Advances in data analytics, big data, and artificial intelligence (AI) have opened up new avenues for banks and other financial institutions to improve their credit decision-making models. Additionally, the increasing appetite for digital transformation and sophisticated tech-driven services has translated into introducing innovative tools like bank analyser in the banking ecosystem. The Indian financial ecosystem […]

Early Warning Signals for Bank Liquidity Assessment

Early warning signals in banks are indicators that help lenders and financial institutions identify potential liquidity problems in businesses before they become critical. These signals help banks proactively manage their exposure and protect themselves from losses. The liquidity of a business is reflected in the abundance of its cash and readily convertible cash equivalents. Strong […]

Early Warning Signals in Banks for Liquidity Profile of Businesses

Early warning signals (EWS) are indicators that help banks identify potential liquidity problems in businesses before they become critical. These signals help banks proactively manage their exposure and protect themselves from losses. The liquidity of a business is reflected in the abundance of its cash and readily convertible cash equivalents. Lenders prefer borrowers who have […]

How Account Aggregators are Using ‘Informed Consent’ and Revolutionising Digital Lending

When financial data is involved, consenting without the full knowledge of the terms and conditions can have trust-reducing consequences for consumers. This can make financial consumers more reluctant to consume important services like loans. On the other hand, consumers may also need to share the same data several times when applying to multiple service providers […]

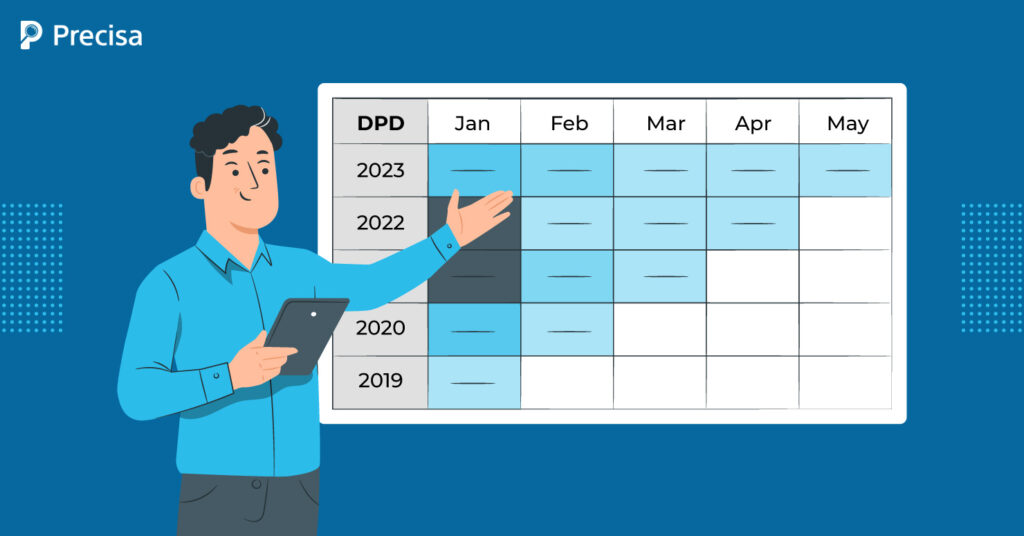

Calculating DPD in Finance: A Comprehensive Guide

As India’s lending ecosystem becomes increasingly digital and data-driven, monitoring borrower behaviour has never been more critical. With the Reserve Bank of India reporting a moderation in retail credit growth to 16.6% in June 2024—down from 21.3% the previous year—banks and NBFCs are placing greater emphasis on early risk detection and delinquency tracking to protect […]

Calculating DPD in Finance: Guide to Analysing Delinquency

As India’s lending ecosystem becomes increasingly digital and data-driven, monitoring borrower behaviour has never been more critical. With the Reserve Bank of India reporting a moderation in retail credit growth to 16.6% in June 2024—down from 21.3% the previous year—banks and NBFCs are placing greater emphasis on early risk detection and delinquency tracking to protect […]

Why Lenders Must Review Circular Transactions Closely Before Making Lending Decisions

The lending industry has grown immensely in the last few years. According to estimates, the global lending market grew from $ 7887 billion in 2022 to $ 8682 billion in 2023. By 2027, the global lending market size is projected to grow to $ 12176 billion. In the realm of business loans, a variety of […]

Early Warning System in Banks: A Guide to its Role in Preventing Failures

The global digital lending market, which stood at $12.6 billion in 2022, is projected to reach $71.8 billion by 2032, growing at a CAGR of 19.4% from 2023 to 2032, as per Allied Market Research. Globally, the COVID-19 pandemic disrupted traditional banking channels due to frequent lockdowns and the need to practise social distancing. This […]

Understanding DPD in Finance: Unveiling Early Risk Signals for Proactive Mitigation

In today’s dynamic financial world, risk management is critical to ensuring the stability and sustainability of financial institutions. One critical part of risk management is the early detection of prospective credit defaults, which can have far-reaching consequences for an institution’s financial health. To accomplish this, financial experts use a variety of instruments and indicators, one […]

Enhancing Credit Appraisal through Collaborative Data Sharing and Open Banking

A recent Mckinsey report indicates that collaborative data sharing in finance has the potential to boost the GDP of economies by 1 to 5 per cent by the end of 2030. In light of this, many nations in the G20 have identified micro, small, and medium enterprises (MSMEs) as a major driver of economic growth, […]