Fintech Generational Shift: How Younger Consumers are Disrupting Traditional Finance

Do you know we have used online banking for almost 20 years? Time has flown very quickly, but the financial sector has changed significantly throughout the years. The demographic shift among young people is influencing the developments in the fintech industry.

Younger consumers’ preference for individualised and digitised financial services is transforming the banking landscape.

As a result, financial services now operate differently. In contrast to earlier generations, young people today are more likely to welcome technology’s involvement in the banking industry.

The proliferation of startups over the last ten years has led to the greater adoption of fintech solutions. This blog post will explore how this technology has transformed businesses and the financial ecosystem.

Fintech’s Appeal on Younger Consumers and Disruption of Traditional Finance

Financial tech continues to be popular among younger generations because it gives them access to the technological and digital tools they need to meet their financial demands and requirements.

To meet this demand, numerous financial institutions have effectively utilised fintech’s capabilities to update their offerings in response to evolving client needs.

By 2032, the worldwide fintech market is projected to be valued at USD 917.17 billion. It is currently valued at about USD 226.71 billion.

Financial technology brings exciting opportunities to transform how people interact with their finances. Its focus on speed, convenience, affordability, and personalised solutions challenges traditional banks to evolve and innovate.

By collaborating with fintech companies or investing in their own digital strategies, banks can leverage these new technologies to enhance the customer experience. This will allow them to remain competitive and thrive in a changing financial landscape.

How Fintech is Changing the Traditional Finance Industry

Here’s how financial technology is impacting younger consumers:

1. Driving the Global Digital Economy

The younger generation of consumers is more ready to use the technology that has contributed to the growth of the global digital economy.

Not only does having access to these technologies benefit individuals personally, but it also makes transactions easier for them to accomplish, as they can now do so from any location in the world.

The growing interest in cross-border transactions has seen immense growth in developing nations over the course of the pandemic.

Fintech firms have been maturing more steadily in recent times due to the increased adoption of technology and the Internet of Things (IoT), which has allowed consumers in developing countries to find customised solutions for their financial demands.

Fintech companies have been able to bridge the gap and offer consumers solutions to their difficulties, particularly regarding what younger consumers want and need in terms of their personal finances.

2. Artificial Intelligence (AI) and Machine Learning (ML)

Modern financial technology has the potential to revolutionise the banking and finance sectors by providing AI-powered solutions. Fintech businesses are using AI to:

- Streamline and automate procedures

- Give individualised financial guidance

- Find instances of fraud or security lapses, and

- Improve client support

Therefore, banks can automate their procedures, stop fraud, and obtain comprehensive insights for making wise judgments by utilising AI and ML in the financial services industry.

For younger consumers, this translates into more seamless banking encounters, customised suggestions, and enhanced fraud protection, all of which promote confidence and trust in financial services.

3. Data Analytics and Personalisation

Companies are utilising data analytics to offer highly tailored and innovative financial products and services to younger consumers.

Fintech apps have an extensive analytics capability that lets them evaluate users’ credit history, spending trends, and behaviour. By utilising this data, financial technology can offer tailored solutions to its customers.

4. Smart Chip Technology

Smart chip technology has significantly impacted the financial sector. The banking industry has noticed a notable rise in payment transaction security as a result of smart chip technology. Younger customers can feel more secure about their financial safety owing to smart chip technology, which improves security in banking transactions.

These chips generate distinct codes for every transaction, making fraud more difficult and providing peace of mind when making digital payments and transactions.

5. Biometric Sensors

Fintech’s biometric sensors feature has significantly innovated the banking sector. This innovation is mentioned in almost all the top predictions and trends.

These days, financial services, including online and mobile payments, ATM transactions, and mobile banking, can be connected with biometric sensors. These sensors help lower fraud risks, increase convenience, and improve security in the banking industry.

6. Embedded Technology

Younger consumers are increasingly finding embedded payment experiences and financial services enticing, and this trend is also influencing new-age initiatives like the Metaverse.

According to experts, millennials are likely to use banking services, which include insurance and investments available in the Metaverse.

Consumers, and more strikingly, younger consumers, are looking for embedded financial and technological experiences that have been specifically tailored to their needs and requirements.

7. E-Wallets and Mobile Banking

E-wallets have transformed the way younger customers make payments. These days, enhanced features in digital payments have made payments quick, safe, and easy.

Due to their prominence as the primary digital payment method, e-wallets positively impact the banking sector. To add money to the wallet, users must provide the details of their bank accounts. As a result, banks also see an increase in their clientele.

The proliferation of smartphones has forced banks to release mobile applications that provide easy-to-use financial services. The majority of banks now provide a mobile banking app with:

- Interface that is easy to use

- Ability to deliver almost every service available in traditional banks

- Advanced security features such as fingerprint and facial recognition

The Bottom Line

Undoubtedly, a generational shift is contributing to the outstanding growth of the banking sector. Fintechs have improved consumer access to financial services.

Modern technology applications are significantly disrupting traditional lending and financial models, challenging banks to adapt to a new reality. Increasing speed, experience, and accuracy have made online services seem like the best choice for younger consumers.

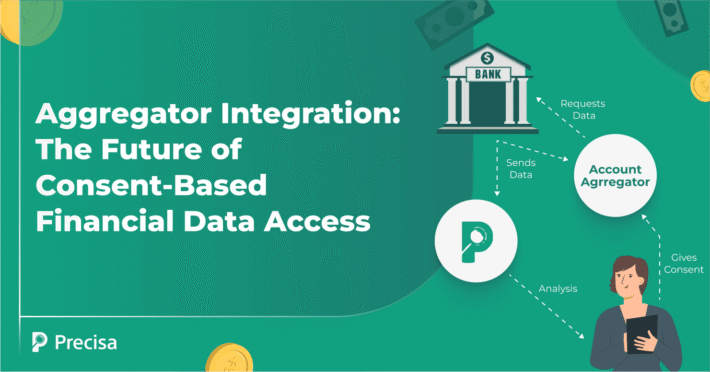

Precisa is a cloud-based fintech platform with AI capabilities. It offers various solutions, including GSTR analysis, bank statement analysis, and account aggregator integration, among others. Also, the features are easy to integrate with current tech stacks of financial companies and existing processes without jeopardising data security.

Book a free trial to learn more about Precisa!