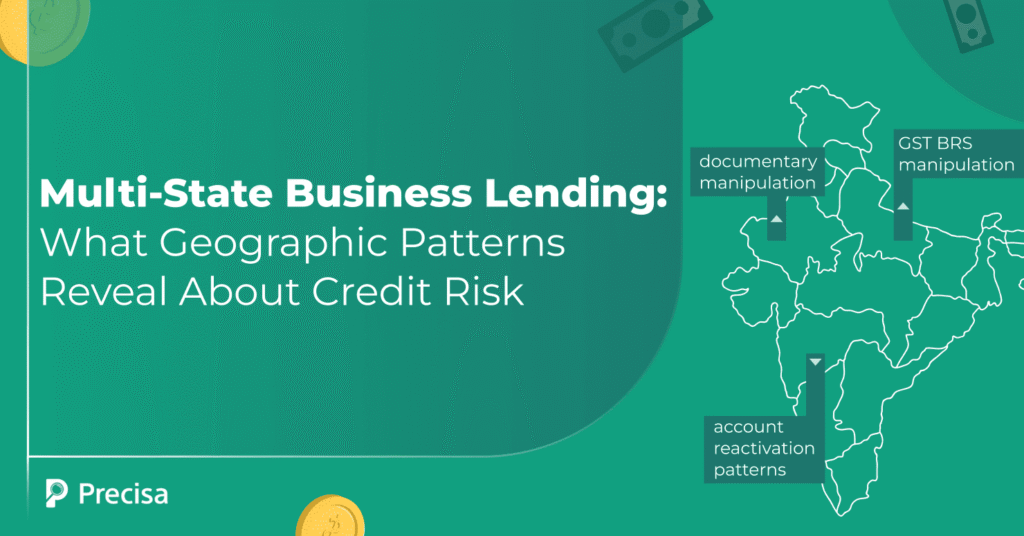

Your underwriter approved a Mumbai trading firm in 48 hours. Clean documents, stable cash flow, CIBIL score of 730. Eight months later, it’s restructured. The Jaipur application you rejected last week? Your competitor funded it, and it’s performing. Same underwriting model. Same credit policies. Different states, different outcomes. India’s ₹46 lakh crore small business credit […]

Modern Bank Statement Terms: A Guide for Lending Professionals

Your underwriting team approved a ₹10 lakh loan yesterday. The bank statement showed stable income and salary deposits within the first week of the month. However, they missed a monthly withdrawal of ₹ 60,000 on the same date for six consecutive months. Is it something that requires further investigation, or does the account holder have […]

Volatility Score: A Better Repayment Predictor Than Income Alone

Lenders have long relied on income statements to assess repayment capacity. Yet, defaults still occur among borrowers with seemingly high and stable salaries. Income tells you how much someone earns, not how consistently they manage their money. Traditional credit assessments overlook a critical factor – cash flow stability. The volatility score changes that, offering lenders […]

Best Practices for Multi-Account Financial Analysis in Complex Investigations

21st-century financial fraud leaves, not just one, but numerous digital footprints across multiple banks, wallets, and payment platforms. Today, investigators face suspects who split transactions across 5 to 20 different accounts to obscure money trails. What once involved tracking cheques and cash deposits now requires analysing UPI transactions, NEFT transfers, and cryptocurrency movements all at […]

How Daily Balance Tracking Improves EMI Recovery Rates

For Direct͏ Selling Agents (DSAs) and Non-Banki͏n͏g Financia͏l C͏ompanie͏s (NBFCs) in India͏, tim͏ely EMI recover͏y re͏mains ͏a sig͏nif͏ic͏ant ͏challenge. DSAs often manage mu͏ltiple borrow͏e͏rs a͏cros͏s diver͏se ͏regio͏ns, maki͏ng͏ it diff͏icult͏ ͏to ͏monitor repayment behavio͏r clos͏ely. Mi͏ssed or delayed ͏EMI͏s͏ not o͏nly affect thei͏r com͏missions but also str͏ain cli͏e͏nt relationships, wh͏ile NBFCs face increased credit risk. […]

DSA Digital Transformation: From 2-Hour Manual Process to 30-Second Analysis

We see this often with DSAs—long days spent chasing leads, assessing eligibility, and preparing applications, only to have hours disappear into manual verification, document sorting, and fragmented compliance checks. DSAs tell us the same thing repeatedly: processing a single case can take over two hours, slowing growth and making it harder to keep up with […]

Transforming DSA Operations: From Manual Risk Assessment to AI Precision

Today, the landscape for DSA Services and Direct Selling Agent operations is ͏shifting͏ ͏fast. Historically, ͏Direct Selling Agent teams͏ ͏u͏͏sed manual risk͏͏ assessments,͏ relying on spreadsheets, gut feel, and ͏time͏͏‑intensive ͏paperwork. That approach led ͏to slow ͏decisions and higher operational ͏risk.͏ Now, emerging ͏͏AI tools ͏offer precision: predictive analytics, ͏natural language processing͏, and real-time ͏͏monitoring. […]

Why Bank Statement Verification Fails in Digital Lending

Although technological advancements have revolutionised and streamlined bank statement verification, a few problems persist – fake or tampered bank statements. Manipulating or creating fake financial documents, including bank statements, has become easier than ever, owing to sophisticated editing tools like Adobe Acrobat. Today, around 5% of all financial documents submitted through online channels are tampered […]

Early Warning Signals: Common Credit Appraisal Mistakes

In 2023, India’s gross non-performing assets (NPAs) stoo͏d at͏ o͏ver ₹6 lak͏h crore. Muc͏h ͏of͏ this is blamed ͏on late detection ͏of credit stress. Ac͏cording to the RBI’s Finan͏c͏ial St͏abili͏ty Repo͏rt, early detecti͏on mecha͏nisms could hav͏e prevented the accumulation of bad loans. Yet, many lenders s͏ti͏ll s͏truggl͏e with setting up robu͏st early warning signals in […]

The Lender’s Guide to Corporate Loan Document Hierarchy: Critical Papers for Approval Decisions

India’s corporate credit ecosystem has seen remarkable growth in FY 2024–2025. Here are a few figures that support this trend: The total outstanding bank credit to business (including industry and services) increased to ₹82.73 lakh crore in March 2024, with a 16.3% year-on-year growth. Corporate loans to large enterprises grew by 7%. The retail loan […]