Maximize your financial decisions with Precisa’s updated statement analysis software

Business owners often have to make smart, strategic decisions under pressure. Having access to critical financial information is necessary to help expedite this process. However, combing through bank statements can be a cumbersome, time-consuming process.

Precisa’s financial statement analysis software is designed to scan through bank statements and gives you access to the exact information you need for specific time frames in minutes. We keep updating our software as per the evolving needs of our customers by making sure that we listen to their valuable feedback carefully. Here we are with the latest upgrades.

Best Financial Statement Analysis Software Made for You

Precisa’s brilliant tool is especially helpful for lending institutions or platforms that need to verify thousands of bank statements in a day. Precisa’s financial statement analysis software has now gone a step further by enabling its users to be able to find critical information even faster. We’re excited to introduce three fresh updates serving our users’ need for speed and efficiency.

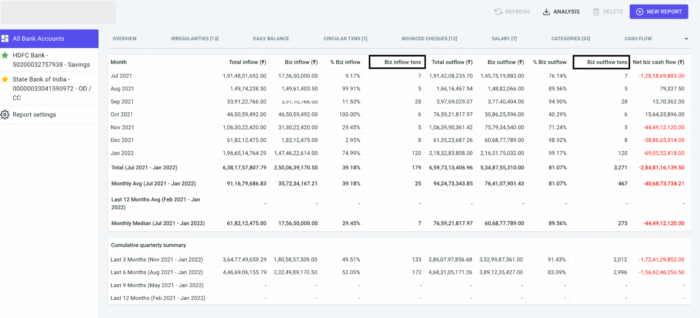

1. Track Monthly Business Inflow and Outflow at a Glance

Business cash flow is an important factor in measuring the state of a company’s finances. Business inflow could be in the form of revenues, financing, and capital investments. Business cash outflow, on the other hand, refers to expenses, EMIs, and salaries.

Precisa’s financial statement analysis software now helps users detect all monthly business inflow and outflow transactions at a glance saving valuable time for business owners.

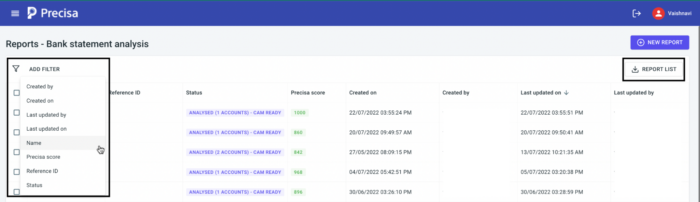

2. Filter Report Pages

Precisa’s Financial statement analysis software enables users to create any number of reports based on the specific information they are looking for. Users can now also filter the report page based on parameters like ‘Name,’ ‘Status,’ ‘Created by,’ etc. The reports you need can be downloaded in excel format for further analysis or sharing.

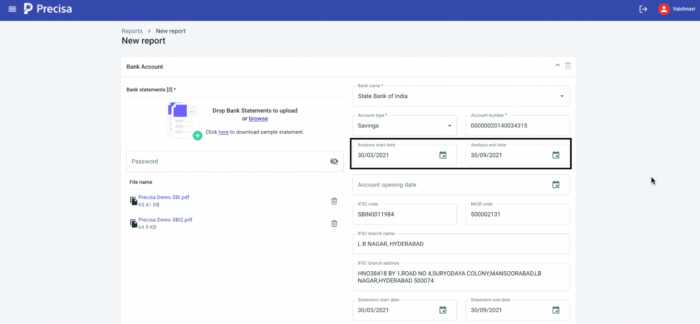

3. Customise the Analysis Period

Say you’ve uploaded your bank statements for a period of three months – April to June. But you only want financial analysis for the period of April 28 to May 8. Earlier you would have to filter out data from the main report manually, but now you can easily do the same by using Precisa’s custom analysis feature. Here are two ways to do this:

- Users can set the “Custom analysis start date” & “Custom analysis end date”. If the statement period is automatically detected from the files uploaded by you, then the custom analysis start and end date will be populated by default.

- Users can also change the custom analysis period by visiting the “Report Settings Page” once the report has been generated.

Key Takeaways

More and more businesses are looking to automate processes today to increase productivity. Manually reviewing thousands of bank statements a day is no longer an option as you need to be able to identify exactly what you need and find it quickly. Precisa’s financial statement analysis software simplifies this process for users, helping them to work with exact data and find track patterns that help them make superior business decisions.