Lending is a tricky affair. It is always essential for lenders to be very careful about whom they are lending the money. There are a lot of risks associated with lending, and one of the most significant risks is that the borrower may not be able to repay the loan. That’s where bank statements come […]

How Finance and Accounting Firms Can Benefit From Bank Statement Analysis

Bank statement analysis includes a review, breakdown, and analysis. This scan is done by commercial and retail banking, investment companies, financial institutions, and accounting and auditing companies. A bank statement analysis shows the records of all the transactions undertaken by the applicant, such as deposits, withdrawals, cash transfers, interest earned, debit card payments, bank service […]

What Makes Precisa Better Than Other Bank Statement Analysers?

Automated bank statement analysers have become the engines that drive borrower assessment. A BSA allows you to flex your analytical muscles and put creditworthiness under scrutiny. But not all bank statement analysers are made equal. Here’s why Precisa is better than the others. 9 Features that make Precisa Outperform other BSAs Precisa bank statement analysis […]

Bank Statement Analysis: Benefits, Challenges, and Current Solutions

A bank statement is a summary of a specific account holder’s inflows and outflows over a set time period. The bank’s transactional history is commonly regarded as reliable documentation for determining the financial health of any customer. As and when incurred, all sources of revenue, expenses, withdrawals, overdraft payments, credit card payments, and so on […]

Do You Know What Exactly Does a Bank Statement Analysis Tell Us?

Getting a bank loan approved is a time-consuming process that necessitates a thorough paperwork review. The verification process differs by the bank. Before sanctioning any loan, the bank considers four key factors: safety, liquidity, spread, and profitability. Banks will then examine previous funds flow statements from the bank statement over a period of time to […]

How Useful Is Financial Statement Analysis for Banks?

Every loan process or audit of financial transactions—no matter if it is an individual loan or a commercial loan—starts with a bank statement. For instance, a bank statement could disclose information crucial in approving or validating a loan. What’s more? There’s a lot. How useful is financial statement analysis for banks? Let’s check that. What […]

How to Find the Right Bank Statement Analyser for Your Lending Business?

As an individual lender, a bank, non-bank financial company, or any other financial institution, you examine the prospective borrower’s bank statements to determine whether to lend them money. A bank statement is one of the most reliable sources for seeing all of your prospective borrower’s transactions and trends over time. However, during this situation, lenders […]

Precisa’s e-Statement and Bank Account Authenticator Can Spot Fraudsters

Versatile software and tools that enable editing and modification of official documents make it easy for anyone to counterfeit them. This makes it easy for fraudsters to manipulate sensitive documents like bank e-statements to obtain loans or other financial benefits. In the financial year 2021, the Reserve Bank of India (RBI) reported bank frauds amounting […]

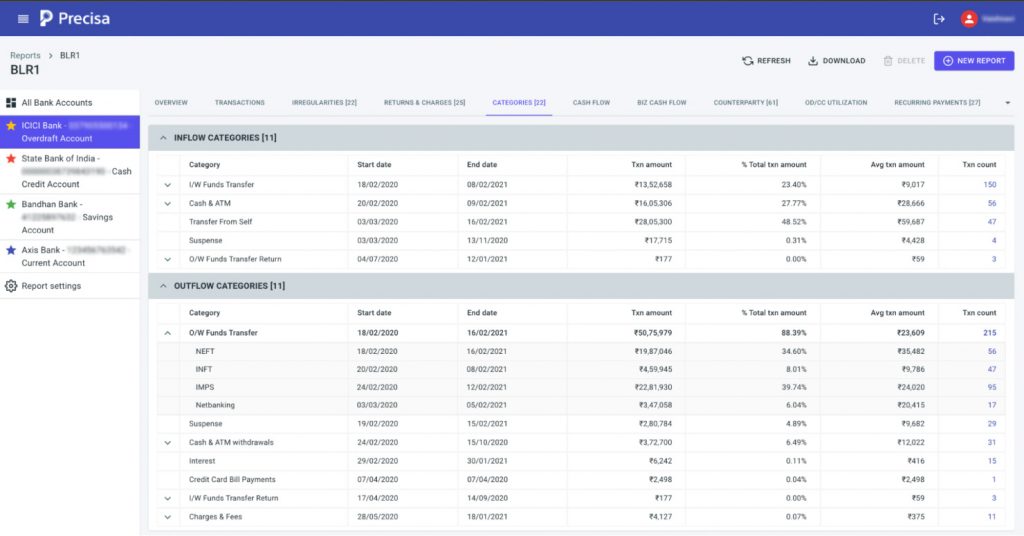

Bank Statement Analysis Simplified with Added Categories for Inflow and Outflow

Manually assessing data from the Bank Statement PDFs is a strenuous and time-consuming process. Automated Bank Statement Analysis tools on Precisa allow its users to extract the data and categorise them and facilitate more detailed segregation from the bank statements. Why Do We Need a Category View? Different public and private banks have various formats […]

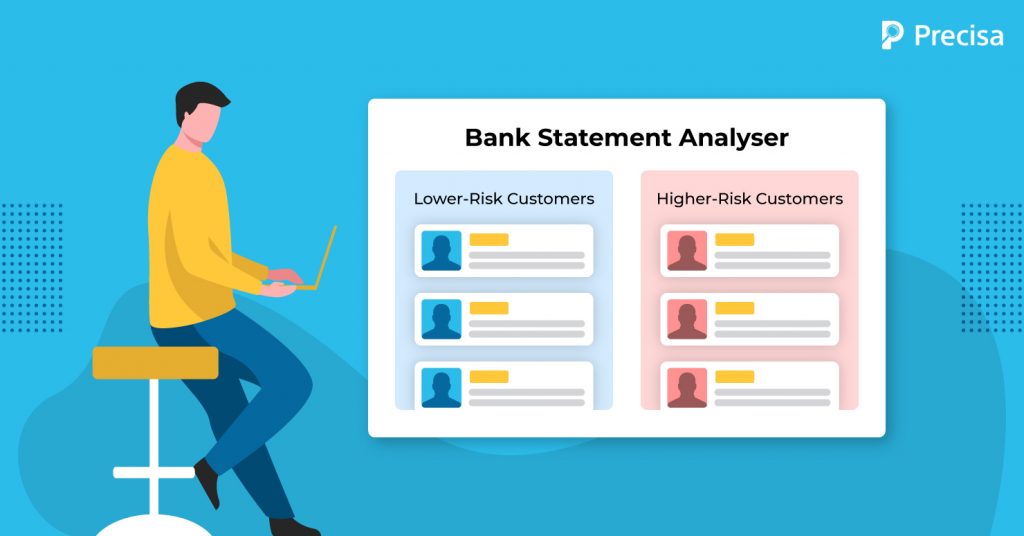

How Bank Statement Analysers Are Aiding in the Search for Lower-Risk Customers

Global loan defaults have increased at a faster rate than they were before the pandemic. Direct consumers and small businesses are still struggling to pay back loans, which is unlikely to improve very soon. While retail lending accounts for 22% of total bank lending and 3.7% of total NPAs, personal loans, home loans, and vehicle […]