The market size of the digital lending industry in India was worth just $ 9 billion in 2012. By the end of 2023, it is projected to reach a value of $ 350 billion. Fintech companies have played a major role in the accelerated growth of digital lending, and in particular, small business financing. The […]

How Can Precisa’s Bank Statement Analyser Improve the Loan Origination Process?

As of 2023, the India Digital Lending Platform Market is expected to grow at a CAGR of 27.90% to USD 923 million and reach USD 3159.19 million by 2028. This growth, however, is accompanied by several challenges, such as the loan origination process, which is time-consuming and complex, and requires several procedures to determine a […]

The Benefits Of Using NBFC Software For Financial Management

Non-banking Financial Companies (NBFCs) are integral to the financial system. Their contribution to financial inclusion initiatives, dissemination of timely credit to the Micro, Small and Medium Enterprises (MSMEs) and infrastructure development projects are all significant chapters in the story of India’s thriving digital economy. As of October last year, India has 9500 registered NBFCs with […]

How NBFCs Are Using the NBFC Software to Drive Growth and Innovation

NBFCs play a vital role in the financial ecosystem by extending a broad range of banking services to SMEs, entrepreneurs, and individuals lacking access to traditional banking services. A report by Research And Markets forecasts a promising future for the NBFC sector, with an anticipated CAGR of 18.5% between 2021 and 2026. Financial institutions are […]

Everything You Need to Know About Credit Appraisal Process

The creditworthiness of a person determines their probability of obtaining a loan from a bank or other financial institution. Furthermore, it also summarises how worthy they are of getting new credit in the future. Typically, lenders go through an individual’s debt and credit management history to assess their creditworthiness before approving or rejecting their application. […]

Top Features to Look For in an NBFC Software

A Non-Banking Finance Corporation (NBFC) is a company that carries out the business of a financial institution as per Section 451(c) of the RBI Act. Their functioning falls under the purview of the Ministry of Corporate Affairs and the Reserve Bank of India. Presently, NBFCs are involved in lending activities, leasing, hire-purchase, insurance, receiving deposits […]

The Impact of Fintech Companies on Small Business Financing

The last five years have witnessed a significant rise in the market share of fintech companies. For instance, the global fintech lending market size alone was estimated to be valued at $449.89 billion. By 2030, it is projected to rise to $ 4957 billion, growing at a CAGR of 27.4%. Small businesses, in particular, are […]

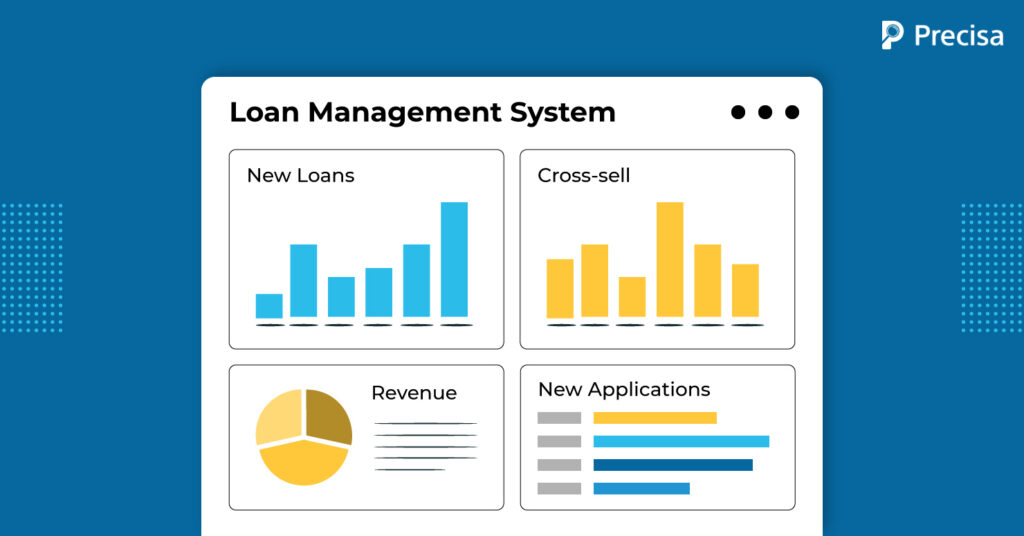

How Can a Loan Management System Improve the Loan Process Flow?

Loan management is a crucial part of the lending industry, and it involves tracking, servicing, and managing loans from application to closing. The global loan servicing software market is estimated to reach $ 4812.08 million by 2028, with a CAGR of 12.19%. The manual loan management process can be time-consuming, complex, and prone to errors, […]

6 Common Pitfalls To Avoid In The Credit Appraisal Process

Digital transformation has influenced the rate at which business or personal loans can be disbursed. As of 2023, the value of the digital lending market in India is estimated to be $ 350 billion, primarily driven by fintech startups and non-banking financial companies (NBFCs). Despite this growth, loan rejection rates are also climbing. For instance, […]

Unleashing the Potential of Technology in the Credit Appraisal Process

The advent of credit bureaus in the 1960s was a turning point for the modern credit economy as credit scores and credit reports were first introduced. While we have come a long since then. The arrival of the fintech wave, coupled with innovations, is gradually transforming and streamlining the conventional approaches. For example, technology is […]