Your underwriter approved a Mumbai trading firm in 48 hours. Clean documents, stable cash flow, CIBIL score of 730. Eight months later, it’s restructured. The Jaipur application you rejected last week? Your competitor funded it, and it’s performing. Same underwriting model. Same credit policies. Different states, different outcomes. India’s ₹46 lakh crore small business credit […]

GST Compliance Ratings: How Tax Filing Delays Impact Business Loan Approvals

The Goods and Services Tax (GST) regime in India emphasises transparency and accountability and has reshaped how financial institutions assess businesses’ creditworthiness. GST compliance, especially timely and accurate tax filing, has become a critical factor in loan approvals for Indian businesses. Lenders now view compliance as a primary indicator of creditworthiness and risk. Delayed tax […]

Real-Time Bank Account Verification for Lenders: How It Works

Loan evaluation in India still depends heavily on bank account verification, but the number of applications banks, NBFCs, DSAs, and advisory firms handle every day is much higher and complicated than what traditional processes were built for. Many credit underwriters still rely on manual checks, even though the Reserve Bank of India’s 2022 Digital Lending […]

Why DSA Ratings Drop: How Manual Due Diligence Costs You 10x More Cases?

Direct Selling Agents (DSAs) connect potential borrowers with the most suitable financial institutions and vice versa. As the number of borrowers grows, financial institutions are relying more on DSAs for loan distribution. However, as DSAs, you face stiff competition and numerous challenges; manual due diligence is one of them, which ultimately impacts DSA ratings. DSAs […]

How API Integration Simplifies Bank Statement Analysis for Lenders

APIs (Application Programming Interfaces) now drive innovation and operational efficiency across fast-evolving technology domains. API integration enables lenders to automate bank statement analysis, replacing manual reviews with data-driven insights. This approach accelerates and standardises the process for extracting and analysing customer financial data. All lenders, including fintechs, banks, and NBFCs (Non-Banking Finance Companies), process thousands […]

GST-Bank Reconciliation: Why Customer Mismatches Are Red Flags in Business Lending

Lending decisions are only as strong as the financial data behind them. Yet, lenders know that not all numbers on tax returns or balance sheets can be taken at face value. GST-Bank Reconciliation provides one of the most effective ways to ensure this transparency. This process involves aligning a company’s Goods and Services Tax (GST) […]

14 Red Flags in Bank Statements That Predict Loan Defaults

Loan defaults are surging in India, especially for small-ticket and unsecured loans sectors. According to new data from March 2025, delinquencies (overdue by 90 days) spiked to 3.6%. Default rates are notably high among young borrowers and those in tier-3 cities. While traditional risk-scoring methods work fine, they rely heavily on credit history and CIBIL […]

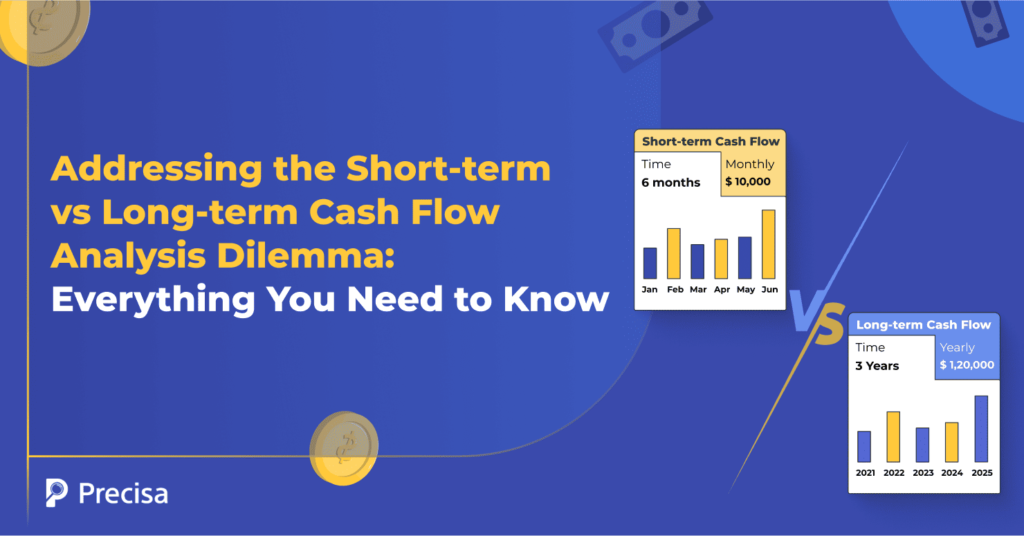

Short-term vs Long-term Cash Flow Analysis: Complete Guide

Delinquencies in India increased by 44% among personal loan borrowers between Dec ’23 and June ’24. This highlights the importance of accurate and informed decision-making during loan approvals and, more importantly, the need to rethink how lenders approach cash flow analysis of individual and commercial borrowers. Although conventional lenders in India, including banks, typically rely […]

Major Document Lending Challenges Facing Fintech Companies

Despite showing promising signs of revitalising Indian lending, the challenges faced by fintech companies are by no means insignificant. These generally include a combination of a complex regulatory framework, evolving operational guidelines by the Reserve Bank of India (RBI), and most importantly, document-heavy processes. From Know Your Customer (KYC) documents and income proofs to property […]

The Lender’s Guide to Corporate Loan Document Hierarchy: Critical Papers for Approval Decisions

India’s corporate credit ecosystem has seen remarkable growth in FY 2024–2025. Here are a few figures that support this trend: The total outstanding bank credit to business (including industry and services) increased to ₹82.73 lakh crore in March 2024, with a 16.3% year-on-year growth. Corporate loans to large enterprises grew by 7%. The retail loan […]