Blogs

Recent Posts

- Ushering in a New Era of Debt Recovery for the Modern Lender

- Is Automated Decisioning Stage in Loan Processing the Right Strategy?

- Tech-Driven Precision: Navigating RBI’s Updated Priority Sector Lending

- Safeguarding Innovation: Top Security Trends for Fintech Firms in 2024

- 5 Reasons Why Adoption of Business Intelligence in Banking is Set to Increase

Categories

Top 10 Search Terms

Mumbai

Mumbai

303, K L Accolade, Rd Number 6, T.P.S III,

Golibar,Santacruz East, Mumbai,

Maharashtra – 400055

Bengaluru

Bengaluru

Beyond Epic Co-working Space,HM Vibha Towers,

4th Floor, Above Chroma store,Next to Forum Mall,

Adugodi, Koramangala,Bangalore – 560029

Pune

Pune

Rachana Park, 3rd Floor,Atreya Society,

Off. Senapati Bapat Marg,Wadarvadi, Pune,

Maharashtra – 411016

© All Rights Reserved • Precisa • MADE WITH ❤️ & ⚡ IN INDIA

Blog

Things to Know About GoI’s Stimulus Package and How It’s Impacting Lending

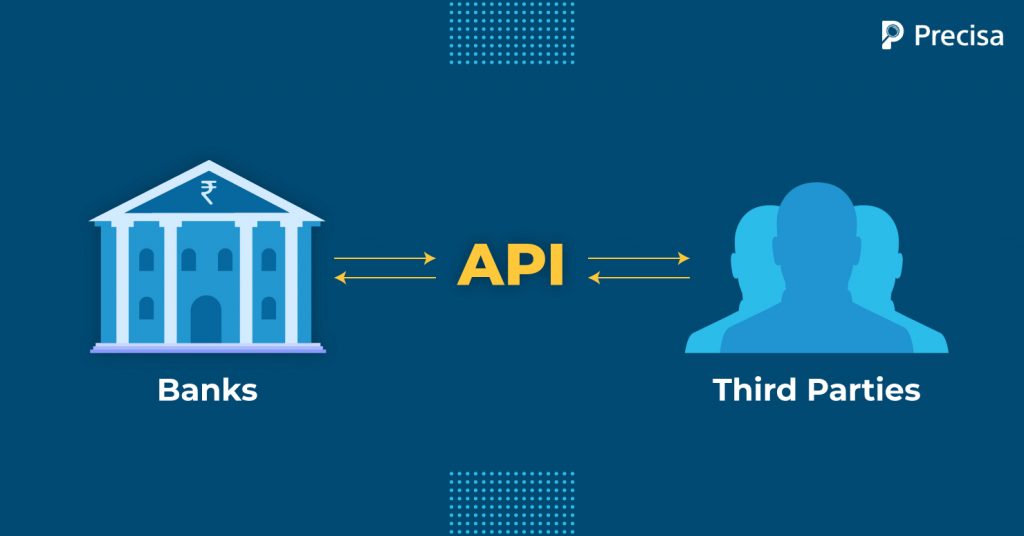

What are APIs in Bank Transactions, and How Are They Effective?

Finance Sheet Research Tools Build Bankers Faith and Responsibility

7 Major Lending Trends to Look Out For in the Wake of COVID-19

How to Analyse Multiple PDF Bank Statements In Minutes?

Why Bank Statement Analysis is a Key Component of Credit Appraisal

Is Bank Statement Analysis (BSA) the Best Tool to Identify Customer Behaviour?

Business Intelligence in Banking Industry: Why Are Banks Banking on BI?

