Short-term vs Long-term Cash Flow Analysis: Complete Guide

Delinquencies in India increased by 44% among personal loan borrowers between Dec ’23 and June ’24. This highlights the importance of accurate and informed decision-making during loan approvals and, more importantly, the need to rethink how lenders approach cash flow analysis of individual and commercial borrowers.

Although conventional lenders in India, including banks, typically rely on cash flow statements from the past two to three years, short-term cash flow analysis is gaining traction, particularly among new-age lenders, including non-banking financial companies (NBFCs).

What are the factors driving this change? Rapidly evolving borrower profiles, a significant rise in seasonal income patterns, increasing personal loan delinquencies, and the emergence of tech-driven lending models.

So, should lenders focus on a borrower’s short-term or long-term financial records before approving loans?

This article attempts to answer this question and help lenders optimise their cash flow analysis periods and enhance lending accuracy.

What Is Short-term and Long-term Cash Flow Analysis?

At its core, lenders conduct a cash flow analysis to determine a borrower’s financial health and evaluate their creditworthiness. However, lenders may choose to conduct a short-term or a long-term analysis depending on the type of loan, risk-taking ability, and borrower profile.

Let’s understand what short-term and long-term flow analysis means.

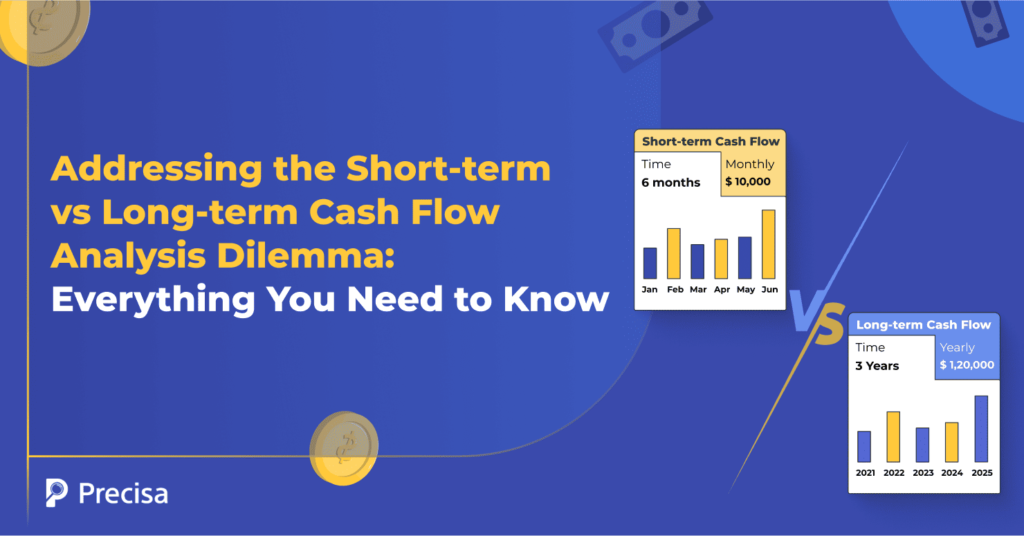

- Short-term Cash Flow Analysis: As the name suggests, short-term flow analysis primarily considers a borrower’s recent financial history and upcoming cash inflows, and the analysis window can vary between a few weeks and six months.

- Long-term Cash Flow Analysis: It examines the borrower’s historic financial transactions and projected income for one to three years.

When Should Lenders Prioritise Short and Long-term Cash Flow Analysis

Let us explore when lenders should prioritise short and long-term flow analysis.

Short-term Cash Flow Analysis

Short-term analysis is ideal when lenders are dealing with small-ticket loans and borrowers with seasonal or fluctuating incomes, including gig workers and freelancers.

Furthermore, short-term analysis is one of the most effective ways to approve personal loans, buy-now-pay-later (BNPL) products, and assign credit limits for credit cards.

Long-term Cash Flow Analysis

Long-term analysis is ideal for financing MSMEs’ long-term projects and approving home loan applications and mortgages.

Unlike short-term analysis, long-term analysis should be primarily carried out while dealing with large-ticket and complex loans.

Importance of Cash Flow Analysis for Lenders

Here are some major reasons why lenders must prioritise cash flow analysis:

Evaluating a Borrower’s Creditworthiness

One of the main reasons why cash flow analysis is non-negotiable for lenders is to determine a borrower’s creditworthiness and repayment capacity.

This step allows them to get an overview of the income, profitability, and cash flow trends to ensure the borrower can adhere to the loan conditions within the stipulated time frame.

Keep Credit Risk in Check

Timely and data-driven cash flow analysis allows lenders to anticipate potential defaults. A thorough analysis of cash flow records and balance sheets offers a clear opportunity to detect red flags and discrepancies.

Loan Structuring

Lenders can provide personalised loan products with tailored repayment schedules and loan conditions depending on the borrower’s financial profile.

For example, while a freelancer would prefer flexible repayment terms due to fluctuating monthly income, stable businesses would prefer to opt for structured loans with defined and predictable timelines.

Determining Collateral Valuation

Apart from analysing bank statements and cash flow trends, lenders must also calculate the value of the collateral against the loan amount to justify the risk involved.

This is where financial analysis can help lenders make informed decisions and assess whether the collateral’s market value is at par with the loan amount.

Optimising Cash Flow Analysis Periods

Here are some ways lenders can optimise their cash flow analysis periods to ensure maximum accuracy while making lending decisions.

1. Match Analysis Period With Loan Type

Lenders must consider ditching the one-size-fits-all approach and ensure that the analysis period matches the loan’s profile.

For example, credit cards, BNPL, and some personal loans require a relatively shorter evaluation period compared to other types of loans, including home loans, business loans, and more.

2. Rely on Rolling Forecasts

Typically, banks and other conventional lenders rely on historical data instead of rolling cash flow predictions to make lending decisions. The rolling cash flows analysis for each borrower may vary depending on their line of work, revenue streams, and other sources of income.

For example, while a 13-week rolling analysis is ideal for SMEs, quarterly evaluations may be a better indicator of the financial health of gig workers and freelancers.

3. Blend Short-term and Long-term Cash Flow Analysis

Making accurate decisions can get a bit tricky, particularly while dealing with complex loans that may require a granular evaluation of the borrower’s short-term and long-term cash flows.

Therefore, lenders must be equipped to implement a hybrid approach that provides clear short and long-term cash flow insights. For example, a business may be profitable in the last few years, but it is facing a minor financial crunch in recent weeks due to unforeseen circumstances.

Parting Notes

As the lending landscape becomes increasingly crowded with banks, NBFCs, and other types of financial institutions, lenders must go above and beyond to provide seamless borrowing experiences while enhancing their lending operations.

To stay competitive, lenders must ensure they make sound lending decisions and rethink how they approach each loan application. While short and long-term cash flow analysis provide valuable insights into a borrower’s financial health, lenders need to identify how they can apply the same to optimise their cash flow analysis periods.

Precisa offers intelligent solutions to help lenders transform how they perform bank statement and credit report analysis. The solutions are designed to provide granular insights into a borrower’s financials and empower lenders to make better decisions.

Book a demo today to learn more!