As per reports, the inflation rate for October 2022 was 6.8%; for the year 2021, the annual inflation rate was 5.1% in India. Inflation is on the rise, not only in India but globally. Increasing inflation impacts both consumers and companies – businesses have to deal with the rising cost of production and consumers with […]

Fintech in India | A Dive Into the Promising Fintech Sector & Its Future

India is home to 7500 + fintech startups along with 23 unicorns UPI monthly transactions reached a value of approximately $135 billion Fintech in India has 80 % adoption, compared to 64% in the rest of the world – According to the inputs by Invest India Financial technology, abbreviated as fintech, is a work in […]

Why Choose Precisa as Your Trusted Bank Statement Analyser?

Precisa is a cloud-based bank statement analyser with intelligent automation designed for decision-makers in the lending, insurance, wealth management, and personal finance industries. It can help reduce NPAs, create risk profiles, and make smart lending decisions with features like: 1. All Bank Accounts Analysis In addition to providing analysis at an individual bank account level, […]

Leverage Precisa’s API Integration to Credit More Loans With Less Work

Precisa’s bank statement analyser is a cloud-based analytics solution with smart automation designed for decision-makers in lending, insurance, wealth management, and personal finance. Bank statements are good indicators of a business’s or individual’s income, expenses, and spending patterns. Analysing the data from bank statements gives a reliable picture of the applicant’s current performance and future […]

AI-Powered Bank Analysis for Better Credit Decisions

Precisa’s Bank Statement Analyser is an effective tool for classifying, verifying, and analysing bank statements to uncover abnormalities or manipulations. Our analyser produces the most accurate results, improving your credit appraisal quality. Fintech firms can use the bank statement analyser to monitor their performance and evaluate their clients’ business positions. This handy tool provides many […]

Digital Lending Regulations: Bane or Boon?

The advent of technological innovations has radically changed customers’ banking habits. The widespread adoption of digital lending and payment methods following Demonetisation signalled the rise of India’s fintech-led Banking, Financial Services and Insurance (BFSI) system. Lending was the next banking activity to move to the digital space. The Indian digital lending market grew from a […]

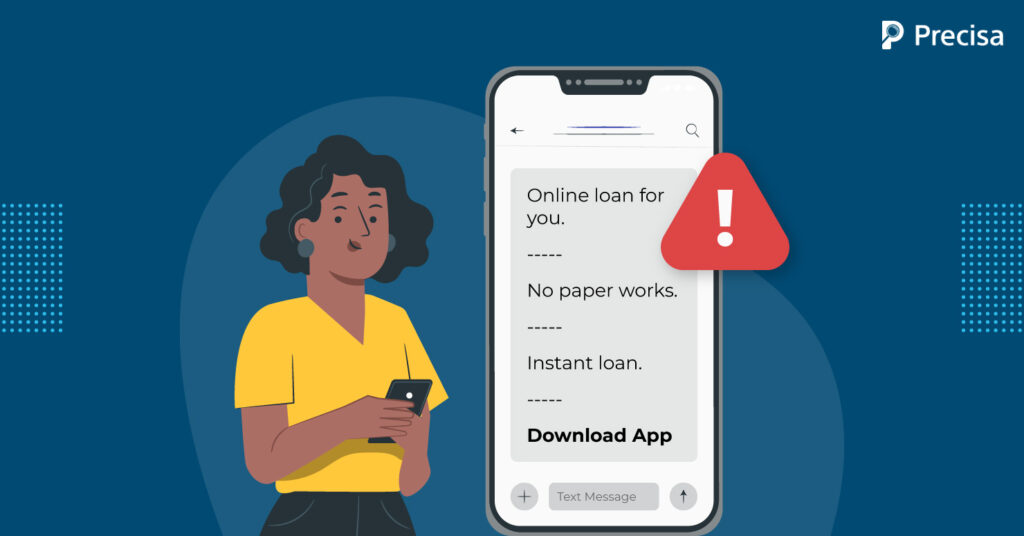

5 Ways to Avoid Falling Prey to Illegal Digital Lending Transactions

As of September 29, 2022, India’s digital lending industry was valued at $200 Billion. The growth of this industry has created more credit opportunities for micro, small and medium enterprises (MSMEs) and other underserved segments. Several legitimate digital lending businesses have contributed to this growth. However, incidents of digital lending fraud are also on the […]

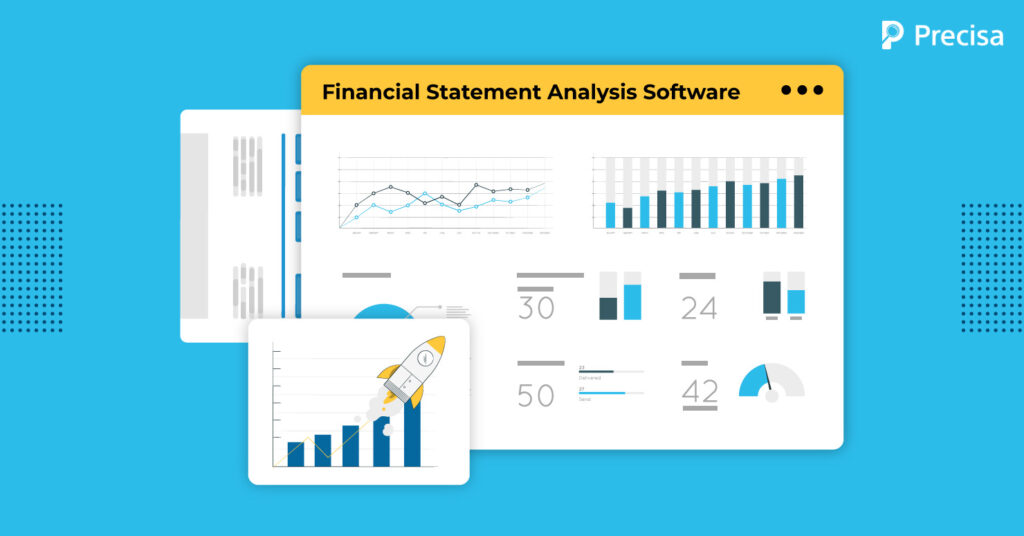

Financial Statement Analysis Software: Aiding Fintech Growth

Financial statements contain important data regarding a business’s performance. They are report cards of a firm’s financial health and blueprints for future operations. Financial statement analysis is a strong tool that helps the C-suite in strategic decision-making. It is an activity requiring accounting expertise and knowledge of some bookkeeping programs. However, advanced financial statement analysis […]

How Fintech Firms Improve Finance and Web Payments in Rural India

“Where there is a will, there is a way.” This is how the fintech sector navigated the rocky roads of rural India. From demonetisation, India recognised the need to adopt new technology and embrace digital payments. Rural India lagged behind the rest of the nation in the digitalisation process. India’s fintech market is the third […]

4 Actions Banks Must Take To Prepare for Open Banking Wave

The banking industry is on the cusp of a significant change. Open banking, which refers to using Application Programming Interfaces (APIs) to allow third-party developers to access financial data, is set to transform banks’ operations. This new wave of open banking presents challenges and opportunities for banks. There are four actions banks need to take […]