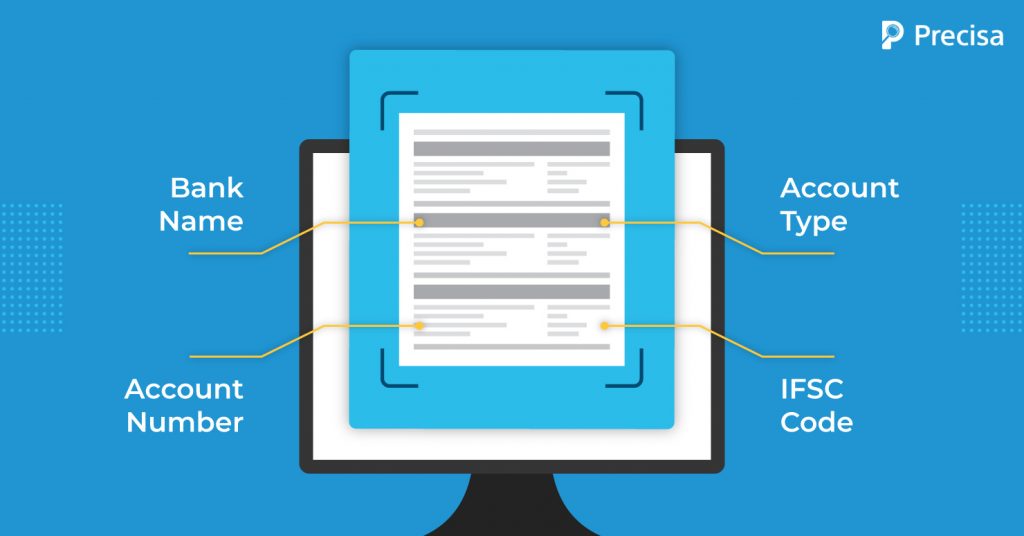

Precisa Introduces Smarter Bank Data Retrieval for Fast and Reliable Bank Statement Research

Role of Customer Due Diligence in Lending

Recent Posts

- Ushering in a New Era of Debt Recovery for the Modern Lender

- Is Automated Decisioning Stage in Loan Processing the Right Strategy?

- Tech-Driven Precision: Navigating RBI’s Updated Priority Sector Lending

- Safeguarding Innovation: Top Security Trends for Fintech Firms in 2024

- 5 Reasons Why Adoption of Business Intelligence in Banking is Set to Increase

Categories

Things to Know About GoI’s Stimulus Package and How It’s Impacting Lending

What are APIs in Bank Transactions, and How Are They Effective?

Finance Sheet Research Tools Build Bankers Faith and Responsibility

7 Major Lending Trends to Look Out For in the Wake of COVID-19

How to Analyse Multiple PDF Bank Statements In Minutes?

Why Bank Statement Analysis is a Key Component of Credit Appraisal

Is Bank Statement Analysis (BSA) the Best Tool to Identify Customer Behaviour?

Business Intelligence in Banking Industry: Why Are Banks Banking on BI?

Precisa Introduces Smarter Bank Data Retrieval for Fast and Reliable Bank Statement Research

Role of Customer Due Diligence in Lending

Recent Posts

- Ushering in a New Era of Debt Recovery for the Modern Lender

- Is Automated Decisioning Stage in Loan Processing the Right Strategy?

- Tech-Driven Precision: Navigating RBI’s Updated Priority Sector Lending

- Safeguarding Innovation: Top Security Trends for Fintech Firms in 2024

- 5 Reasons Why Adoption of Business Intelligence in Banking is Set to Increase

Categories

Mumbai

Mumbai

303, K L Accolade, Rd Number 6, T.P.S III,

Golibar,Santacruz East, Mumbai,

Maharashtra – 400055

Bengaluru

Bengaluru

Beyond Epic Co-working Space,HM Vibha Towers,

4th Floor, Above Chroma store,Next to Forum Mall,

Adugodi, Koramangala,Bangalore – 560029

Pune

Pune

Rachana Park, 3rd Floor,Atreya Society,

Off. Senapati Bapat Marg,Wadarvadi, Pune,

Maharashtra – 411016

© All Rights Reserved • Precisa • MADE WITH ❤️ & ⚡ IN INDIA