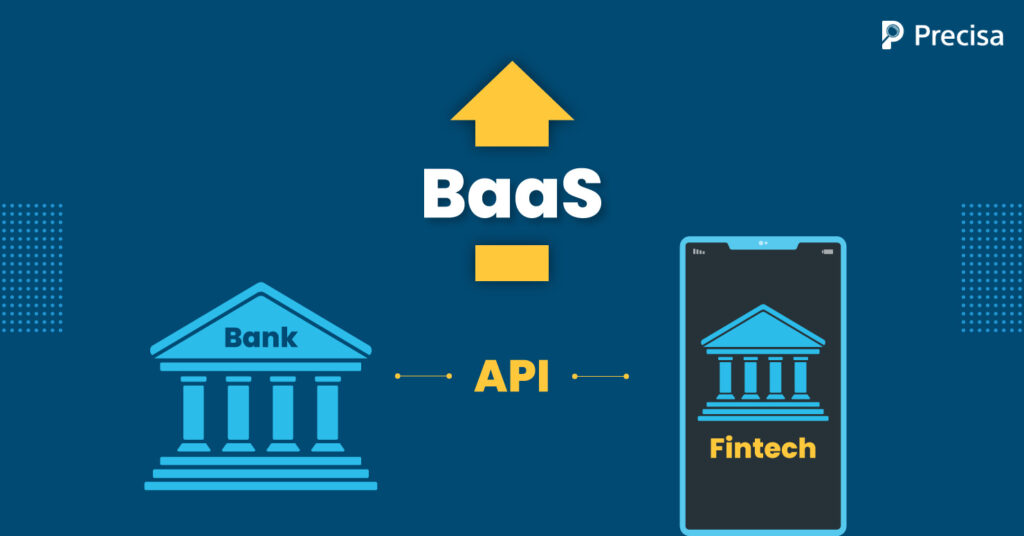

Is BaaS a Real Threat to Traditional Banks in India?

BaaS, or Banking as a Service, is part of the FinTech revolution that is gripping the world, as well as India. BaaS refers to banking services that operate entirely online. BaaS platforms offer complete end-to-end solutions digitally. Traditional banks, which have hitherto been used to doing business offline, are now experiencing a crisis of faith. […]

The Rise of Banking as a Service (BaaS) In India’s Fintech Centre

Banking as a Service (BaaS) has replaced open banking in India, and it is transforming the banking business. This may appear to be a bold statement. However, industry developments such as the rapid expansion of neobanks and the proliferation of customer-centric banking products support it. BaaS is becoming more popular as the demand for customer-centric […]

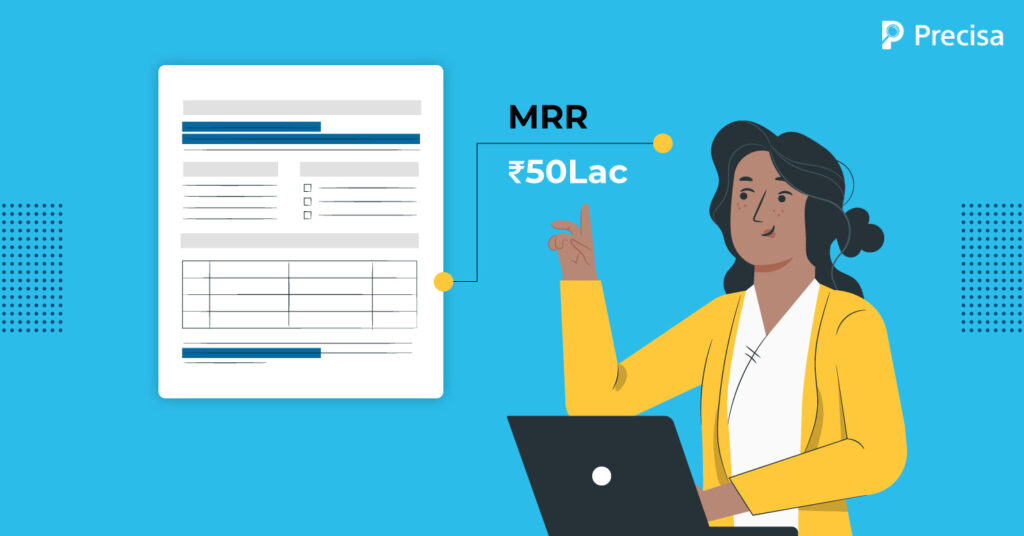

Underwriting SaaS Companies for Cash-Flow Based Lending Using Precisa

Over the ages, traditional banks have struggled to play a bigger role in the expansion of SaaS companies. On the surface, a SaaS company lacks many of the traditional creditworthiness indicators, such as inventory and receivables. With intangible assets and technologies that some banks still consider experimental despite decades of proof points, SaaS companies struggle […]

How Open Banking Is Transforming Small Businesses Post-COVID

Before COVID, markets such as Europe and the UK were already rolling out open banking protocols. Now, two years into the pandemic, it is poised to change how business is done globally. Open banking is a system that allows banks to exchange financial data and services with third-party providers (TPPs), such as fintechs, with the […]

Creating Bank Statement Analysis Reports with Precisa

Bank statements are excellent indicators of a company or individual’s income, expenses, and spending habits. As a result, most financial institutions determine a customer’s creditworthiness based on a thorough examination of their bank statements. With our easy-to-use web application, we at Precisa aim to simplify the bank statement analysis process by allowing you to upload […]

Role of User Experience Design in Fintech

The speed of digitisation in financial services had been picking up for a while, but the pandemic has accelerated it big time. Fintech-as-a-Service (FaaS) platform, growth in digital-only banks, increased usage of biometric security systems, and the rise of autonomous finance have all lately emerged. When it comes to digital transformation, Fintech, of course, is […]

A New Era for Fintech: Embedded Finance

It wasn’t long ago when Google Pay, Paytm, or UPI came into our lives and revolutionised the financial services sector and our purchasing habits. It feels incredible to effortlessly purchase goods, pay for expenses, book tickets, all in one go with just one tap/click. This seamless integration of financial services into a traditionally non-financial platform […]