Accounting is considered to be one of the oldest professions in the world. Every business needs the accounting function to thrive and be efficient, as it drives growth and optimisation. Currently, the accounting process faces several challenges as the amount of financial data generated from digital processes keeps increasing. Bookkeeping alone – which requires systematic […]

How AI Is Improving Categorisation Accuracy In Bank Analyser

Today, data-driven decisions have become a success mantra for many forward-looking businesses. The traditional way of making impactful decisions based on intuition or limited data points can result in an opportunity loss. This is where software solutions powered by Artificial Intelligence (AI) score over legacy software. The AI software market is projected to grow from […]

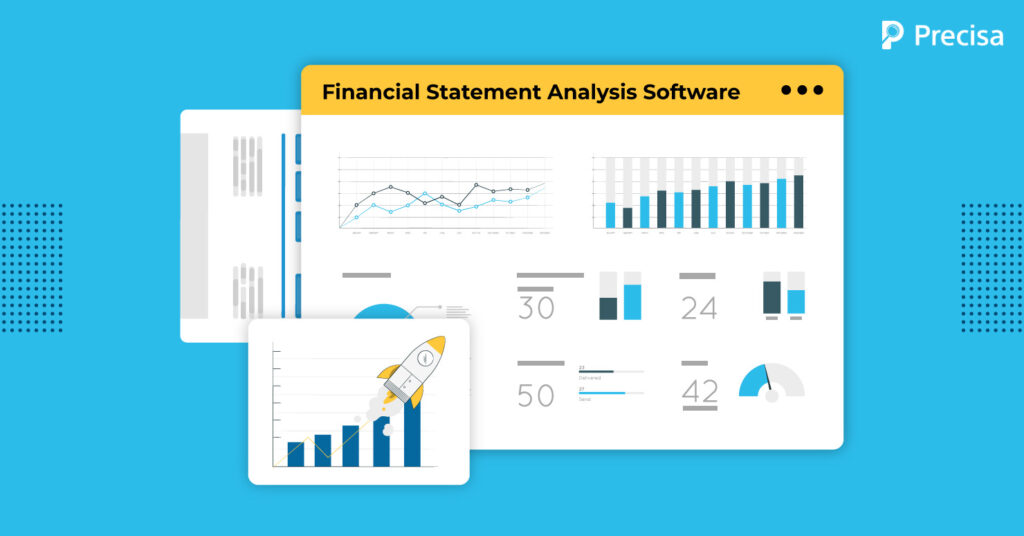

Financial Statement Analysis Tools: Innovations, Opportunities, and Challenges in the Era of AI

The adoption of Artificial intelligence (AI) across various industries and domains is increasing rapidly, as is evident from its application and utility. The finance sector, in particular, has embraced AI enthusiastically to modernise the entire industry and streamline the traditional manual banking processes. A Forbes report reveals the global AI fintech market is expected to […]

Benefits of Bank Statement Analysis Software in Insurance Underwriting

Since 2020, the insurance sector has experienced an accelerated rate of digital transformation. Triggered by the growing demand for digital insurance services, companies aimed to implement basic processes such as digital customer service, payments, and renewals. However, companies are still struggling to respond quickly to the growing demand for Business to Business (B2B) and Business […]

How Can Precisa’s Bank Statement Analyser Improve the Loan Origination Process?

As of 2023, the India Digital Lending Platform Market is expected to grow at a CAGR of 27.90% to USD 923 million and reach USD 3159.19 million by 2028. This growth, however, is accompanied by several challenges, such as the loan origination process, which is time-consuming and complex, and requires several procedures to determine a […]

Why Are Bank Account Analyser Options Crucial to loan Sanctioning?

A Statista report states that Indian banks sanctioned loans worth 30 trillion rupees in the retail sector in 2021. It is also worth noting that a majority of the chunk from that pool, i.e., around 15 trillion rupees was for the home loans segment. As this trend will continue in the foreseeable future, banks and […]

What Is Trend Analysis in Financial Statement Analysis

Trend analysis is a technique for creating precise predictions based on historical data and analysis. It enables comparing data over a specific time frame and detecting uptrends, downtrends, and stagnation. In financial statement analysis, trend analysis involves evaluating an organisation’s financial information over time. Depending on the situation, periods might be counted in months, quarters, […]

Why Choose Precisa as Your Trusted Bank Statement Analyser?

Precisa is a cloud-based bank statement analyser with intelligent automation designed for decision-makers in the lending, insurance, wealth management, and personal finance industries. It can help reduce NPAs, create risk profiles, and make smart lending decisions with features like: 1. All Bank Accounts Analysis In addition to providing analysis at an individual bank account level, […]

AI-Powered Bank Analysis for Better Credit Decisions

Precisa’s Bank Statement Analyser is an effective tool for classifying, verifying, and analysing bank statements to uncover abnormalities or manipulations. Our analyser produces the most accurate results, improving your credit appraisal quality. Fintech firms can use the bank statement analyser to monitor their performance and evaluate their clients’ business positions. This handy tool provides many […]

Financial Statement Analysis Software: Aiding Fintech Growth

Financial statements contain important data regarding a business’s performance. They are report cards of a firm’s financial health and blueprints for future operations. Financial statement analysis is a strong tool that helps the C-suite in strategic decision-making. It is an activity requiring accounting expertise and knowledge of some bookkeeping programs. However, advanced financial statement analysis […]